*Nothing written below is financial advice. Always do your own research when dealing with your finances

One ETF to rule them all?

The majority of the Australian FIRE community roughly subscribes to one of the three combos when it comes to ETFs:

- 40% Oz shares (VAS or AFI) 60% international (VGS or equivalent)

- Pros

- Great exposure to the entire world with enough Australian shares to take advantage of franking credits

- Don’t have to fill out a W-8BEN form every couple of years

- Hedged against the Australian dollar

- DRP option available

- Cons

- Highest management fees (0.164% assuming the above weightings) out of all the three options (more on this later).

- Have to manually rebalance

- Pros

- 40% Oz shares (VAS or AFI) 60% international (VTS+VEU)

- Pros

- Great exposure to the entire world with enough Australian shares to take advantage of franking credits

- Low management fees (0.101% assuming the above weightings)

- Greater diversification than the other two options

- exposure to emerging markets

- Cons

- Extra admin to fill out W-8BEN form (less than one hour every few years)

- DRP option only available for VAS, not VTS or VEU

- Potential estate issues when you die for VTS and VEU units

- Have to manually rebalance

- Pros

- 100% Oz shares – Dividend focussed (VAS or AFI) (Thornhill approach)

- Pros

- Take full advantage of our unique franking credit systems in Australia

- Dividends are less likely to be affected during a downturn

- Hedged against the Australian dollar

- Don’t have to fill out a W-8BEN form every couple of years

- Low management fees (~0.14%)

- Cons

- Not diversified outside of Australia

- Miss out on international market gains

- Capital gains traditional low for this strategy

- Home bias

- Pros

All three strategies have their merits but they all require rebalancing with the exception of an all Australian ETF. The issue with that strategy is, of course, you don’t have much diversification as Australia is only roughly 2 percent of the world economy. And with how much private debt Australians have right now… if Australia went through a recession the all Australian portfolio would not fare well.

The point is that each one of these strategies is missing something and require manual intervention whether it be rebalancing, extra admin work or more diversification.

Wouldn’t it be good if there was an ETF that took care of all this for you?

Vanguard Diversified ETFs

So what are they exactly and what’s the difference between buying this ETF vs one of the three options mentions above?

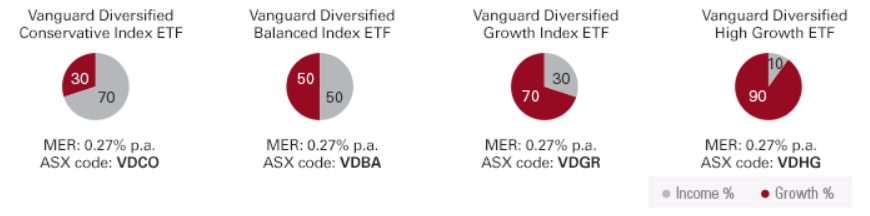

To put it simply, any of the four diversified index ETFs above offer a complete one stop shop solution for anyone looking to invest.

They solve a few problems that our three options above had

- Diversification – Exposure to over 10,000 securities—in just one ETF.

- Auto Rebalancing

- DRP option

- Hedged against the Australian dollar*

- It wasn’t listed above as a con, but all four diversified index ETFs are actively managed using Vanguard Capital Markets Model (VCMM)

The two big ones that stand out are of course the auto-rebalancing but also maybe surprisingly the active management component.

Rebalancing is not hard to do, but it’s something that if left unattended can most certainly affect the performance of your portfolio over the long term. As for the active management component. You may be wondering why there is any management at all? I thought Vanguard is all about minimal management to keep fees low and it’s really hard to beat the index anyway??? I’m not sure about this part beating the market either but I guess we will have to wait and see how it performs. It uses a modelling system called VCMM to simulate potential outcomes and pick the correct balance for your desired portfolio out of the four options above.

*As pointed out by Chris in the comments. The diversified ETFs are not 100% hedged. Please check the PDS for each ETF to find the amount of hedging

Who Is This Suited For?

To be honest, it’s a bloody good product for 99% of people. What they are offering here is as close to the perfect ETF as I’ve ever seen given the management fees and what it offers.

The best thing about this ETF is how idiot-proof it is. A complete n00b could buy one of the four diversified ETFs (depending on their investor profile) for the rest of their life and get respectable returns with minimal effort.

People avoid things that appear confusing and hard. That’s why Robo investment companies like Acorns and Stockspot are in business. They essentially are providing what this ETF is providing at additional costs because they make investing super easy and friendly. With the other three options listed above, it can be daunting to explain to a complete n00b how to rebalance. As soon as they don’t understand something, the majority of the time they can get spooked and give up altogether.

That’s why this ETF is so special. You can confidently recommend this product to anyone and be sure that they can’t stuff it up or get confused.

- Set up a broker account

- Buy this ETF when you have the money to do so

- Turn on DRP if you want

- Do tax when it comes around

- Repeat forever

So if this ETF is suited for 99% of people, who is the 1%?

Why I Won’t Be Switching To These ETFs

This is something I have been wanting to bring up for a while now.

Has the Australian FIRE community forgotten just how important management fees are?

I have been seeing a lot of people recommend VDHG, which as I have mentioned above is a fantastic product. No doubt about it.

The only issue I have is that at a MER of 0.27%, it’s more than double that of what my MER currently is (0.101% or option 2 above). They are both very low fees, but I plan to have a portfolio of a million+ within the next 5 years and hope to live for another 50 years at least! Now even though the management fees are very low, over a long period of time it does add up!

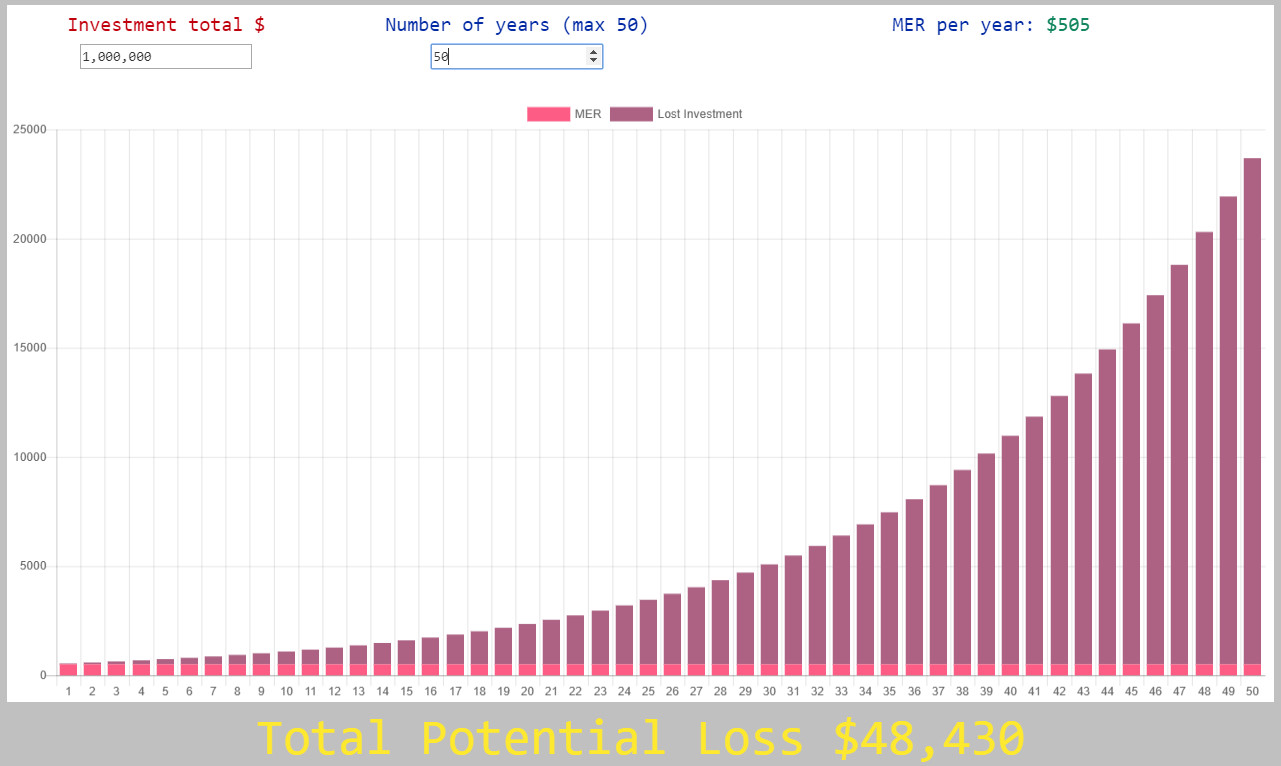

I have actually been working on a web app recently (so close to being published) that works out lost investment potential from management fees which gives you a visual of what I’m talking about.

Management fees are unavoidable, but how much you pay is your choice to an extent. I have calculated my current investment potential loss from management fees to be $48K over 50 years at $1M invested.

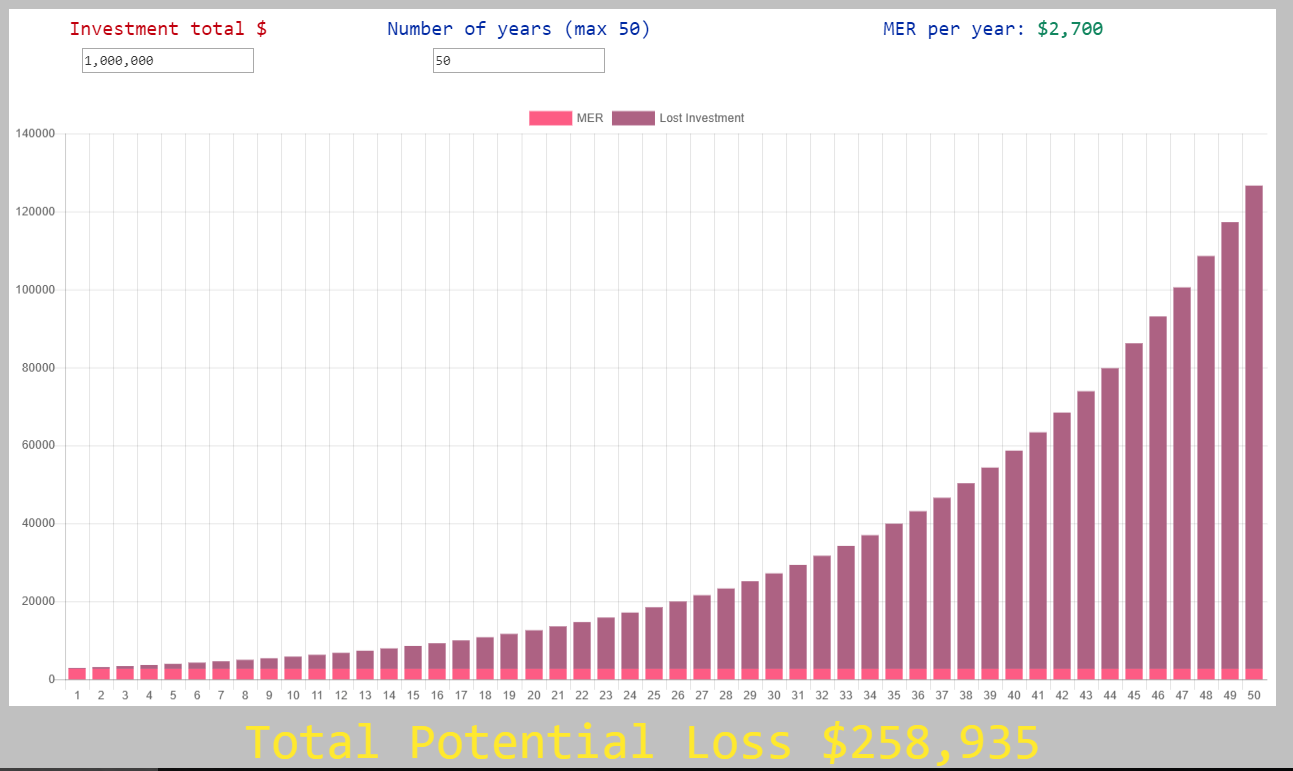

If I change the management fees to be 0.27% we get the following

Holy shit!

We went from paying under $50K over 50 years in investment potential loss from management fees to over 5 times that amount at over $250K!

Ok, I need to clear a few things up about the above graphs because it’s a big deal.

What am I actually talking about when I say investment potential loss? I’m referring to how much management fees are costing the investor when you factor in that the money paid to management could have been invested and compounded at 8% return (that’s what the graph is using as a return rate).

If I had $1M in my portfolio with my current weightings I would be paying Vanguard $505 a year. If I had $1M with any of the diversified index ETFs, I would be paying Vanguard $2,700 a year.

The difference between $505 and $2,700 a year over a lifetime adds up!

Conclusion

If you’re reading this blog, odds are you’re somewhat interested in personal finance and investing. The question you need to ask yourself is whether or not you are willing to learn, educate yourself and do the extra things required for the lower MER ETF options. Or if you think that the higher MER for the diversified index ETFs are justified. I personally choose to keep my MER as low as possible because paying less in management fees is a guaranteed return. You could argue that the diversified index ETFs will outperform my ETF combo but that is unknown without a crystal ball.

If you don’t know what half of the words in this article are even about, then the diversified index ETFs are most likely the best ETF for you. Just pick your investor profile and off you go. And don’t sweat the extra management fees. If the simplicity of the diversified ETF gets you into investing, you’ve more than made up the difference.

Great article! I’ve always thought why people have been reccomending this ETF. From what I’ve read as well hedging can work for short time horizons of less than 5 years. Over longer horizons (15+ years) though the fees associated with hedging can eat into your returns and leave you worse of. Definitely worth considering if hedging fits with when you plan to RE.

https://www.advisorperspectives.com/articles/2015/06/09/four-reasons-why-we-do-not-hedge-against-currency-volatility

This isn’t the original article I read about the topic but the gist is the same.

Nice article mate.

I think the fees are justified with these ETFs – the pure simplicity of it for the investor is great.

The preferred option would be VDHG, but I don’t like the mandatory 10% in bonds, or the hedging either. Looking at their other funds, the hedging has a horrible effect on distributions, creating large taxable events.

And while it’s not really quantifiable, what’s the cost of someone trying to do it themselves and potentially blowing their portfolio up making crap decisions. The less decisions an investor has to make, the less chance they can hurt themselves.

Like you though, while I like the idea of these ETFs, they aren’t for me. They should do well over time though, and are suited to lots of people.

Thanks Dave,

Anything Vanguard will have low fees (which is why they are so great) but the difference between what I’m paying now over a lifetime vs VDHG is over $200K!

I’m willing to rebalance and fill out a form every few years to get the lower MER option and potentially over $200K (in today’s dollars) extra over 50 years.

But it’s a personal decision.

I have often considered going 100% VTS because the US market is plenty diversified and that MER of 0.0004 is soooooo good. VDHG is literally 6 times the cost of VTS is management fees!!! This cannot be ignored and it does matter.

The thing that keeps me coming back to VAS are those juicy franking credits and VEU to get whole world exposure at a low MER (compared to VGS).

I 100% agree with you about people stuffing it up though! This is where these diversified Index ETFs dominate.

Where do you see USA in next 50 Years? Will they still be close to 50% of world stock market or quiet possibly they could be replaced by new world powers. I am planning for just Aus and World ETFs with added bonds in retirement and not speculating on one country.

Hi Steve,

I’m not sure where USA will be in 50 years. But what I can say with 100% certainty is that paying a MER of 0.04% is better than paying 0.18%.

Everything else is speculative.

Hey, how do you see the labor changes to franking credits impacting your decision to invest in Australian stocks?

I have IVV 100% at the moment and looking to get another ETF. Any reason why IVV isn’t on here?

I’m a fan of IVV. This post was written quite some time ago when I hadn’t really looked at it.

Thanks Firebug. Yeah it is definitely a huge amount of fees over time!

That’s interesting to hear about VTS. Although half the US markets revenues come from overseas, that’s still taking a fair bet on one country and excluding a lot of profitable ex-us companies who are in direct competition with them, and could indeed win market share away from them.

There’s also the currency issue to consider. It’s still probably a good idea to have a decent weighting to Oz like you do currently. And the rest being global exposure I think is a good idea, rather than US focused. It’s worth paying a few extra basis points for the extra certainty of holding the global market in that case.

I’m definitely no expert on indexing, but there’s also possibly some estate tax issues with VTS – do you know what happens there?

Later on, I plan to use VGS for a global-market one-stop-shop 🙂

To quote the great Oracle of Omaha:

“For 240 years it’s been a terrible mistake to bet against America, and now is no time to start.”

With the global economy the way it’s structure. The US is basically the entire global market. Just like how you get some international exposure through certain Australian companies. The US is so interconnected with the entire world that it would be impossible for the entire economy to go down without dragging the majority of the world with it. See 2008

Regardless, I don’t want to miss out of the European and Asia market gains which is where VEU comes in.

The estate tax issue does not affect me because I buy in a trust and not my own name. But even if I did buy in my own name, I don’t really care if my kids have to pay uncle Sam some extra tax if they would be so fortunate to inherit anything from me in the first place!

I’m not even sure I want to give my kids a big inheritance. I will cross that bridge when I get to it.

Hi firebug,

Can your next post be on “trust” and explaining what they are and how it benefits FIRE?

Cheers keep up the good work

https://www.aussiefirebug.com/pay-less-tax-part-1-buying-assets-in-a-trust/

👋 AF,

Old article, but I would love some help!

Could you look at the Vanguard Diversified High Growth wholesale fund please?

From what I can make out it is the same as the ETF and charge 0.29% annual management fee.

I’m 34 y.o and you can buy in for $100k (if you call them up).

For a n00b like myself I think this could be an even better “hands off” option.

The underlying vanguard funds are all the same, but you can set up BPay and pay say $200 a week straight into the fund without brokerage fees. (Minus 0.009% spread)

So my dilemma is to take advantage of the current corona dip and put $200k savings into this fund or buy the 6 underlying funds in various weighting’s and rebalance myself.(Much cheaper but more chance of emotional selling)

Did your original article take in to account brokerage fees on all 6 or so underlying index funds over 50 years?

Can you see any downsides to the wholesale fund as opposed to the VDHG ETF?

Cheers

Nathan

Sydney, Australia

Hi Nath,

The fund and the ETF are literally the same product just packaged differently. If you’re all over the brokerage already, then there’s nothing really to add. If the MER is the same then it doesn’t particularly matter (other than the brokerage fees).

Hope that helps 🙂

And put me down for number 3 – the dividend approach 🙂

Keep in mind though, an indexer can take the same living off dividends approach as well. They just might need to have a little more capital, or weight more towards Oz for a decent level of income.

Great article mate, i really enjoy reading your journey.

I agree with your argument about fees but I have opted for the VDHG option after much research.

I currently have my portfolio set to VDHG (60%), VAP (20%) and VAE (20%). VAP = A-REIT Aust Property and VAE = Asia ex Japan, Aust, NZ.

I have set this weighing as i calulated the % of nominal world GDP of the US is about 25% and of Asia as a whole is almost 25%, so i have chosen an equal weighting to both indicies. I calculate the weighting of the US index to be about 30% of VDHG. So thats why i have an amount equivalent to this invested in VAE.

As i don’t own and investment property i have invested in VAP. I am starting to look at the undervalued European market through VEQ in the near future.

I think with any Vanguard ETF you can’t really go wrong if you dollar cost average over the long term.

https://www.youtube.com/watch?v=XchwE9zVdnw

Nik

Great choice Nik.

There’s nothing wrong with the fees (they are very low for what this ETFs offers). I just wanted to highlight that with a largish portfolio, over a long enough period of time the difference between MER’s adds up!

Nice portfolio 🙂

A couple of thoughts. On your fee calculator, are you using a static 1 million as the amount invested or are you accounting for growth? I’m assuming that you’re using a static 1 mill but I would have thought growing the mill would be more appropriate even accounting for withdrawals?

Also, with the proposed changes to franking credits from Shorten and the Labor party have you done the math on what impact that might have on the amount needed to retire?

Hi Sean,

You’re correct in assuming static. I haven’t even thought about adding in the growth tbh. Could be done… Let me release it first with static and I’ll see how it goes. The effects would be amplified which would further my point… I’ll look into it.

The franking credit changes will not affect me as I don’t plan to use them to get a refund. Let’s see if they actually become law first. I doubt it will get through.

Hey AF,

Just wondering when you say “you don’t plan to use them (franking credits) to get a refund”, isn’t part of strategy #2 getting the franking credit refund? Follow-up question, do you take advantage of AFI’s DSSP to avoid paying income tax on dividends? My husband and I are high-income earners so I’ve switched our return to be DSSP (for AFI) – do you think it’s better to get the DSSP or DRP + franking credit?

Thanks so much!

Laina

Hi Laina,

I think my mind was in a different place when I wrote that comment 2 years ago.

As for the DSSP. I don’t use it but it does make sense if you’re a high-income earner!

Sorry if that’s not much help, I haven’t spent a lot of time on it.

Cheers

so AussieFireBug, which of the 3 portfolio combo do you follow?

Option 2 all day baby!

So do you manually reinvest the dividends on option 2?

Wouldn’t this require you to wait until you’d amassed enough for another package of shares?

Cheers 🙂

Yes I manually reinvest them.

They are just added to my savings each month when they come in. I dream of the day when I can purchase a $5K chunk with one dividend payment…

I am new to ETT and just purchased first one in Pearler( trading platform)What’s the relationship of dividend and Share Registry? I’m still not sure. And is dividend go to my bank account and how to I do DRP?

Hi. I know this thread is quite old but stumbled across it and have found it to very helpful. I am very very new to the share market and am wondering if you could give some advice as to what shares to buy to accompany my AFI shares.

Have never done trading before. Bought these some time ago advice given from my dad who has since passed and am now wanting to expand a little bit

VGS

I am an Option 1 investor but quickly being won over to the Thornhill approach. The reason is not even about fees, it is mainly about CGT and especially CGT on shares held outside of super. Secondly it is about smoothing the ride with dividends despite the market fluctuations.

I still think however VDHG beats the pants off all the available robo or robo-style products out there now both for fees and for allocation of stocks (compare Stockspot highest growth option to VDHG’s for instance – poles apart in allocation). I still suggest all my lazy investor friends to do VDHG however.

Once VDHG is available inside of superannuation providers that offer share picking as an option, it will also be more popular with only 15% tax on earnings and once in pension phase free of any taxes (until the government scratches its bum again anyway!)

The pother thing I dislike is the 10% of bonds – I’m not a bond lover. I have cash set aside for my needs and the rest needs to be 100% stocks.

BTW, I really enjoyed this post – a great read.

Check out Australian Super index balanced

Thanks Phil 🙂

100% with you about recommending VDHG to lazy investor friends.

I’m a subscriber to VDHG, for simplicity’s sake. If it gets me investing and is better than most scenarios, I’m in.

However, I was surprised at the numbers you ran re how fees add up. I’m not sure I’ll ever get to a ‘mill, and my growth there would be pretty slow as I’m also chucking money in PPOR’s offset. However, it’s good to have in the back of my mind (I’m in the wholesale fund and am paying 0.29)…..doesn’t it make VTS look cheap!

In your etf portfolio’s you didn’t add any bonds to correctly match the equivalent diversified ETFs or robo advisor products.

You mentioned high fees on VAS + VGS portfolio of 0.16 which isn’t high at all. Compared to diversefied 0.27%, robo 1% active management 1.5-2+%.

Any of the products from diversefied down are cheap products which will let you achieve FI. I would be less worried about the small details and just commit to regular saving and investing while also enjoying your life on the road to FI

Steve! This is exactly what I’m talking about!

You say VAS+VGS is cheap (which it is in relation to most other products) but the difference between that portfolio and other options translates to hundreds of thousands of dollars difference over a lifetime!!!

It’s one thing to say that the MER is justifiable (which it 100% is), I have issues though when people blindly say it that the difference between a MER of 0.16% and 0.101% (for example) doesn’t matter because they are both cheap. It does matter!

If you are willing to pay the extra then so be it, but please don’t disregard it as a small detail.

To be honest I’m glad he didn’t add the books because I think (and I think many others would agree with me) that those bonds are a drag and end up actually costing you more on top of the MER in lost gains.

That’s my $0.02 anyway

Hey FB – good points.

But why not model in the trading costs? When I ran the numbers I also included the costs of additional trading in and also rebalancing. It narrowed the MER gap somewhat.

In the end I’m not sure its an Apples V Apples comparison. The HIGH GROWTH diversified fund invests in 9 funds. Your benchmark portfolios are much simpler (don’t include any cash etc). Not saying that its a bad thing just different.

Also its worth noting that these funds are managed and move with the current Vanguard research, for example they reduced Australian allocation (among other things) – which so far seems to be a good bet (adding hedging less so but they did this to soften volatility).

https://www.mlc.com.au/content/dam/mlc/documents/pdf/investments/Vanguard_notice-Diversified_Funds%20-Fee%20-reduction-change-of-asset-allocation.pdf

Hi Bludger,

The trading costs are hard because not everyone pays the same amount. I currently don’t pay brokerage fees at all because I have an affiliation with my broker.

Even if I did though. We only trade when we get to $5K which works out to be roughly every month. So that’s 12 trades a year. It would cost me the same amount in brokerage costs regardless of what option I chose. I would still be only making 12 trades a year.

You’re right in regards to Apples vs Oranges. They are different products. You would like to think that the managed component of VDHG would have better performance or less volatility compared to my portfolio, but we’ll see.

That’s why I prioritize a low MER. It’s a definite. You’re not relying on future performance or anything like that. The MER is a set cost and the lower your MER is the better 100% of the time.

Hi,

My current allocation is 45% VTS, 45% VEU, 5% VIF and 5% VHY.

I started quite even among the four then weighted more heavily on VTS and VEU over time.

Why do you prefer VAS over VHY though?

And what do you do with dividends that you can’t reinvest automatically?

Hi NG,

VAS over VHY because of the MER (0.14% vs 0.25%).

I reinvest them of course! Just can’t do it automatically. They arrive in my account and I use them in my next purchase.

Love this article! Thanks Aussie Firebug. Only been investing for about 3 months now, following the barefoot investors breakfree setup, which has ratios in STW, IOO, VAF, VSO and VAP but definetly was looking at the VDHG option. Now your VTS and VEU seems like the way to go.. to many options sometimes I swear!!

Hey Iron Jay,

There’s no right answer here. VDHG is fantastic!

VTS and VEU are also great. They do require more work though.

Do whatever you’re comfortable with mate. If you’re unsure of anything, I’d probably stick with VDHG.

Hi, I have been following your posts for a while and enjoy them, so thanks!

I notice you have VAS, VTS and VEU (Option 2). What do you mean by “have to manually rebalance” ?

Hi Emily,

Thanks 🙂

Have a read of this https://www.investopedia.com/terms/r/rebalancing.asp

Hey AFB,

In your option 2 description, you wrote:

“40% Oz shares (VAS or AFI) 60% international (VTS+VEU)

Low management fees (0.101% assuming the above weightings)”

How do you arrive at 0.101% ? From what I can see:

VAS = 0.14

VTS = 0.04

VEU = 0.11

Where does the 0.101 come from?

Hi Nick,

It’s the average that also factors in the weightings.

The math is

(x1*y1)+(x2*y2)+… etc.

Where:

x = ETF MER

y = The weighting

So in my portfolio, it would be

(0.4*0.0014)+(0.3*0.0011)+(0.3*0.0004) = 0.00101 = 0.101%

My web app (coming soon) calculates this for you and graphs it.

Thanks mate, makes perfect sense! I’ll start using the same formula for my own portfolio.

Hi, one correction: The diversified ETFs are not 100% hedged, only a part of them are. The international fixed interest allocation is, and a fraction of the international shares allocation is hedged. For VDHG for example, ~23% of the funds is hedged, as per the PDS. The majority of international equity exposure is unhedged.

Chris

Good spot Chris. I have updated the article to reflect this.

Long time reader. First time commenting. Just wanna say the radio interview was great. (I saw you mention it in your other post, and not being happy about your answer – but you were great!)

Loved your breakdown of all of this. I often have arguments with my friends about MER as they justify it from their end. Hailing from Canada where the banks often charge you 2.5%, now that I know the system, I am never paying high fees, unless it’s a specific specialized portfolio (such as SPYX).

As I’m not an Aussie local, any chance you can point me to any articles on Franking? I am not interested in investing in Aus, as it’s similar to the Canadian economy, and I don’t have a home bias. But I keep hearing about franking, and really want to understand if it’s worth it. Otherwise, I would just invest globally & in the US.

Thanks, and keep up all your hard work.

Hi Ana,

2.5% 😱😱😱😱!!!

My good friend and fellow FIRE blogger Pat did a fantastic article about franking a little while back. Check it out here

Hope that helps 🙂

Great article mate!

Just starting following you a month or two ago. Really enjoying your posts.

When’s your next podcast coming out?

Keep up the good work!

If you rebalance manually using option 1 or 2, does that create tax implications/cgt? Does vdhg automatic rebalancing? n00b here.

Depends on how you are rebalancing. I might do an article about rebalancing. But to answer your question, I’m 99% sure VDHG does it automatically with no CGT or tax implications. If you’re doing it yourself. You won’t run into any of that unless you’re selling parts of your portfolio to rebalance.

Hope this makes sense. I’ll probably do an article because it’s easier to explain through a video or something like that.

Cheers

I’m looking forward to that article, why do you need to re balance? and when you say re balancing do you mean you just need to look at how much % each of the different ETFS has? or do you re balance as in sell some and buy others… my next step after the mortgage is done will be ETFS and I was planning on just smashing VDHG but this article scared me.

I’ll explain everything in the article but essentially it’s more to do with the % each ETF has. You don’t need to sell to re balance.

I didn’t mean to scare you off VDHG. It’s a great ETF. Just be aware that the extra fees add up over time.

Great article. I actually invested in VGDR for its simplicity of an all in one auto balanced index etf but that was before I knew about FIRE.

I totally get what you’re saying about keeping MER down as low as possible.

What do you think about an alternstive strategy to option 2 of 60% oz shares and 40% international?

That way you get benefits of franking credits with some exposure to overseas markets just flipped.

Is anyone else doing this?

Finally, in terms of manually rebalancing do you have any resourses where someone currently in the 99% could learn to become part of the 1%?

Hi Tom,

It’s pretty simple mate. You just keep track of your portfolio and when you need to buy, buy the portion of the portfolio that is the lowest in terms of percentage of where your weightings should be.

If you’re running a 40-60 international to domestic approach and international goes way up, next time you buy just top up on the domestic part to help rebalance the portfolio to the correct weightings.

I know a lot of people who were running 60-40 for Oz-International. It’s a decent split I think.

Rebalancing will almost certainly create a tax event for the end holder, unless the underlying funds are sold at a loss. How could it not?

My understanding is any income received, asset sold and cap gains realised inside a trust structure (which is what ETFs and managed funds are) must be passed thru to the end shareholder. Just like the small turnover VAS has results in some capital gains as part of the distributions each year, as an example.

Can you point me somewhere to read up if this is wrong?

Cheers, Dave.

Perhaps the trust uses any reinvested dividends or coupons to buy into any asset class it is currently underweight? Similarly any new money going into the trust via a creation basket could be put directly into any underweight allocation rather than shared out on the generic 90/10 split? That would presumably reduce the amount of assets it would have to sell to rebalance, and it likely wouldn’t have to rebalance much anyway unless there is really dramatic outperformance in one asset class vs another?

Yeah I’m not sure on this either. How does the diversified ETFs re-balance? I’ll investigate more

Hope this helps others with the same question in mind. I have been considering gradually switching to these diversified funds from my current VAS + VGS portfolio due to rebalancing tax implications.

Also if I pass away, most certainly my wife will never have the inclination to start learning how to rebalance

https://static.vgcontent.info/crp/intl/auw/docs/literature/research/constructing-australian-diversified-funds-whitepaper.pdf?20190815|193023

“The rebalancing process is made more efficient from a

cost perspective through the use of cash flows, including

fund inflows and outflows to adjust the portfolios back to

original targets. This strategy ensures that the number of

rebalancing events can be kept at a minimum, reducing

costs and tax impacts, yet still enables investors to

maintain an asset allocation aligned with their intended

risk-return characteristics.”

Great post. sorry I don’t have the knowlege to give constructive feedback but stoked to be learning from you and others, especially those with an AU perspective, albeit later in life. Keep up the good work!

Thanks Greg 🙂

Great read.

One thing to note also: VDHG also gives you international small companies index.

40% Oz shares (VAS or AFI) 60% international (VTS+VEU)

What ratio of VTS and VEU?

I have 30% of each. So VAS 40%, VTS 30% and VEU 30%.

I am liking the thought of investing in VAS, VTS and VEU as prescribed however there is no exposure to property, commodities or bonds though this method, would love to hear people’s thoughts and the pros and cons of not including property, bonds and commodities in your portfolio

Ben I think Aussie Firebug already has plenty of property exposure through his investment properties, roughly three quarters of his net worth in fact, so it probably makes sense not to have more here? For people without property investment though I agree it would probably make sense to have something here, I did use SLF myself but sold that when I was buying a house, I’m sure there are other good ETFs for property exposure.

I think there is a case to be made for bond and commodity ETFs, they tend to be good diversifiers and can have negative correlation with shares and property which helps smooth returns over time, but the performance tends not to be as good historically. So if you need some comfort when things are going bad that you have some investments that will likely hold up ok, then it makes sense. If you’re ok with riding out the bad times (everyone says they are until the bad times actually arrive!) and have a really high risk profile then you could presumably just go with a pure equities portfolio.

Cheers Sean most appreciated, do u or anyone here have any commodity, reits or bonds ETFs they could recommend with low MER would love to check and compare some. Have also just discovered this bit of information on the barefoot investor forums…..

“One thing I think everyone who invests in the US needs to know is when you maybe subject to US Estate Taxes if/when you died. For non-resident and non-US citizen persons any investments above $60,000USD will have their US based assets taxes at 40%.” Which makes me lean more towards VDHG

The Stockspot annual ETF report has all the MERs on the ETFs in the Oz market. https://www.stockspot.com.au/etf/#downloadreport-section In general Vanguard tends to have the cheapest ones, Blackrock/iShares is usually pretty decent as well.

Commodity ETFs tend to have fairly high MERs, presumably because of the roll cost for futures backed and storage costs for physical backed but I don’t know for sure.

I wasn’t aware of that issue with the estate tax, does that apply to ETFs as well? Anyone know the tax residency of the structures underlying the ETF which actually hold the investments made, that might make a difference?

As the wife and I began our FIRE stage this year, the limitations of a market at all time highs, along with low interest rates meant, we went more VHY in the short term to provide income an will be averaging into VAS as we go along. Also having in hand a bunch of USD, I went a slightly different route, opening an account at Schwab and buying VTI directly – again averaging in perhaps over the next twelve months. This route offers a pure investment, rather than hedged with extra costs, or floating exchange rate/value – which we preferred. Thanks for the article and all the comments!

Hey Firebug,

Your note on the higher cost of VDHG scares me a bit. I currently only have the ability to save around 6k a year for ETFs (also simultaneously saving for a property deposit)

I was looking at the retail fund option which has much higher costs compared to its ETF. The ability to BPay smaller amounts per week into a retail fund rather than saving 12 months to purchase one 5k bundle seemed appealing at first

But reading this I might rethink my options now. Still will be investing in VDHG. just have to work out how

Great article. Keep up the good work 🙂

Hi, have you seen the new Betashares ETF thats launching that tracks the ASX 200? Fees are going to be half of Vanguard’s VAS, only 0.07%. Just wondered what your thoughts are and if you might start looking at that instead of VAS

All over that bad boy.

Might have something in the works about it soon. Watch this space 👊

Hi, I have a question about the investments within the EFT itself. I do a bit of Uber driving and had a guy in the car who worked for the investment arm of a bank. I asked him on his thoughts re EFT’s and he said the discussion within his organisation about EFT’s was whether a particular EFT also invested in other EFT’s. So nesting EFT’s within EFT’s, within EFT’s, etc. He thought that Vanguard were a good operator, but does anyone know whats actually inside the EFT box? or do we buy the products based on faith?

Hi Tom,

Some ETFs bundle other ETFs inside them. You can find out exactly what’s inside the ETFs by looking at the facts sheets for them (https://www.vanguardinvestments.com.au/retail/ret/investments/product.html#/productType=etf)

This will show you what companies are inside the ETF and their weightings.

Hello, Approx. 90% of VDHG includes

Vanguard Australian Shares Index Fund (Wholesale)

Vanguard International Shares Index Fund (Wholesale)

Vanguard International Shares Index Fund (Hedged)

Vanguard International Small Companies Index Fund (Wholesale)

Vanguard Emerging Markets Shares Index Fund (Wholesale)

It seems like you will be actually paying double fees because of these funds have their own fees and then you also pay the VDHG fees on top of that.

I might be wrong. What are your thoughts?

btw I love reading your blogs and listening to your podcasts!! Keep up the good work.

Thanks, DN.

It’s a great question and one to be aware of.

From the PDS “As the Funds invest in a number of Underlying Funds, Vanguard’s management fee in the Underlying Funds is fully rebated back to the Funds. This ensures investor do not incur duplicate fees.”

So only one fee mate 🙂

Unlike investment platforms like StockSpot and Acorns. Which charge you a fee ONTOP of the underlying funds…

Great article! I was reading Andrew Hallam’s book (as I am an expat) and he shared this link – wealthgame.ca – it has a calculator for modelling the cost of fees – http://www.wealthgame.ca/ – hope its useful!

Good article, thank you! There is a little typo?

>I have been seeing a lot of people recommend VDHD, which as I have mentioned above is a fantastic product. No doubt about it.

>The only issue I have is that at a MER of 0.27%

I think you meant VDHG? I spent a minute or so searching for this mysterious VDHD, hehe

Good spot. All fixed now

Dear Aussie Firebug,

What are you thoughts on VGAD? Is the 0.21% management fee a factor in favouring VGS with its 0.18% fee, even if VGS is un-hedged (to my knowledge).

Thanks,

Jeff

VGAD is fine. But isn’t it the exact same as VGS but hedged? If so, I would choose the lower MER options of VGS every day of the week as I don’t need it to be hedged over a long period of time.

Hi all,

Great post!!

Just a quick question. I’m only starting out and was thinking of investing $5000 in VGHG or the equivalent managed fund, and then adding another $5000 a year. My question is what strategy do you employ to add funds to your investment? I understand the fees and brokerage differences between ETF’s and retail funds. Can you dollar cost average into an ETF with only $5000 per year or does the retail fund sound more suited to me?

Thanks!!

VDHG*

Hi Markus,

You can definitely DCA ETFs. I like to think of the brokerage fee as a percentage of the purchase price.

If I’m charged $9.50 and purchase $5K of ETFs. I have essentially been charged a 0.19% buying fee. I’m happy with paying that fee. But if I bought $200 worth of ETFs, I would still be charged $9.50 and that works out to be 4.75%. I’m loosing nearly 5% straight off the bat in buying fees. That’s way too high for my liking. That’s why you see a lot of people recommending to only buy in lump sums of around $5K. Of course, everyone is different though, and you need to be comfortable with whatever option you choose.

Now as for the whole managed fund vs ETF debate. It really comes down to how often you purchase and at what amounts. If you’re investing style is to buy $200 worth of ETFs each week, I would think the managed fund is the way to go. But if you’re buying lumps sums every month or so, maybe ETFs are the better option.

Hope this helps mate

Thanks heaps for your reply!

Sorry I didn’t fully word my question right. I was thinking of investing $2600 twice a year into VDHG and was wondering if you would still get the benefit of DCA with investment deposits spread apart that far.

Also, how have you found SelfWealth? I chose them after listening to your podcast.

Does it take you that long to save $2,600? If you have the lump sum of $5,200 I would personally just buy in one hit. Also, the brokerage fees as a percent on $2,600 is a little high for my liking.

SelfWealth has been great. Does exactly what I need it to do and is the lowest brokerage fees. Everyone should use them

Hi

This is a great article, thanks for this.

But correct me if I’m wrong, I think the VAS + VTS + VEU combo would be worse off because of the 3x brokerage fee?

Scenario – If I am investing $10k each month buying Option 2 vs. VDHG.

Under Option 2:

– Brokerage fee for the 12 monthly transactions buying the 3 ETF would be $19.95 x 12 x 3 = $718

– ETF Management fee would be $121.. ($120k x 0.101% MER)

– total fee is about $840

Under VDHG:

– Brokerage fee for the 12 monthly transaction buying the 1 ETF would be $19.95 x 12 = $239.4

– ETF Management fee would be $324 ($120k x 0.27% MER)

– total fee is about $563

If we use a broker like Self Wealth instead of say Comsec or Westpac which all charge about $19.95..

then it’s also about $443 (VDHG) vs. $479 (VAS+VTS+VEU)

Not sure if I’m missing something or if my calculation is incorrect, or if you had not taken into account the brokerage cost?

Thanks and look forward to you response

Victor

Hi Victor,

Your calculations are spot on. But I don’t buy 3 ETFs each month. I purchase one ETF (the one whose weighting is the most out) each month which would mean the brokerage fees would be the same. The only difference would be the management fees.

Also, as the portfolio grows, the brokerage means less and the management fees really come into effect. I would like to see your numbers again with a $1M portfolio (which is what we will have within 5 years if it all goes to plan).

Cheers

Hey Aussie Firebug,

I’m considering Wholesale Vanguard High Growth Index Fund at MER of 0.29% which is the same as VDHG as opposed to VAS 20%/LIC 20%/VTS 35%/VEU25% with a weighted MER of 0.1055% as the former is essentially set and forget.

My main concern is myself! Having to make a make a monthly decision when to buy ETF and ‘timing’ the market. Rebalancing should more straightforward as probably just need a good spreadsheet. Some months can be so busy at work, or when I travel internationally twice yearly, so I’m mindful of these as well. Hence automating it sounds extremely attractive especially with the DRP turned on during wealth accumulation.

The downside to Wholes Vanguard High Growth Index Fund is that its asset allocation is fixed and not flexible although that can be changed by buying into another fund to rebalance the portfolio.

I understand that you buy an approx $5k ETF monthly. Do you just buy at a fixed time in a month i.e. 1st Monday of every month, or do you watch the price and decide on the time within that month or defer it to the next month so it’s $10k for that month if the price was right? I have $8k per month to buy into a fund and don’t want to go into paralysis by analysis, especially when the market is volatile or ‘high’.

1) Would be interested to know how you decide when you buy your ETFs. So, dollar cost averaging or value cost averaging (VCA)? And if VCA, how do determine when is the right time to buy?

2) Would you change your asset allocation to more conservation funds i.e. bonds, when you retire i.e. when you have >$1 million invested? If so, how much? 10%, 30%?

Would be interested to know your thoughts!

Hi coninfection,

1. We buy as soon as we have reached $5k in savings. No timing or waiting. As soon as we have it, I transfer it over to SelfWealth and do the trade.

2. Not planning to. When we have 1 Mil+ we will be living off dividends and I don’t see any reason to stop investing for dividends once we have reached the goal. We may go a bit more internationally… but we’ll see.

If you don’t trust yourself with making those decisions, maybe the diversified ETFs are the right investment for you.

If you had at least $100,000 to invest (which Vanguard tell me gets you the wholesale rate – and also allows you to invest across multiple funds), would you choose to invest directly in Vanguard index funds as opposed to ETFs where a broker account is required (with likely brokerage fees)? The main advantages I see with direct investment in one or more Vanguard index funds (at wholesale rates is):

1) Do not need to pay brokerage

2) Management fees are only slightly higher than the ETF fees (and much lower than the retail fund fee)

3) Regular investments can be made without paying brokerage which allows dollar cost averaging

4) Distributions can be re-invested

5) Receipt of an annual tax statement; not sure if taxation is straightforward using a broker account?

I have never invested in index funds or ETFs before, so there may be other issues that I am not aware of. I would be interested to hear the thoughts from more experienced investors (including the different taxation implications).

Same question here.

0.29 Wholesale high growth

0.27 VDHG

Purely looking at the MER plus brokeage, if say innitial 100k in both with additional 25000 after a year (0.12 brokeage cost on Commsec) rather than DCA:

MER: 10 saved on wholesale

If 200k others stay the same:

MER: 10 saved on VDHG

Maybe the question comes down to what budget range you are under and you wanna go LSI or DCA. Any thoughts would be appreciated.

Hi Aussie Firebug,

I’m considering a portfolio with the following allocations

VAS 35%

VGS 55%

VGE 10%

I have 2 questions.

Firstly…

I’m able to invest roughly $6000 per year at this stage so to kick things off I was going to buy $6000 of VGS now, then 8 months later $4000 of VAS. The problem though then is that the 10% VGE allocation I want to achieve is only ~$1000 which makes brokerages far too much even with SelfWealth.

What would you do in this example?

A) wait until I have bough 2 parcels of VGS and VAS and then buy VGE, meaning a 10% VGE allocation is now worth $2000?

B) work backwards and buy $2000-$3000 VGE first and then build VAS and VGS until my desired allocation?

Secondly…

I plan on rebalancing by increasing my holding in the fund most lacking behind the desired allocation.

Do you top up whichever fund is lacking the most with the same amount of $$ no matter what the funds allocation is? Using my allocations as an example, if VGS were the fund that was down the most I invest $6000 in it making it higher than the target allocation. The problem is if it is VGE that is due to be topped up and I add my yearly $6000 it then would become hugely over represented.

Sorry for the long winded comment!

Thanks for putting together such a great blog!

Or would VDHG be a better option until I have ~$20000 and then I can sell it and buy the 3 other ETF’s?

We aim to buy $5k every month and use the method you have outlined, topping up the allocation that’s most lacking.

I wouldn’t stress about the weightings that much at the start. I would aim for a certain amount to be invested each month and top up the allocation that needs it the most. This will throw your weightings all over the place at the start but it doesn’t matter that much. When you build up the portfolio to a decent amount the market swings will be the major cause to weighting in balance.

How much can you save each month? It may be worth looking into opening an account with vanguard so you can bpay each month smaller amounts and not pay brokerage.

Unfortunately only $500 a month. 3 kids and only 1 and a bit income makes things tight.

I considered the retail fund but I don’t like the hefty fees that come with them.

I have the discipline to put the $500 away and not spend it so that’s why I was keen on an ETF.

If you don’t think the allocation weighting are that big an issue in he beginning, I’m leaning towards the 3 fund combo. It’s cheaper and gives me more control and gets rid of bonds, which, as I’m only 25, I don’t see as necessary yet.

I was going back and catching up on the podcasts and recently listened to both your Vanguard as well as the stockspot podcast which got me thinking.

Given that stockpot basically tailors a diversified ETF portfolio for your needs, does the Vanguard Diversified Funds replicate this at a lower cost – MER 0.27%. Stockpot obviously has a management fee (effectively 0.66% per year, plus the flat annual fee $55) plus the underlying cost of the included ETFs. Brokerage is covered in their fee though.

The advantage i see in stockpot is access to non Vanguard ETFs within the portfoloio and possibly an advantage if your strategy/alignment changes. Though you could always add individual ETFs to your diversified. I cant see how stockpot can offer a significant advantage at the cost – even though not excessive. As long as you are able to assess your own investment profile, needs and strategy.

They can add value not by offering a superior investment, but by making the process of investing extremely easy, friendly and helpful. Because let’s be honest, investing with Vanguard for a n00b is pretty daunting. I have a slight obsession with personal finance and hell, it took me a few months to get my head around everything and I’m still learning to this day!

There is a market like this in just about everything. You can learn how to get fit by learning online and watching videos and stuff. Or you can pay a personal trainer who can show how everything works and what to do. But you pay extra for the PT of course.

They can add value not by offering a superior investment, but by making the process of investing extremely easy, friendly and helpful. Because let’s be honest, investing with Vanguard for a n00b is pretty daunting. I have a slight obsession with personal finance and hell, it took me a few months to get my head around everything and I’m still learning to this day!

There is a market like this in just about everything. You can learn how to get fit by learning online and watching videos and stuff. Or you can pay a personal trainer who can show how everything works and what to do. But you pay extra for the PT of course.

Thanks for the helpful advice FB. Am interested in how to think about ethical ETFs, and whether you have experience with the newish Vaneck or Betashares ethical ETFs, or the Vanguard ESG ETFs. I admire your commitment to counting your dollars – an honesty we don’t often have in ‘polite company’ as my Nana would have said and which has disadvantaged me over my life – but I’m not a person who will seek overall total value at any (including ethical) cost. In the system we are in (capitalist) we can become more thoughtful buyers, and I’d be keen to see the committed ESG and ethical ETFs grow in profile, but am an absolute novice (pre) investor so haven’t developed any insights yet into this space. Do you have any? Or can you point me in the direction of helpful commentary/analysis of being committed to this? Thanks for your site.

Hi Anita,

I honestly have not looked into ethical ETFs, to be honest. Maybe something I’ll lean towards in the future. But as of right now, I’m looking at what can help me achieve my goal of producing a passive income stream to live off.

I would like to invest with companies that share the same values as me too though, so maybe it’s something I should look into. I don’t know of any ethical investors in the FIRE space off the top of my head sorry.

Thanks

Anita, like you, I am also novice ETF investor who is interested in ethical ETFs, even if the fees are slightly higher. The Betashares ETHI is new on the block & I was tempted to purchase that. I also would like to hear from others who have more experience on this subject.

Looking at setting up a portfolio with VDGR and a couple of other etfs such as VAE . I’m 55 so will be looking at dividend return as well . Does anyone know how the diversified ETF s

Behave in a market crash? ( ref dividends) wondering if I’m better to have about 5 or 6 different etfs rather then VDGR.

I m thinking VDGR rather then VDHG cause of my age ( less volatility) or separate afic and VDHG . Any thoughts would be great . I have a cash buffer that I would like to keep topped up with dividends.

Thankyou in advance 😊

Hi did you end up purchasing VDHG or VDGR? Im 37 and deciding which to go with. Im lazy and want a set and forget etf that is simple. I wonder how it works later in life when you to reduce asset allocation to more bonds,cash over stocks though?

Cheers.

Thank you so much for this excellent comparison.

My concern is are we comparing apples with oranges?

For example VDHG/VDBA has bonds and fixed interest which is a necessary component to mitigate risk in a bear market.

If you add VAF with an MER of 0.20%, to the VAS+VTS+VEU combo, I think you still achieve a respectable MER of 0.136% with VTS 25%, VAF 40%, VEU 10%, VAS 25%. Of course, VAF can be adjusted to a lower figure particularly for younger investors to decrease the MER.

Good point. The diversified index ETFs are a different product and marketed to different investors. Can’t really be compared but it’s fun doing so 😜

Hi FB, great post by the way…

im in the lazy investor camp, not that im not into putting in the effort but i have other main focus, i just see this a good place to park my sleeping money w/o much administration and yes i can take that lesser profit for the time saved.

a couple of questions

1. am i right to assume i can purchase VDHG as a regular stock using my online brokerage? im planning to buy one of 200k worth of shares, maybe another 200-300k later after i sold a property.

2. will the value of the stock (if via #1), is inclusive of the management fee (MER?).

3. DRP is auto for VDHG right?

Yes you san buy it through online broker or thru vanguards.

Yes pretty sure inclusive of mer?

They’ll send you the paperwork once invested and you can choose DRP or not .

Thanks Emma.

One more thing, how does the compound interest works in ETF?

say the value of ETFA is $10 and hypothetically earns 10% interest annually consistently.

so jan 1 purchase 1 share then my investment is $10.

year 2, my investment becomes $11 (value of ETF share)

year 3, my investment becomes $12.1…. and so on (excluding MER for simplicity)

Great post! The VDHG ETF has a lot more diversification that just the 3 ETF models you suggested. The automatic rebalancing with the bonds held in VDHG allows for faster recovery from a market correction. Perhaps this would get you better returns in the long term, and make up for the 0.16% difference in MER?

Maybe. We’ll have to wait and see 😉

Hello. I have a question about potential lowering of MER Fees.

Haven’t Vanguard already lowered the VDHG ETF by a couple of points? Further, whether they have or haven’t, the more popular an ETF that’s globally diversified like this one may become, isn’t the likeness the MER will lessen with an increase of investment? Therefore the expense consideration may likely be cut with demand.

Cheers. Aaron.

It’s definitely possible Aaron. That’s what usually happens, the more people buy in, the cheaper it gets. Let’s hope it keeps coming down 🙂

G’day mate not sure if this has already been asked but what do you mean when you say option 1 and 2 needs to be manually rebalanced?

Usually when you have a portfolio that’s domestic and international. You will want to have a set percentage for each. Like 60% Aussie and 40% international. As the shares grow, they will become unbalanced over time which is why you need to rebalance them. You can either sell parts of the portfolio and buy the other part to maintain an appropriate weighting. Or you can simply wait until you buy each month and just buy the underweighted part (that’s what I used to do).

Hope that makes sense 🙂

Ah yeah that makes perfect sense. Thanks mate love your work

Hi FB Community, I thought I’d leave a comment on this topic as the largest portion of my portfolio has been with the VDGR index fund since its inception. Originally I chose the fund as I was only 20 at the time and wanted to get into the stock market in the simplest, most diversified way possible. Not to mention the theory behind the allocation was somewhat similar to that of Ray Dalio’s ‘all weather portfolio’. Initially, my biggest hurdle was getting over a constant need to see where the value of my holdings were at but now as I’ve matured as an investor and trust in my investment goals, I’m able to think a little more strategically.

Given I’m investing for the long term and am no longer greatly concerned with the daily fluctuations in price, I think it’s important for anyone targeting these ETFs to consider the alternatives from a dividend perspective. I would recommend looking into the ETFs which would make up the diversified index fund you’re interested in and identify which are paying the greatest dividends on average (I went on an average based off the last 8 dividends for each holding).

I think it is worth the time to identify which individual ETFs suit your investment strategy and what the return will be because long term growth predominately depends on a DRP and periodic investments.

Well said Lachlan!

Hello AFB, Congratulations for your blog. Such a great discover!!

About to start my FI journey but just a couple of questions from a newie. My idea is to keep it as simple as possible (No more that 3-5holdings) Ideally would be VTS and VAS. Planning to invest around $1500 a year. Would you open an account with Vanguard and invest $300 weekly or self wealth and $5000 every 4th month to keep the MER as low as possble?

As a newie I would be more comfortable starting with Vanguard and be able to invest more often smaller amounts but I found thatit is only possible to invest in their retail funds and no ETFs. What option would be the closest to VTS and VAS?

Also trying to find the best (possible) choice since the beginning so I would not have too many accounts in the future (Vanguard, Selfwelath, Commsec..). I would like to set it up since the beggining and only invest regularly.

Thanks for what you do and hope you keep the good work!

Hey mate,

I personally would look to increase my income/savings rate so I could dump in at least $2K-$3K a month. If that wasn’t on the cards, I’d just save it up and do lump sums every couple of months.

But that’s just me.

Glad you’re enjoying the blog 🙂

Thanks mate!

And in that case of lum sums of $5000 every 4 months (that would be my max savings rate for the moment) ,would you use vanguard VHDG retail fund, or a mix of VTS, USA Bonds and VAS in SelfWealth?

Thanks

Thanks mate!

And in that case of lum sums of $5000 every 4 months (that would be my max savings rate for the moment) ,would you use vanguard VHDG retail fund, or a mix of VTS, USA Bonds and VAS in SelfWealth?

Thanks

For my goals and strategy, I’d dump it all into A200.

This last comment do you mean you’d change everything to the new betashares A200 ETF with their 0.07% management fee?

Or maybe just exchange VAS for A200, keep VTS and VEU for diversity.

Yes, basically this.

I wouldn’t sell off any investments I already had, but I would direct all new investments to A200 yes.

Hey AFB,

Just curious as to how you got the management fee of 0.164 of VAS/VGS when VAS is 0.10 and VGS is 0.18 according to the vanguard product pages.

Are the individual numbers I mention applied only if you invest 100% into one fund of the other?

Is there a formula to calculate the total management fees of a fund based on percentages invested in each asset?

Ignore this… I saw a previous comment above from another reader.

No worries 👍

Thanks for the article – found it interesting

Personally I’m also an option 2 guy

(A200/VTS/VEU – MER 0.064% assuming 40/30/30)

For anyone else interested, this is also worth a read:

http://passiveinvestingaustralia.com/vdhg-or-roll-your-own

Hi AFB, your calculation of a 0.101% fee would mean you would be paying Vanguard $1010 per year, not $505 as stated in your graphs.

This will definitely change the total potential loss comparison if you wanted to look into updating it?

Hi Mark,

I really need to come back to that web app and publish it. I’m really bad with stuff like that. Maybe one day!

Hey guys, looking for a little advice here. I’m in a bit of a pickle. I started investing in index funds a few years ago. Based on advice then, I bought 4 of Vanguard’s retail index funds and currently contribute < 1000/month. Given that I’m thinking of investing larger amounts every few months soon, I am considering getting ETFs instead given the lower MER. Would you guys sell the index funds to get the ETFs in that case? And I’m wondering if 4 ETFs-VDHG, VTS, VAP, VAE will be too many? Trying to find a good split between the Australian, US, Asian and Property markets. Or do you guys have a better options of ETFs for that split besides whats already listed in the article? Thank you!

Hi Mahendrah,

No advice on this blog mate, only thoughts and opinions 🙂

With that said. It’s almost impossible to give thoughts and opinions without greater context for a situation. And there’s no one size fits all approach either. Continue to learn as much as possible as ultimately it’s going to have to be you that’s comfortable with the plan.

Hope that helps

Hey AFB,

I’m still getting through your site, as well as SMA and several others, so still working out ETF vs LIC, domestic vs international, allocation etc, but my question here is mainly to do with your allocation to VGS. Specifically, why VGS and not VGAD (hedged)?

Admittedly, it has worked to date, but if AUD/USD rises, won’t that mean you’ll cop a hit? Potentially quite a bit if US stocks tank? Surely the 0.03% higher MER is worth it?

Thanks and keep up the good work.

BG

Sorry just saw VGS is Option 1, not 2. Still wouldn’t mind your thoughts on hedged vs unhedged in this context, cheers.

BG

Hi Brad,

I don’t hedge because it usually costs more and I’m comfortable with the currency risk. Some people will be happier to pay more for VGAD but I actually find comfort in having two of our ETFs (VTS and VEU) trade in USD. It’s a bigger currency and historically the dollar (AUD) has been lower than what it’s currently at right now.

Cheers

Noob question, when you say management fee (0.27% for VDHG), how does that work say if I use Commsec? Don’t I just pay $19.95 for the brokerage fee?

You just pay the brokerage fee. The MER gets taken out of the investment before it ever gets to you. You’ll never need to pay the management fees, they are simply taken out of your returns before it gets to you.

Very good article!

I just want to clarify your above MER examples. I agree with what you explained but it all depends on the total return you get each year from the different ETFs. If you consider that VDHG will always do better than VGS then you don’t need to worry about fees.

Thanks Vince.

Yeah you could assume that… but not sure why you would? If I knew for a fact that a hedge fund would return me 3-4% higher returns over my lifetime (vs an index fund), I wouldn’t think twice about paying their 2% management fee.

Hey mate just recently discovered your blog and really digging it!

Was hoping to get your opinion on vgs + vge (or vae) vs vts and veu. I’ve done some reading up on it and there are strong arguments for each case (https://forums.whirlpool.net.au/archive/2634114 for example). Was also wondering, are there any other tax implications other than the W-8BEN form that needs to be filled out when purchasing non-Aus domiciled funds.

Cheers

Hi Daz,

VGS and VGE are both fine products. There really isn’t a magical product that suits everyone so it’s impossible to say what works best for someone without know the complete picture. And even then it’s hard.

I’m not an accountant but I don’t think there’s anything else that needs to be filled our other than the W-8BEN form…

Hope that helps mate

Hi Aussie Firebug,

Always love your blog, you’ve really opened my eyes on many things. But unfortunately, I must have misread something somewhere about the ETFs on your blog. I thought VTS/VEU bought via Pearler would not require US tax filing, only Aussie tax filing. And any ETFs bought within a personal super restricted trading account (not self-managed) require no tax filing at all, US or Aus. I thought great, and went off investing. But after reading all this stuff, I am getting a bit concerned that I might have misunderstood something.

If I am holding VGS, VEU, A200 only, do I need to submit a US tax return (I am an Aussie citizen and tax resident)? Does this change if I missed submitting the W-8BEN form in time during my first year? Not worried about getting the lost 15% withholding tax back, the amount is a lot smaller than what a tax accountant would cost. Just wondering if there is a requirement to file US tax…

Also what about any ETFs held in a personal super account? I don’t have to worry about that at all, because the super firm does all tax, right? Or do I have to worry about US tax there, too?

Thanks heaps!

You don’t need to do a US tax return. You just need to fill in one of these forms (every 3 years) for your VEU:

https://au.digital.computershare.com/W8Ben

Thanks heaps, zdamant. That’s great news.

What if I just following the VDHG profile, would it be better?

What if I just following the VDHG profile, would it be better? Instead of invest directly in VDHG

Not sure what you’re asking exactly sorry 🙁

Hi AFB,

Thanks for the great blog mate.. very new to investing and keen to get started, but I’m in a slightly unique position so wanted to get your thoughts.

I’m young and have a decent sized cash position at the moment (6 figures excl. super and property equity) but around 30% of this needs to stay in cash indefinitely for various reasons. With that being said, what type of asset allocation/ETF’s might you recommend I look at? VDHG seems most appropriate but I’m not sure if the 10% bonds component + my 30% cash allocation is too much?

Cheers!

Hi P,

All the products mention in this article are solid. It’s really hard for me to say what I’d do without knowing the complete picture like risk tolerance, investment horizon and future plans. Have a read up of the above products and you will start to get a feeling as to what might work best for your situation.

Sorry if that doesn’t help much.

Cheers

Hi Mr FB

I’m looking at A200 40%

AFI 30%

AUI 30%

I will have international plays within all these 3

What are your ideas

Problem is I have just listened to your podcast with the Great Peter Thornhill

Regards

LBJ

Hi Leonard,

What are my ideas for your portfolio? I have no idea mate! Really hard to know what I’d do without the full picture.

Those products you’ve listed are quality though. Whether or not they’re the right for you is another story…

Hi mate,

I’ve subscribed to your podcast and am excited about my early stages of my FIRE journey. I’m looking at a covering my bases with 3 ETFs which are A200 (asx200), VOO (s&p500) and VEU. My 3 questions are; do you invest via a brokerage (such as my current Nabtrade account), or do you invest in your ETFs via Vanguard directly by setting up an account with them directly?. I’m trying to find ways to cut down my brokerage fees over the long term as I am planning a 25-30yr investment strategy with regular purchases on a quarterly basis. My 2nd question was, I’ve chosen VOO which is not an ASX listed Vanguard ETF, but a US listed one. (I chose VOO instead of VTS because I wanted to stay with the s&p 500 and not the entire US market), is there any cons to this method other than the currency exchange? 3rd question is do I need to fill out a w8ben form for VOO and/or VEU?

Cheers mate, and thanks for your commitment to the podcast and blog etc

Hi Ricky,

Congrats on starting your journey 🙂

1. We invest through a broker

2. To be honest, I’m not sure mate. I’ve never invested this way so I haven’t researched it I’m sorry.

3. You will need to fill out the form for VEU. Not sure about VOO.

Cheers

Hi Mr. FB,

I am 19, turning 20 in a couple days, and want to start investing in ETFs. I have been working full-time for a year now, and have 5 figures saved, but I am really unhappy with the returns I get with it all just sitting in my bank account. The VDHG seems like a good place to start investing – I’m not looking to invest in other ETFs – but I am unsure of the asset allocation I should hold! You mentioned you invest whenever you have $5k to spare. I think $5k is a small amount considering the amount I hold in the bank as cash. But considering the bear-ish outlook on the market, I also don’t want to invest a huge amount right now. Currently, I’m holding a 100% cash account.

You got any thoughts? Rules of thumb or tips I can use to help make a decision?

Cheers

D

Hi D,

My rule of thumb with investing has been to invest consistently no matter what the market is doing. I know a lot of people think the market is going to correct soon, but I’m of the belief that over the long term, the trajectory will always be up!

Hope that helps.

Cheers

Hey mate,

Recently started to get into investing in ETFs and VDHG was my first purchase. I realised later on that I could take on more risk and did not care for the bonds plus wanted to skew more to international stocks. I started to slowly build up my portfolio with A200 and VTS and plan to get VEU soon enough.

My question is should I just dump the VDHG and buy up the other ETFs I desire or just hold onto them for now and don’t worry about them. Really appreciate your content and youtube channel.

Thanks.

Hi Phil,

Both options are fine. If it were me personally, I’d just hold on to them.

Cheers

Thanks for the advice mate, will hold onto the VDHG I have purchased and buy the other ETFs I desire.

> I have actually been working on a web app recently (so close to being published) that works out lost investment potential from management fees which gives you a visual of what I’m talking about.

Wondering if your web app has been released yet? 🙂

Not yet 🙁

I sorta have changed my opinion about the whole thing now lol. Not sure if it makes sense. I’ve come to the conclusion that the difference between 0.04% and 0.27% is largely irrelevant in the grand scheme of things. There are about 100 other things that will impact your journey a lot more than this decision.

Thanks for the comprehensive writeup as well as responding on the questions. I recently started investing in VDHG via the Vanguard personal investor platform.

It says on the website, there is no brokerage, and 0.25% annual fee (capped at $600) to use the Vanguard personal platform.

I dont understand how is this not a good deal if you never go above $600 regardless of your portfolio. Given you example of 50 years investing, you only end up paying $30,000. Even if the cap is increased, I would be suprised if it gets to $250,000.

What am I missing?

Hi mate,

I’ve narrowed down to two potential portfolio options:

1) VAS 30/ IVV 50/ VAE 20

2) VAS 20/ VGS 60/ VAE 20

My reasoning for the above is:

In the first case I have more VAS than in the second case as the second case has relatively less US exposure through VGS. I’m bullish on Asia and prefer VAE to VGE as well as factoring in the percentage GDP of Asia, I think the asia allocation is reasonable?

I do like the first option but understand that it isn’t as diversified as the second option which would have a higher MER. What are your thoughts on the ETFs and the allocations? Which would you be more inclined to go with?

Thanks mate!

Hmm. Speaking from a psychological point of view and one of practicality.

Most people, myself included will invest an amount that they can afford. Let’s say 50k a year.

Hardly anyone I know, will make comparisons between 2 or more funds and then choose one with a lower MER with the idea of investing that management fee saved into the fund as well, I.e 52k vs 50k. That 2k is lost income but that depends on performance of the underlying fund as well.

Then rebalancing has costs associated with it as well including CGT.

In effect, the differences are not as great as you make out (i think!)

Hi Tewary.

I’m inclined to choose my investments the same way as you’ve described – based on performance rather than the cost of fees. I admit I’m relatively new to ETFs, but my understanding is that the costs associated with the MER are effectively built into the market price of the ETF, so in the end it’s how the ETF performs as far as market price growth (in combination with dividend returns) that matters. Whether its MER is “high” or “low” is totally meaningless.

I am frankly a bit surprised that yours is practically the only comment on here that makes this point (I think Vince’s comment is the only other one here that suggests that chasing the lowest fees is pointless). Maybe I’m missing some very important piece of information, though, as again, I am quite new to this form of investment.

Paralysis by analysis.

To be avoided at all costs!

Best wishes buddy

Yes, true!

Thanks. You too.

Hi Aussie Firebug! Can you tell me, what are the potential estate issues with the transfer of VTS and VEU shares in a will? (I understand that a w8ben form is required for both funds). Thank you very much.

Hi Simone,

I’m not too sure about estate issues with those funds. I haven’t looked into it really because we invest via a trust and won’t run into certain issues vs other people who have invested in their own name. I’d be interested to know if you find out though

Passive Investing Australia has argued that franking credits are largely “priced-in”: https://www.passiveinvestingaustralia.com/franking-credits-how-much-more-are-you-really-getting meaning there could be little benefit.

If this analysis is correct, are there still good reasons for holding a large percentage of Oz shares in your portfolio? For this reason (and others) I find it difficult to justify holding a lot of Oz shares meaning my strategy is very different to 1, 2, and 3 because they all advocate heavy investment in a small country. Instead, I’d go with VEU + VTS (or just VGS). Am I missing something important?

Hi Rob,

That seems to be reasonable logic. I know our allocation for Australian shares is very high, but that’s what we are comfortable with. Everyone’s different though and there’s no such thing as the perfect investment.

We have a personal preference for a dividend stream as opposed to selling shares during retirement and have allocated a large portion of the portfolio to fulfil this preference. It’s not 100% about returns for us.

As I get more flow from dividends, I worry less about checking the stock market or reading market news, I like these funds because it allows me to make wise rebalancing decisions.. with out me doing anything , or checking anything. I’m really trying to drop back to checking the market once or twice a year. Not checking financial news or checking stocks also reduces my anxiety. Also is their any guarantee that reading/checking markets consistently will lead me to better decisions? I like these funds for these reasons and will personally use VDHG for the long run, despite the MER

The higher fees in VDHG are offset a little by dividend franking. I like VDHG for it’s simplicity.. This is important when you are busy with your career and when you are slowing down in old age.

Hi Aussie Firebug, and whoever else that may read this that wishes to contribute.

Firstly, congratulations on your investment growth, and thank you for your insight into investing and the level of detail you go into to help the lay person like myself understand investing.

I’m 37 years old and have been investing inside super, although haven’t been paying much attention lately with a growing family. I’ve followed yourself and Barefoot for a while now and have always wanted to invest in an ETF, just never pulled the trigger, which I regret.

Since the family is growing and I’m thinking more about mine and my kids future, I’m going to pull the trigger now. It appears the VDHG would be a good option for me over 20-30 years (when I retire), even with the higher management fees, purely for a no fuss, all taken care of option. Can you recommend any other ETF’s comparable to this?

And for my kids, can you recommend any ETF’s that I can setup for them?

Many thanks in advance to whoever can help.

Thanks for the kind words Paul. I’m glad you’ve got some value out of my content 👍

I can’t recommend anything mate. But I can say that VDHG is a very suitable product to reach FIRE in Australia in my opinion. If I were to do an all in one ETF solution… I’d probably look at Betashares DHHF product too. Cheaper and doesn’t have bonds. I prefer that but everyone’s different.

I’d invest in the same product for my kids too. But that’s just me. There’s a lot of circumstances and personal nuances that need to be considered too.

Hope that helps 🙂