Aussie Firebug: Hi, Dev, welcome to the podcast. Thank you so much for coming on.

Dev: Thank you for having me.

Aussie Firebug: For those out there who don’t know who you are, Dev, why don’t you give an overview of who you are and where you’re from?

Dev: Yeah, sure. I rise. So my name is Dev. I’m based in Melbourne in Australia. And a bit of background about myself. I’m a medical professional. I’m actually a practising doctor. We arrived as a child in 1990 from India with my family. And this was this was at the time I the start of Australia’s recession. So I was basically a 90s kid. And since then, you know, my patients, which I see are actually born in the 90s, which is pretty scary, given that, you know, technically I’m a millenial.So I work full time in the field of field of medicine. A part from medicine, my passion really is finances and teaching since I’ve been in medical school. So this sort of is a sort of a part time gig, which which I’m really interested in.

Aussie Firebug:Yeah, nice. Now to your doctor from Melbourne, which is really interesting because there’s a bit of a stereotype that doctors are bad with money. So I have to ask you, first of all, is that stereotype true in your opinion?

Dev: Yeah, it’s interesting, look, doctors do struggle with the concept of money and finances, and I do get a lot of questions from doctors who can get quite easily confused with saving or investing or debt reduction or financial principles on a guess which which can be quite a surprising thing to find because when you think about it, most doctors did reasonably well at school and then went to medical school, which wasn’t generally easy to get into, and then went on to become specialists. They are Generally quite a bright bunch, but a lot of them also don’t have the slightest clue about finances or money. So I think the general stereotype, although sounds a little bit extreme, but in my sort of personal experience from the questions and the types of questions that I get from doctors and sometimes nurses, yeah, a lot of them don’t have much of an idea about money or finances.

Aussie Firebug: It’s really interesting because like you said, everyone knows how much schooling you have to go through to become a doctor and yeah, it’s usually the bright, the brightest people go and get the right sccores do the exams and become doctors. So it’s yeah, it’s very, very weird that there is that stereotype that seems to be a true that doctors are perhaps not interesting in finance maybe. Is that something that you’ve come across?

Dev: I think if you look at a life of a doctor or how you become a doctor, for example, is a fair bit of temptation for doctors to, you know, as soon as a graduate, you know, by the fancy cars or big homes. I guess thinking about my sort of medical career, it was six years of medical school. Then you kind of become a doctor, called an intern. You haven’t really seen any money until then. So there’s a fair bit of temptation to spend money and buy things you probably don’t really need. And one of the things that I find interesting is when I became a doctor, the skills as a doc doctor or even as an academic doctor are not easily transferable to the world of finances. So the assumption that being smart to get into medicine automatically equals being smart with money is quite incorrect.And, you know, many doctors get into the habit of really focusing on their career and subsequently sort of leave their finances on the back end, on the back track and not really think about it actively.

Aussie Firebug: Yeah. And I guess that’s true for a lot of professions, not just doctors. What my sort of confusion there and I think a lot of people just assume, yeah, like you said, they’re usually the smartest people or the brightest bunch of people. So you would just put two and two together and think really smart people are good with money, but it doesn’t necessarily work out that way, which is really interesting.

Dev: One of the things that I get asked a lot, actually, you know, even in it when your consulalting patients, is there is quite a misconception with patients sometimes sayin “oh, you’re a doctor, you must make a lot of money. You must not even think about money because there’s so much money around”. And that’s a sort of general conception that patients of the general public have in terms of doctors, you know, big houses, fancy cars, happy family, all that sort of stuff. In a lot of cases, from certainly from a financial point of view, that’s that’s actually not true. I’ve had some doctors have contacted me who are in financial strife just and sometimes I wonder about how did you go so wrong or how did you get the basics so difficult?

Aussie Firebug:Do you think there’s a bit of keeping up with the Jones amongst the medical professionals?

Dev: I think there is some element of that, but I think a lot of the element is just the doctors just not concentrating on on money per say. It is a bit of a taboo topic in the medical profession to discuss finances and money. The vast majority of doctors don’t do medicine to make a lot of money despite what a lot of people might think. That’s actually not true. A vast majority of doctors do it for the right reasons. But this byproduct of that is if you are a great doctor, then you will get a lot of patients. If you see a lot of patients, you will make a lot of money. Then you become a great doctor because you’ve seen a lot of patients. You’ve far more experience and the average doctor. And of course, you see a lot of patients and you make a lot of money. It’s a bit of a cycle. And I think that’s where you can get quite busy and quite engrossed in your profession and not really focus on your finances. And I think to your point, there is a bit of keeping up with the Joneses, but there’s also a fair bit of, look, I’m not very good at finances, I’m very good at medicine. So therefore, I’m going to go out and let my accountant deal with it or let myAdvisor Deal with it and not really spending the time to learn about finances themselves. And I think that’s a real issue. And of course, in any medical school finances is not taught. And I think in any Australian university degree, finances are not taught. And I think the first time a doctor may have some sort of inkling about learning about finances is when they actually become a consultant, which is, you know, six years in medical school, maybe up to sort of six to 10 years of postgraduate training.You’ve done all that training. And eventually there’s probably a, you know, two or three hour seminar about how to set up your private practice. And they’re talking about finances and trust accounts and all that sort of stuff. And that’s sort of gets squeezed in when perhaps that should have been discussed quite early in the career.

Aussie Firebug: You know, that’s super interesting for me to hear. I’ve I’ve actually had a few friends that have gone on to be doctors, but they weren’t really close friends. So I’d like to get the information from a doctor. How does it work? If you want to become a doctor, you go to university, how many years or how long does it take from you?Study uni to actually become a doctor? And what is sort of the salary progression like? Because people do think as soon as you become a doctor that you must be minted earning hundreds of thousands of dollars, which assuming that you do eventually. but what sort of the how many years is it take to get to the big bucks,

Dev:It’s a good question. So certainly in Australia there are two pathways for medicine. One is the undergraduate pathway, which is fast evaporating. I think a lot of the medical schools are converting to the American style post-graduate pathway. So for ease of ease of clarity and future proofing this podcast episode, perhaps we’ll talk about the postgraduate pathway. I went through the undergraduate pathway but not many universities offer that anymore. There are some who do say if if you if you took the postgraduate pathway, you know, after year 12, you get into pre-med and sciences, which is usually three to four years. Then you’ve got to sit an entrance exam called the GAMSAT or and and sit an interview panel. And if you’ve got in the first attempt, then medical school is generally about four years after your first degree. So you’re already looking at the earliest if you did a three year science degree. You’re looking at the earliest finishing up medical school is about seven years or so. Now, if you took the old undergraduate degrees, which I did, which is around six years. So you’re sort of on par with that. Once you’ve done the seven years of training, you need to do what’s called internship, which is kind of your apprenticeship really, where you get assessed every sort of three months or so. And subsequent to that, you become a resident medical officer or hospital medical officer, depending on which part of the country you’re from.So then you become a doctor without having to have active supervision so that when you’ve finished your internship. So now we’re probably about sort of eight, nine years down the track.And then you’ve got to start thinking about what specialty you want to do. Now, the shortest specialty in Australia. If you’re lucky to get in first attempt is general practice. You still need to do a post-graduate training for that, which is at the very least three years. So the shortest pathway to becoming a specialist in Australia would be eight plus another three years equalling about 11 years or so. Now, if you were looking at other specialties like surgery, opthamologist, a gastroenterology and all this sort of subspecialties you’re probably looking at about sort of 14 to 16 years, at least sometimes even longer. Now, the difficulty about medicine is that you’re constantly having to sit exams. So even if you get into a postgraduate training programs, you need to sit an exam to get in. You will get assessed every six months.And after you finish your training, whether it be general practice or other super specialty programs, you will need to sit exams during your training, but also sit exams at the end of your training and then go on to exit exam. So a lot of special specialist colleagues have that. I guess one of the what we are sort of called the bottleneck and what tends to happen is that either you either never get into a program or you get into a program, then you kind of sit these exams, which hopefully you’ll pass the first attempt.Now, most people probably will pass the first attempt depending on the specialty, but a lot of them won’t. So if you got through medical school, got through internship, got through residency, got through registrarship all in one hit without having to restart anything, you’re looking at at least 11 to 16 years depending on what specialty you choose.

Aussie Firebug: Well, that it is. That is mind boggling. At what point are you actually earning money? Is it that when you get into the the officer stage?

Dev: You start earning money as an intern. So they’re asked basic salaries for interns across Australia depending on the state.So you’d find that the populous states like Victoria and New South Wales with a lot of interns tend to get paid the lowest. Whereas if you went to South Australia or Northern Territory, your internship salary is higher because they want to attract doctors to those areas. So you do get paid as an intern and that’s all set wage. Then as a resident, your salary increases and this is all in public health. So you can’t privately practise in Australia unless you’re a fellow, unless you’ve fully completed all of your training. So you must stick around in the public system and then you start earning some money in residency. Then if you get onto the program in in surgery or general practice or physician training, then you earn a little bit more. And of course, each year the hourly rate increases depending on your experience. And that’s all governed by the enterprise bargaining agreement. So you don’t have any bargaining power on that. So it’s a little bit different to IT, where every job has a different. Hey, you can sort of negotiate. Whereas if I was a registrar in surgery at the Royal Melbourne based on year three, I will be getting paid roughly the same as St Vincent’s Hospital or Monash Health. You know, it’s all sort of governed by the public health LBA. So you do make money. But in terms of, you know, serious money, I would argue you’re probably making serious money midway through your registrarship, which is your specialty training and possibly when you’re a consultant.

Aussie Firebug: And what are we talking here like for the interns? And then the I forgot the second one.What would an intern start on? That’s about six years to get to an internship. Is that right?

Dev: I fondly look upon my internship and I think my base salary was like nineteen and a half bucks an hour or something like that. I’m not particularly sure what the hourly rate is these days, but I would say as an intern, if you’re making less than sixty thousand dollars as a starting salary, I’d be pretty surprised. And of course interns are very protective and they’re really not allowed to work more hours in what’s scheduled. Whereas when I was an intern, it’s free for all. It work, you know, 60, 70 hours a week if you wanted to. So residency probably looking at about sort of, you know, 80 to 100 thousand, depending on how much extra work you want to do. And of course, that sort of increases. And registrarsship you probably looking at, you know, sort of between sort of eighty five and and, you know, potentially, you know Hundred thirty one hundred and forty thousand, depending on the specialty that you do.To give me an example, if you’re a registrar in surgery, you’d make a fair amount of money as a registrar in surgery. But of course, with that is a fair amount of work as well as you constantly on call and having to work extra hours. So you do. You do make money, but on a per hourly rate, it probably doesn’t work out as much.

Aussie Firebug:Yeah, definitely. Like, you know, as you said, sixty thousand, even 80 to 100. That’s that’s good money. Definitely. By any profession. I think the median income in Australia for a household is is something like seventy or eighty thousand. And that, you know, most of the time includes two people. I don’t know how they work that out, be it household to me. Yeah, two people maybe once not working, but that’s still good money anyway you look at it. But I guess when people think of doctors, they think, you know, if you know a couple of hundreds of thousands of dollars, which you eventually do get to in the end.But it’s interesting, very interesting to hear you speak about the process and how long it actually takes to build up to that. The other question I had as well, how much does a medical degree roughly cost? What is typical, hexed debt at the end of a 11, 12, 13 year degree.

Dev: Yeah. So in Australia, we’re very lucky, unlike our North American colleagues, where medical school can cost in excess of three hundred thousand dollars for six years.it’s an absolute rort in America. In Australia, we’re very lucky to have Hecs or help.Essentially, if you get the marks, you get into medical school under what’s called a merit system and hecs and help debt I think nowadays is, between sort of 7-8000 per year. I don’t know exactly how much it is nowadays, but certainly when I when I graduated, I graduated with a Hecs debt of less than 40 grand over 6 years. So and the beauty of that is you dont have to pay any of that upfront. Your your cost to study is basically your living expenses. For me, it was, you know, living in Tasmania had to pay for my water, my rent and all that sort of stuff. But I had a scholarship and a stipend from the government that helped me. Butyou dont need to foot that bill up front, which is I think is a fantastic system because otherwise people like myself would not have been able to afford to study medicine in Australia. There is another way to do it. I think there is something called a full fee paying student. Now, I think you still need to get the marks to get in. There are some universities that also full fee paying students. That’s for Australian citizens in addition to international students. And of course, if you go through that pathway, you’re you’re looking at at least sort of 30, 40 grand a year in terms of tuition costs. But most people in Australia wouldn’t be at all for that. And that is not the majority of students that go to medical school. And I think I think even in my class, the class of 2006, (if you’re listening. Hello) most of them came from average families and all of them were merit based.

Aussie Firebug: Very interested. Yeah. I sort of I just had in my head that it was like, yeah, roughly like close to $100000. I dont know why I thought that. But to hear that you graduated with such a small hecs debt, that’s I think that’s a good thing. Australia needs more doctors and if we make it like the American system or it eventually does become like the American system would make a career like medicine offputting. Like if I have children one day and they aspire to be a doctor and if it costs three hundred thousand US dollars to become a doctor I’d be like, well if you really like it, go for it. But then that’s such an off putting figure and such a hurdle that you gotta get over, especially if you don’t come from affluent family that has a lot of money to help you pay for it.

Dev: Absolutely, I mean, I always sort of view debt as not a great thing. I know there’s technically good debt and bad debt, but I always imagined debt to be trying to swim a lap of, you know, 50, meet a lap pool with an anchor basically weighing in on your feet. If you’re graduating from medical school with a debt of $300000. You can imagine why the North American health system. The American health system is so expensive because then the fees and charges and the procedures mean doctors will have to jack up their bills because they need to pay their student loans off. Medical care in America is so much more expensive than what it is in Australia. I think fortunate we are very, very fortunate in Australia to have a great public health system. And I’m spruiking it a little bit, but I’m very fortunate to get to work in a health care system that’s fairly equitable and also very fortunate to live in a country where you don’t need to be a millionaire to become a doctor. I think that’s that’s fundamentally still achievable today in Australia.

Aussie Firebug: Yeah, for sure. That’s very good points. And I’m in London at the moment and I live with the nurse who is working in the medical system here, the NHS. Australia does have that reputation to have it of having a really good health system Even here, she said that the nurses and medical professionals do recognise it as one of the best in the world. So that gives me a bit of pride, you know, coming from Australia, knowing that we’ve got such a good health system. So, yeah, that’s a good thing. Definitely.

Dev: But I think that just your run knowledge is if there if if a UK citizen walked through an Australian hospital and certainly at the hospitals that I work at, they get free health care here, too. We have reciprocal rights.

Aussie Firebug: I like the Commonwealth connection there. I think that’s a good thing. So why don’t we transition and Why don’t you tell us how you become interested in the world of finance and fire? And was there a light bulb moment or did you just stumble across it?

Dev: Yeah. So, look, I’ve been I’ve been frugal all my life. I wasn’t as I explained before, I wasn’t born into a wealthy family. You know, I come from come from an immigrant family, arrived here in 1990. One of the things that my parents instilled in me is in fact one of the reasons why we came to Australia was we wanted a fairer system and Australia offered that. My parents always instilled the value of hard work and also the value of not not wasting money because we didn’t have much money to waste when we came in and that sort of translated all my life in high school. When I did get into medical school, I was fortunate enough to get a scholarship and a stipend from the Australian government. I used to study for six years and I had to learn to be very careful with my money. So there was only, you know, set amount of money coming every month. And I had to be very, very careful. Now, I’m not sure whether you’ve been to Tasmania any of. When I lived in Hobart, one of the things that I found really interesting was the electricity bills were quite expensive. And I was well known to turn off my hot water system overnight so that I can save on electrcity bills, So I was a bit of a stingy bugger. That sort of carried through medical school. I applied basic financial principles and I said I have to say 50 per cent of my scholarship and stop and money every month. That was my goal. And by the time I finished medical school after six years, already learnt the importance of saving and I had a sizeable lump saved, ready to buy a house pretty after 2007. So that sort of principle continued throughout my internship and residency, which I finished in 2008. And in 2009 I started investing outside of super and this sort of started off as a research experiment, to be honest. And then I thought about retirement and how to maintain the lifestyle in the long term. I didn’t have any formal plan back then, and I initially started off in the top 20 stocks of Australia, the ASX 20, and branched out to index investing. In 2009 I bought my first home, which is that was part of my saving because I’ve saved a lot of money for medical school. So I didn’t really know anything about fire when I was doing all this. And the irony behind by my first time was I thought I’d paid too much for it. Never in my wildest dreams did I imagine the property market to end up where it is today. And subsequently, between 2009 and 2013, when I started doing research about investing, saving debt, et cetera. Two names kept coming up. One was Jack Bogle, the founder of Vanguard, and the other one was J.L. Collins. And I started listening to another American podcast called Dave Ramsey. His American based. I’m not sure whether you’ve heard of Dave Ramsey. There have been out there that. And then then by 2013, now we’re looking at sort of, you know, how many years now? Sort of six years after I finished medical school, I’d consistently invested money outside of my super, super into the index funds. And I noticed one of two things. And again, but until then, I had no idea about fire. And I noticed one of two things. One was the investments happened behind the scenes because I’d set up an automatic system by BPay which is very similar to super contributions. And the second thing I noticed was I’d received dividends the entire time. Now, I wasn’t really aware about dividends And despite my core value of investments rising just a little bit over those years, when I took the dividends into account, this is what made the difference. And I think at about 2013, perhaps you could call it that was my light bulb moment when I said, well, hang on, I’ve just consistent invested small amounts of money. And the actual core value hadn’t really risen too much, but the dividends made it all worthwhile. That started off what started off as a hobby, really. And an experiment ended up being a light bulb moment in 2013. I think that was when I sort of went, wow, this this can actually end up in a really, really nice place some 30, 40 years down the track. And since then, I’ve just been playing money into index funds as much I possibly can.

Dev: Well, that is that’s a great story, Dev.. A lot to unpack there. First thing I want to say is I feel like there has to be some sort of connection between immigrant mentality and being good financially or having strong foundations for financial health. Because I’ve I speak on my blog about my dad, who he’s Australian, but he has Italian parents.And I and he I feel like he had that immigrant mentality. His parents were immigrants and he brought that into my childhood. And a lot of the values he taught me, I feel that those immigrant mentalities. I just actually we’re still running the annual fire survey that’s running through the month of April this year. But I feel like I should have added it added in a question about some sort of. Are you from an immigrant family or were your grandparents from Australia? Because I feel like this, that there has to be some sort of connection there between the bulk of people in fire with sort of that save money, tuck it away for a rainy day mentality and having some sort of heritage from from an immigrant family, which is it’s funny that you mentioned that, but it’s so true, I feel. Secondly, so I’ve mentioned earlier in this podcast. Well, I’ve had a few friends that went on to be doctors and from my limited experience, there seems to be a driver for someone to want to be a doctor, whether that be wanting to help people after losing a loved one, the status symbol or another reason after all that schooling. The idea of retiring early might might seem crazy. So I have to ask you, what are your plans in the context of retire early and how’s that going to work? And why did you even start to think about having a comfortable retirement? Because, as I said, most people that that I know of and there’s only a few going to medicine with the idea of sort of helping people for the rest of their life and sort of never retiring per say.

Dev: Yeah, great question. And just to win back a little bit about your sort of immigrant mentality point, I think I think you’re spot on in the sense that, you know, I come from India and there is no social safety net there. You have to, you know, work hard and you have to save money. You have to invest for yourself and your family. I think people that immigrate out of countries in the subcontinent, Asia and some of the poorer countries are probably a bit more careful with their money because they’re understand that they’re coming from a country where there is no social safety net. So and that’s probably that’s probably the biggest factor when you come to Australia. Yes, there is a social safety net, but often it’s considered not in good light to be under the social safety net program, particularly in Indian culture. So there’s always this sort of drive to have a job. I mean, the first thing people ask you in India is what do you do for a living? And if you said, I’m not doing anything, then that’s that’s not a great look.So that’s probably where that sort of immigrant mentality comes from.

Aussie Firebug: There’s so much poverty. If people who haven’t travelled outside of Australia or if only, you know, go to New Zealand or I guess rich first world countries like it’s crazy how much poverty there is in the world and how lucky we are to live in Australia.Unless you see it, I guess you can’t you don’t realise how how hard some people are willing to work. And it doesn’t matter that they’re earning fifteen, you know, $10 an hour, whatever it is, they are just really happy that they’re in a job in the first place because where they’ve come from, any sort of life that they’re living in Australia, you seem to be, you know, like they’re they’re a paradise, which is just crazy to think about.

Dev: Absolutely. I think, you know, we are very, very lucky and very fortunate to live in Australia. Just to highlight your other point about, okay, well, you’ve done all this training for medicine and you become a doctor and become a consultant. Then why would you want to retire? I think for me personally, I don’t think I will retire. Really? So the RE component of fire is probably not going to be applicable. What I would want to do personally is to achieve financial independence early so that I have the option of reducing my hours. So I’ll still be a practising doctor.But I would like to, you know, not work full time, perhaps maybe just work sort of two or three days a week as I become older. So that’s really my plan. if you’re doing medicine to retire after 10 years, then then it’s probably not going to be worth it. Going through 14 years of training to work just for and then retire.Although some doctors this thing saying I’d love to retire tomorrow, but in reality, I think I will just be too bored.

Aussie Firebug: How many hours does or how many hours do you work?Because that’s one that’s another sort of stereotype that I always hear that doctors were crazy hours, 70, 80 hours a week. How many hours do you usually work a week?

Dev: Yes,so I’ve just recently reduced my hours actually prior to that. It would not be unusual for me to work 70, 80 hours a week, not would be unusual.

Aussie Firebug: Goodness gracious. Yeah. I can understand you wanting to reduce that.

Dev: Yeah. So it’s not unusual. And look, to be honest. That’s that’s that’s not the most that I’ve ever worked in my life.And when I was doing surgery, it would not be unusual to work longer hours.I mean, you could resident medical officers or house surgeons for a reason because you kind of have to live and work in the hospital. SO the hours are quite grueling depending on the specialty.Now that I’m achieved coniltancy so I’ve got the option of reducing my hours, which I’ve done actually just before Covid struck. I actually reduced my hours. I usually finish up at about 9:00 p.m. at night, but I finished early. So I have that option to try and reduce my hours. And that would be my plan moving forward in terms of, you know, quote unquote, retiring early.And one of the things that I want to really want to be involved in more and more in the future is teaching.I’ve always been involved in medical education, even in medical school. I’m currently employed as a lecturer at a university. I love medical education. I’m well-known to just randomly start doodling on pieces of paper to nurse and medical students. So that’s something I really want to do more and more of that and reduced my clinical time, of course, depending on where this financial thing takes me I really want to provide principles and knowledge to younger doctors that are graduating medical school and younger doctors, interns and residents very early on in their career to make sure that they don’t get trapped and they don’t fall for these traps in terms of financial products and and try and instill some basic principles for those young junior doctors to make sure that they get their finances in order. I want to explain to them that it’s not particularly complicated. A lot of doctors think finances are very complicated. We put so much effort into our careers, but you don’t really need to put that much effort into learning about finances. So that’s where I want to see myself in the next sort of 10 or 15 years in the future.

Aussie Firebug: Awesome. Awesome. Yeah. I feel like you can pass exams to be a doctor. You can learn about index funds. Its Really not that hard. It’s probably a hell of a lot easier than what it takes to become a doctor. You speaking about those crazy hours and it sort of makes sense to me now why a lot of doctors aren’t necessarily great at finance. Because if you are working those sort of hours and you’re living in the hospital or wherever you’re practicing, then yeah if you get out or you have a weekend free or whatever it is, then you do like you’re earning all this money. Eventually you do want to sort of make the most of it. It reminds me of my mates that flew out west and did the FIFO work and were making all this money. Some of them would know just finish their trades. They’re making over 200 grand a year. It’s crazy sort of money. But they were working on an oil rig or on a mine site for four weeks and they were coming back home for one week and sometimes you would take a day to fly home on a day to fly out. So they’re only there, only at home for like five days. So in that five days, they got all this money.They’re being pent up. They’ve got to have fun. They’ve got to do absolutely everything. So in the span of five days, you know, they’ll go out to the pub four out of five days,shout everyone drinks. They’ll buy a new set of golf clubs because they go on golf and on the weekend and they’ll never use them ever again. Like they just blown all this money. Not saying doctors do the same thing, but I think it’s like a similar situation where you’re just burning all these hours at your job and you’re earning all this money. Then when you do get your leisure time, you probably know you’re probably not going to go for the, you know, conservative option. You’re probably going to do something really grand and maybe buy a new car or do something crazy like that because you feel like you’ve earned it. I don’t know about if that’s how you look at it, but that’s sort of reminds me of my mates that earned all that money in th FIFO work.

Dev: Absolutely, I mean, there’s always that risk of, you know, rewarding yourself. I deseserve a Mercedes or I deserve a luxury home and I deserve a huge mortgage that I probably shouldn’t or couldn’t afford. And I think you’re spot on. I think the other thing is a lot of doctors, if they don’t, you know, if if they work sort of long hours last week, the last thing you want to do after a 24 hour call is to come home and learn about finances So I think one of the one of the things that I’m really trying to target is I’m targeting those interns and residents who don’t, you know, who probably work, you know, 40 to 60 hours a week, you know, before they become registrars and consultants and they’re working crazy hours. Really targeting them to sort of explain to them that you need to set up your finances in such a way that it’s uncomplicated and make sure that it just automatically happens in the background because you will get busy and you also get to do things and that’s where mistakes can happen. I think that’s one of the things that I learned in medical school, is that if I had a system in place, if I can set it up in such a way that I don’t have to think about it and it just happens automatically, then hopefully one day, 40 years later, when I’m about to retire fully to open up my portfolio and say, wow, you know, it’s a bit of a snowball that’s that’s become quite large in that time. And I think that’s that’s really critical.

Aussie Firebug: I couldn’t agree with you any more. And that’s that’s such a great point. You bring up because I think about my situation, I started Aussie firebug the website and learning about finance everything when I was working in local government and it’s a bit of a cliché, but it sort of is true. I had a lot of spare time at the job so my mind would wander and I did have time to like research stuff and I clocked out of work at. So I started work back then at like seven. I was an early starter because it was flexi time and I had the clock out at four and then I’d go straight to the gym after work and I’d had dinner and I’d sort of have like close to four and a half hours free every single night to do whatever I wanted, which is really like not not many people have that, especially as you progressed through your career and everything and the kids come on the scene, you sort of your time is sucked up everywhere. So I had all these spare time. And you do you learn when you have spare time, like it was really hard, like you said when you got that meant mental fatigue after working 50, 60, 70, 80 hours a week from work you’re not going to be in the state to absorb anything or want to learn anything new. And I’m dealing with that right now, working in the private industry in London. It’s so. Go, go, go. Busy, busy, busy. And I’m enjoying it. It’s fun. It’s a different it’s a different change of pace.But I don’t have hardly any time to do my AFB stuff. Like we’re recording now. But I think about how long it took me to get the website up to like to make the content at the very start to get all the processes in place at the very start. Took hours every night. I was working on it and I was learning about index investing. Everything like that just took so long because I was in a position to be able to do it. So when my life did get really busy like it has been for the last 18 months or so, I already had stuff in in place and already had processes of how to record a podcast like we’re doing now, how to edit all all that sort of stuff was already in my head. I’d already learnt it. So it wasn’t as hard to do, but I’d already built up the knowledge beforehand. So I think that’s a really key point that you mentioned there. It’s less easy to absorb this information if your if your brain is too busy in your career doing 80 hours a week, it’s just crazy to expect people to learn new concepts. So yeah, I think absolutely a good.

Dev: common themes that I find with with doctors is that, you know, like like all things like all other professions, actually, to be honest, is that they put it off. And of course, you’re an intern. You’re really keen to learn medicine. See, putting it off. You’re a resident. You really came to get into a training program. So you’re putting finances on. You’re a registrar now. You accountable for your training. So you’re putting that off because of exams. Then you become a consultant. Then you got to start your public and private practice and you’re putting that off as well, see, putting finances up. And eventually you find that you’ve done you know, you’ve done so much training in medicine, you put the financial side of it. Often, often, often often off. And guess what? You know, what is the most important thing in finances is the power of compounding. The irony is you end up making a lot of money when you’re a consultant. You know, some consultants make 506 out of seventeen thousand dollars. But if you haven’t started investing and haven’t set up the processes early in your career, it’s gonna be very difficult to catch up. You know, it’s not impossible because you’ve got a huge amount of income, but it’s gonna be that much harder. And of course, now you’re ten years older as well. So your ability to absorb information outside of medicine is a lot less.

Aussie Firebug: Yeah, it’s great point. And it goes through all facets of life, like building good health habits at an early age will serve you well throughout the rest of your life. good financial habits of building good relation habits is so important at a young age or at the start of your relationship or whatever, wherever, whatever area it’s in is good to start. Start young.But you almost get trapped. It’s like a it is sort of the rat race, isn’t it? If you go into the career and then you block out everything, you might come out of the career 30, 40 years later, having neglected what’s really important in life but you’re making a whole bunch of money. It might almost be too late, which is yeah, it’s like the whole hamster wheel thing, isn’t it?

Dev: Absolutely.

Aussie Firebug: Okay. Let’s, um, let’s talk about what you actually invest in. And being a doctor, I’m interested. Do you actually invest in a trust or do. Do you do it in your own name?

Dev: Look, I just do it all in my own name only because I’m a public health employee. I think if you have a private practice, a business ownership or a sole trader, it may be beneficial to create family trust so you can put our assets within those trusts.And that’s that’s basically taxed, effective, but also protects those assets. But I’ve I’ve left my private practice some years ago. I just didn’t enjoy it. I’ve actually found it quite stressful, to be honest. And I’m now entirely in the public system. So I just get paid a wage and I just invest in index funds.I’ve just kept it as simple as possible. In addition to my super

Aussie Firebug: And is it just the standard like Vanguard index funds? You do like some beta shares?

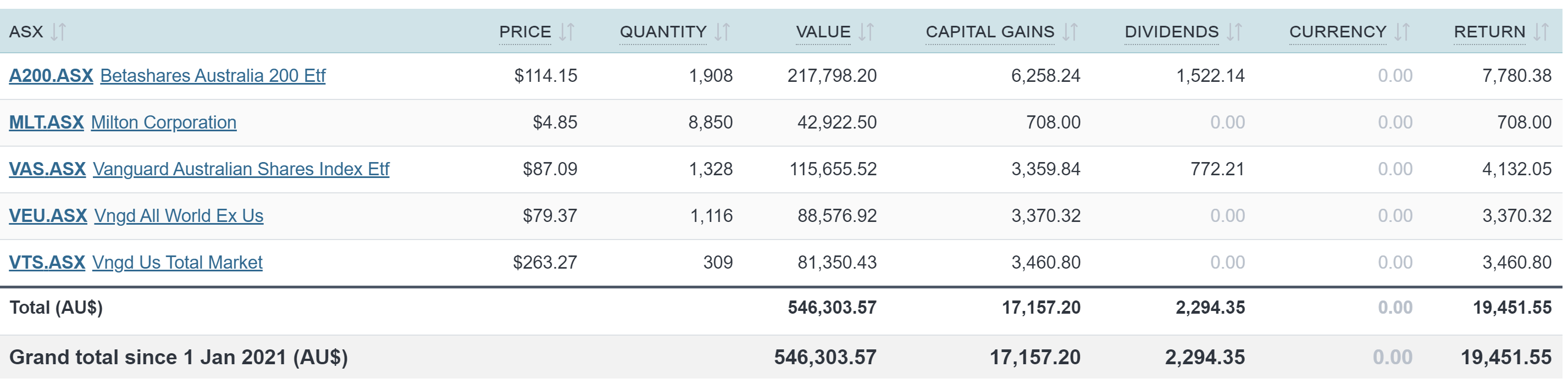

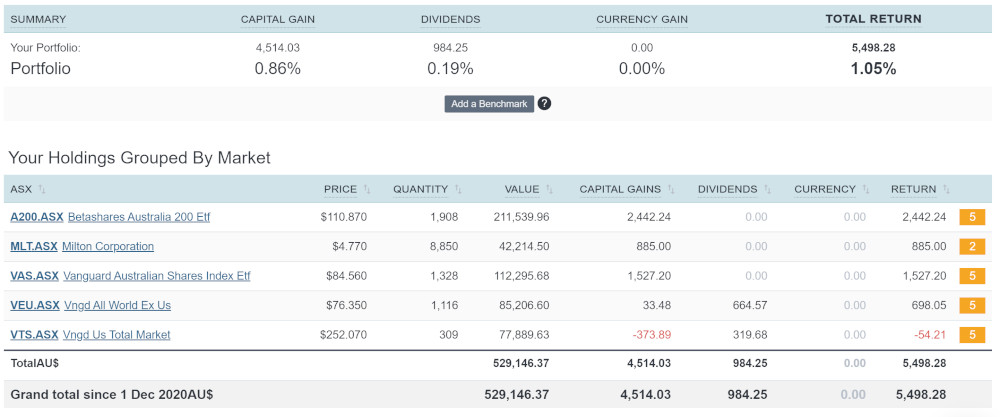

Dev: No, I just use Vanguard ASX 300 Index Fund. I don’t. I don’t do ETF use because I invest sometimes multiple times a week through Bpay. If you if you log into my net bank, all you see is recurrent BP payments into the Vanguard Fund.And if I have extra money, then I invest that as well. But basically, the the the the investments that I do is if I get paid at, say, on Tuesday, I know how much I’m gonna get paid.I’m sort of, you know, lucky because, you know, being a public health employee, you kind of know exactly how many hours you’re doing and you get paid a wage, 20 percent of that after tax income. Just go straight into the straight into the Vanguard Fund. So, you know, if you log into my Netbank, all you see is that 20 percent goes straight in every single week. And I also invest a little bit extra every fortnight because I have a couple of jobs. So the other job that pays me pays me the alternate fortnights. So and that’s basically what I’ve been doing for many, many years. I’ve I’ve sort of stopped, you know, my separately managed accounts and ASX 20, I’d just get the vanguard ASX 300. I subscribe to the wholesale fund and money just goes in.

Aussie Firebug: Yeah, great. That’s timeless, timeless wisdom. Just automating those investments. I do wish that it’s such a powerful feature that automatic BPAY. The only thing is, well, it depends on how much you’re investing, but usually for most people, the ETF option has a slightly lower management fee. But I do wonder like my mind has sort of shifted over the years between lowest management fee is the way to go 100 percent. Nothing else matters. But I’ve come to realize that if something helps you build a good financial habit like doing that automatic BPAY option and setting up that automation, that is probably worth a lot more to you mentally and probably financially in the long run, because you might have not even bothered to set up the ETF option. So I do wish the vanguard lower lowered its fees on the the fund through investing directly through them to be more in line with the ETF option. And I think there’s a whole bunch of reasons why they don’t do that. But still, it is such a good feature that I wish I could do even through the ETF. Just set up that automatic payment where I didn’t have to log into my broker account and actually make that trade.

Dev: So yeah, I’ve found Vanguard. Very easy to use. They don’t have a very sophisticated online sort of system to be on. And I still think that just launched these personal investing platform. It’s called the Personal Investor Service, where they are suggesting Vanguard ETF support through that services brokerage free. I haven’t really looked into it in detail, but so I think I think they’re trying to reduce the fees and I think they’re trying to get rid of retail index funds as well. So basically offering old customers wholesale management fee rates. So I think my my management fees 0.16 percent, which which is slightly higher than ETF, but I don’t think there’s any brokerage. But yeah, you’re right. I mean, you know, if I get paid on a Tuesday by Tuesday at midnight, 20 percent is gone. So I can’t spend money that I don’t have.

Aussie Firebug: Yeah, powerful stuff, powerful stuff. Yes, I did. I did see that product, by the way, the Vanguard brokerage product, which is a bit weird because it is free if there’s no brokerage costs, but there’s a there’s a subscription or like management fee associated with it, which I think is like 20 basis points, which is really it’s a bit of a hidden fee.

Dev: I think the fees cap out at 600 bucks or something. So if you’ve got a portfolio greater than 300000, everything after that, it’s technically free is my basic understanding, but I need to look into it in a bit more indem.

Aussie Firebug: If the previous 10 years or so has taught us anything, the fees are just coming down and I’ve been hearing about zero management fees on a few funds for a few years now.So it is good that more competition is good for us investors at the end of the day. And it’s just crazy how low the fees are compared to some of these managed funds that are not index trackers. So, you know, we can’t complain too much.

Dev: I say to doctors in general are just people that listen to my podcast. I say keep your keep your fees in total less than 1 percent now. In the scheme of things, to me, one per cent sounds like a huge, huge fee. Yes, but there are some and it’s fees, as you suggest, is, you know, 1 to 3 percent even.Some of the some of the people that contact me my jaw drops when I say, you know, 3 percent management fee. I mean, are you telling me that you’re getting 30 times the return is what I’m getting, you know, for those fees? The irony is that probably getting less.

Aussie Firebug: Yeah, I know. It’s absolutely crazy. Although the education about index investing and how much fees do cut into your total return is so much better now. The amount of exposure that has gotten over the last couple years and I think a fair bit thanks to the FIRE movement like I know a lot of people have yet written to me as well, and they’ve looked at their investments with a few managed funds and they like this, you know, 2.5 percent. That’s that’s a bit high. Yeah, that’s that’s like ridiculously high. You know, unless they’re giving you that extra return, which, by the way, it’s sort of impossible to know which funds are going to outperform in the future. Past performance is not a indicator of future performance. So yeah, it’s nuts how how much they’ve been running it. But I feel like the index investing is growing at a crazy rate. So it just means that those managed funds, if they’re going to be going to be still charging those exorbitant fees, you know, they’re going to have to back up with results. And I think in the grand scheme of things, with the rise of index investing, it should weed out those managed funds that are performing well and in the future will only get some of the cream of the crop of the managed funds. So if you want to go down that route, which you know, I don’t, but if people do, it should be a better product in the end. Now you run the dev ragged podcast over at Dev Ragga dot com. How long have you been creating content and what can someone expect when they have a listen?

Dev: Yeah. So I first started podcasting way back in July 2018. So it’s about sort of almost two years now.And currently it’s available via the website, but also various podcasting apps and also have a Facebook page associated with it where I’ll post articles and thoughts of interest and people can contact me or comment on it.Facebook seems to be the primary medium in which questions come through. Matt, not my intention was never to podcast with the general public. My intention was actually to leave a blueprint for my children. So I needed a way for them to learn about finances so that, you know, one day, you know, touchwood, I’m still here in 10, 20 years time, But if I’m not, they can listen to dad. You know and in a strange way, talking to them by podcast medium. And I started to put together 10 episodes and I did it via voice and did it via podcasting because I’m a terrible writer. I mean, I could have started a blog, but my my writing skills are much to be designed for. And subsequently, I put together a 10 episode series covering the basics of personal finance as everything from, you know, the power of compounding to pay your self-concept to who are listened to. Wills to personal insurance, to investing, to debt repaid, debt reduction, etc.. And basically, I came up with five relatively simple concepts that I wanted to instill into my children, and that’s one of the reasons why I started podcasting. And, you know, if if if I can have a couple of minutes, I’ll just go through that and I talk. Repeatedly in each episode. And that is I wanted my children to take a set amount of money and pay it to themselves, and that set amount of money is 20 percent of after tax income. I wanted them to invest it. I wanted them to always reinvest dividends and I wanted them to do it for the long term. For me, long term is at least 20, 30 or 40 years plus. And finally, my favorite ways to automate it. Which is the five core principles that I’ve used in my life over the last 10 years of investing. And the aim was to provide these concepts to my kids, the boom times over recessions, etc., which they can implement in their own lives. Then I floated it to some family and friends, medic’s and non-Medics, and I said, Well, don’t you have a listen to this? See what you think, you know, because I’ve never podcast it before. I don’t know anything about podcasting. I’m very bad at technology. So then they listened to it and they suggested that they know I should keep going because they actually found it relatively useful in their lives. So that’s how it all got started. Then a few of my medical colleagues jumped on board because they found it quite interesting. Then I contacted one of the administrators of a very large medical Facebook group, predominately targeting doctors, and they were keen for me to publish them on their Facebook group.So if the administrator of that group is listening and all the members. Thank you very much for allowing me to publish it on that Facebook group. And it kind of spread from there. And now I’ve got a few thousand downloads per episode, which is quite satisfying and and content wise is very much directed at personal finance, debt saving and investing and more focusing on the concepts of these topics rather than individual personalized advice which I can’t do over the podcast. So what started off as a way for me to provide a blueprint for my two very young children who are very young, One of them is in primary school, the other one’s in kindie, turned out into a more of a serious sort of podcasting episode by episode release online. And and for the people that do listen to my episodes, it’s very much me talking. I don’t have any guests. You don’t need to be a doctor or a health care worker to listen to it. It’s designed for anyone. In fact, it’s actually designed I think for kids above sort of 13, 14 years of age. Some of my business families and kids listen to it. And basically it’s me discussing about financial concepts and trying to relate it to the individual personal finance situation. And that’s the story. So it all sort of started off as a blueprint for my kids and now it’s sort of slowly growing.

Aussie Firebug: But what a great concept. If I will put a link to the podcast in the show notes for anyone out there that wants to have a listen, highly recommend. I couldn’t let it go, Dave. You are a doctor, so I couldn’t let you go without some sort of question about the pandemic that is gripping the world at the moment.. The Corona virus, what is because you hear so much information from this media outlet, from this article, from this president. And, you know, probably we shouldn’t be injecting bleach, but that’s that’s a whole nother topic.But it’s hard to know what is actually happening on the ground. So from your opinion, you’re a doctor. You’re in the hospitals. I’m assuming that you’re seeing Corona in your work.What is going on in Australia? Is it getting better? Do you have any predictions or when do you think these restrictions should lift in your professional opinion? And when do you think maybe they will lift in a political sense?

Dev: Yeah, good question. So, look, I’ve actually learnt a lot about public health policy during this pandemic and and how important public health policy is. You know, people people say, you know, doctors and nurses, we save lives, et cetera. You know, we’re as health care workers are heroes of the world. But strangely enough, the real heroes, I feel are you know, I know it’s gonna sound a bit politically incorrect, but the politicians and the young chief medical officers and the public policy makers who make policies for us to abide by and and what was interesting about this pandemic, which we all thought in Australia was never going to come, let’s face it. I mean, January 1st, 2020, I woke up. I didn’t think a virus in China was going to impact the entire globe, let alone Australia. And what’s interesting is, you know, the concept of social distancing, you know, the concept of staying that 1.5 metres apart and the concept of not leaving the house unless it’s essential duty such as going to work or, you know, grocery shopping. And following those rules, how important. It is because had we not instituted those measures as a country, had we not instituted those measures, measures as an individual and as a family and as Australians, then we would potentially be in a very, very difficult scenario today. So I always think about it this way, right? I mean, the Grand Prix. I remember. I think it’s mid-March was the Grand Prix in Victoria. I remember I was worried that the Grand Prix was going to go ahead and Victoria very and very close.And if I’m not mistaken, just prior to that, eighty thousand people got together at the MCG for the Women’s Twenty20 World Cup. If I’m not mistaken. So, you know, that literally was, you know, six weeks ago. six weeks down the track nowhere in my slightest imagination did I ever think that we would be in such a great position as a country in terms of trying to defeat this pandemic. I guess one of the concerns that I have is now that we’ve done so well, we can get quite lax. So, you know, we just need to slowly let you know the foot off the accelerator and slowly ease into these restrictions being eased because, you know, it’s it’s not it’s not a situation where we can just flick the light switch on and every everyone goes back to normal. I just don’t think we will achieve normal for some months yet. And I guess What’s the way out of this? I mean, I’m no public policy expert, but the first thing we probably need to do is keep our international borders shut because most of this virus and most of the patients that I’ve called up for positive results and most of the patients are in Australian hospitals and most of the transmission is coming from overseas visitors or some sort of contact with overseas visitors. So I think that’s got to be kept for a while. Of course, it won’t affect you because, you know, if you’re in australian citizen, you can still come back to Australia. It’s more the tourists and the visitors. And the second thing is got to be a little bit calm. It’s all about what are we going to do for non-essential businesses? I mean, Matt, this is taking a huge economic hit around the world, especially in Australia. People are suffering. Many patients have lost their jobs. It’s very distressing for them. And it’s it’s an incredibly difficult time for Australians. But I think we’re on the right track. I think I was a bit nervous when the Grand Prix was going to go ahead. And but I have a lot more faith now in the government of a lot more faith in our chief medical officers and the public policy experts. And I’ve a lot more faith in Australians because I think we’ve we’ve all banded together. We’ve all supported each other. We just gotta go a little bit more, perhaps another couple of weeks. I think in Victoria, they’re going to try and ease restrictions in mid-May, if I’m not mistaken, and go from there. Just please don’t inject yourself with disinfectant. I think what I have several colleagues in the United States, some of them in the west west of us in California, some of them in the east in New York City. And I’ve got relatives in other states that I’m very concerned about in Texas and other states and you know, the Texas governor has recently said He really keen on opening the state. I’m actually very fortunate we’re very fortunate to live in Australia where, you know, politicians actually listen to medical experts and public health policy experts rather than say random stuff. So I think we’re very fortunate here and Australians are looking on in horror what’s happening in the United States where things are very difficult.

Aussie Firebug: Yeah, it’s very it’s such a polarizing topic like one because the whole world is shut down. But it’s it’s almost the social experiment of a lifetime in, you know, for better or for worse. The United States, like I think there’s a picture of a beach that opened up in Florida or something that everyone was just at the beach and, you know, just going about their business. And even actually the one country that I don’t feel enough people are talking about is Sweden. Sweden is actually using the herd mentality approach as opposed to the social distancing approach as well. So it’s going to be, you know, give it another 18, 24 months, which, you know, if you’re a policymaker, you’re not going to risk killing more people than necessary or not necessary, but killing more people than what who otherwise could have been saved by experimenting like this. But it’s going to be super interesting to see what happens between the two different approaches. I know everyone is saying the social distancing one is working the best bit. I’ve been reading a bit about Sweden and how they’re having success over there. I don’t know what America is doing, but it’s it’s definitely interesting to to see the fallout of all this.

Dev: Yes. So that has got me thinking as well in terms of, you know, the surge hasn’t really happened in Australia. But is it going to happen three months, six months down the line when restrictions are basically eased? It’ll be interesting to see. And I would hope that the government and, you know, based on their policies, have some sort of game plan on how to do it. And I guess because one advantage of that is we’re far more prepared now and even every single hospital is far more prepared now than we were just two, three weeks ago and I think weeks ago had been hit by a surge of covid 19 cases in Australia I can categorically say that, you know, apart from what some of the bigger hospitals, I think a lot of the mid-sized to smaller hospitals would have been absolutely stuffed. And so at least if a surge does come in three, six months time, we’d be more prepared. We know a lot more about the virus now than we did six weeks ago. And you’re right. I think I am a little bit nervous. I’m sort of expecting if things go haywire, it’s probably gonna go haywire in about sort of six to twelve weeks time. But but personally, in terms of my knowledge about the virus, the way I’d be managing sick patients, the way that I’d be resuscitating them if needed, The way that I’d be transferring them out because of a work in a very small sort of public health hospital, a few hospitals that I work at. You know, we’re far more prepared now than what we were, you know, just, you know, four to six weeks ago when all of this started happening.

Aussie Firebug: Well, that’s that’s excellent to hear Dev now wrapping things up. Last question for you, Do you have any advice out there to other Aussies who are in the medical industry who are on the road to financial independence?

Dev: Yeah. So, look,my advice, the number one thing is, you know, I’m a firm believer in keeping things structured and as simple as possible. I found that the more complex an investment is, the likelihood of it returning better than average returns is lower. And I think it’s probably something difficult to get your head around, because a lot of people think, oh, you know, the more complex things are, the better it is. Right. Because when you think about it, you know, when you go buy a car, the more expensive car that you buy, the better product you get, but in finances that may not be true. In fact, that might be inversely true. So that’s one thing. And generally, I believe in the Australian economy. I believe in humanity in general, even though we’re in a bit of a pandemic. But I think humans will aim to do better for themselves in the long term. So I guess, you know, in terms of basic principles, here they are, right. So you don’t need a huge amount of money to get started in investing. And please don’t keep huge amounts of cash if you want to lose money that’s the best way to lose money to hoard money under your bed or in the bank account because cashes of depreciating over time due to inflation, the value of money just erodes.And as a general rule, stay away from consumer debt and ideally debt in general.But I understand you manage to borrow money to invest or buy a home and make sure you always borrow less than what you can afford. I think that’s one of the timeless principles that Peter Thornhill talks about not the maximum amount of money that you can afford. Always pay yourself first. I use the 20 per cent rule if you can’t afford 20 per cent and start with 5 per cent, start with 10 percent. It doesn’t matter. But start early. Don’t wait until you graduate out of uni or don’t wait until you become a intern or Don’t wait until you become a consultant. Because, you know, even if you have a part time job during medical school or a university, take that money and start investing with that income because the power of compounding is absolutely epic. And now try to understand finance, make an attempt. Who knows? Might actually enjoy it. And lastly, share ideas and keep an open mind and try and find Like-Minded People. I mean, it was a great feeling, Matt, to find your podcast. I think you’ve got a bit of a fan base, by the way. You probably don’t know, but you’ve got a fan base amongst the medical community. I mean, your pod cast channel is widely circulated in in doctors Facebook groups around Australia. So because in Australia. And correct me if I’m wrong, talking about money is a bit of a taboo. What do you think? We don’t openly.

Aussie Firebug: Yeah. Now that’s it’s one of the biggest. It’s why everyone talked about how much they were paying for their bills, how much their home loan was, and everything that we spend money on. We’d all save a bunch of money I could was all open out on the table and we discussed it. Everyone would be richer for it.

Dev: Absolutely. I think I’ve always found that a bit strange compared to other countries, particularly in North America and even in India. People are far more open to talking, talking about money and sharing ideas, talking about it and learning, because at the end of the day, we’re here to learn. And, you know, I’m really happy that I found your podcast because, you know, strangely enough, you are one of the first podcasts that I started listening to when I was, you know, looking up this concept of fire because I was kind of doing it, but I kind of didn’t really know what I was doing until I was able to consolidate what I was doing. So I think what you’re doing is fantastic for the fire community. What you’re doing to the medical community is fantastic. You’ve got a favorite of listeners there. Keep things as simple as possible. I think the more complex things get, it may not be, the higher the returns. The complexity may not actually be the best thing for you. May actually cost a lot of money to have complex investments.

Aussie Firebug: Wise words there Dev. Thank you so much for the kind words as well. It’s nice to hear that I do have some fancy out there in the medical industry. So that is that is nice. If anyone wants to get in contact with you, did they be listening? They may do it maybe in the medical industry themselves. What is the best place to contact you?

Dev: Yes. So DevRaga.Com or if you Google me and just type in personal finance, I’m all over Google and there’s Facebook page associated with that and contact me via Facebook as well. Most of my followers contact me either via the podcast itself, which is cast box or the Web site or most of them actually contact me via Facebook

Aussie Firebug: It’s been an absolute pleasure chatting to you. Thank you so much for coming on the show.

Dev: It’s an absolute honor. And thank you for having me, Matt. And stay safe and really looking forward to catch up with you when you get back to Melbourne.

Aussie Firebug: Yeah, that that’s if I make it back or if they open up the borders for me, hopefully I get back. Hopefully it’s or will not blown over, but hopefully a bit more relaxed come January next year. It’ll be lovely to meet you, mate. And yeah. Looking forward to it. Fingers crossed. Thanks, Matt.