Aussie Firebug: Welcome to the Ozzy Firebug podcast. The financial independence podcast for Australia. Hey guys. Welcome back to the Ozzie Firebug podcast. The financial independence podcast for Aussies, where I interview clever people who’ve already reached or on their way to financial independence. Before we get into the pod today, I’ve got to let you guys know that the annual Australian fire survey is currently open and will be left open for probably another two to three weeks.

I’m a huge data nerd. And I think one of the greatest strengths of this community is that we are willing to share and talk about what is normally considered to Boosie subjects. If we assume that there are a hundred thousand people pursuing fire in Australia, Probably a lot less if I’m being honest, but let’s just go with the a hundred thousand.

We need to have 1056 submissions for this dataset to provide a 95% confidence level, which is the industry standard with a 3% margin of error of the community. So 1056 is the target for this year. The full analysis and data set will be published on Ozzy firebug.com. Of course. So a big thank you to everyone who has already participated, and if you haven’t participated, but want to fill in this survey, head over to Ali firebug.com forward slash survey.

Now onto the pod for today, we have one of my favorite Ali five bloggers on the podcast, and that’s none other than Aussie high fire himself. Some of the topics that we cover are who is Aussie high fire, and what’s the all about. What is high fire and how does it different from regular fire? The role that bonds can play in a portfolio and income insurance during the accumulation phase.

Hey guys, welcome back to another episode of the Ozzie Firebug podcast. Today. I’m chatting with one of my favorite Aussie bloggers and that is none other then Ozzy high fire. Welcome to the show, mate. Good to be here. Thanks for having me. Now I’ll be reading your stuff for many years now, and I actually think I’ve had it on my to-do list to get you on the pod for roundabout to two or so years.

But because I take forever to actually do any Ozzy Firebag related stuff, it has taken a pandemic and being locked down in London in order for me to catch up with my emails and to get you on the show. But I’m glad you’re on now. Speaking of London, actually, you used to live here once upon a time.

Isn’t that

Aussie HIFIRE: right? Yeah. So I lived there for about, I don’t know, 10 years or so. Back when I was year, probably about the same sort of age as you, I suppose. Yeah, I had ideas there working in finance, lots and lots of travel really enjoyable.

Aussie Firebug: It’s a fun thing to do. Isn’t it? If you don’t mind me asking were about when you lived in London, did you did you live.

Aussie HIFIRE: Yeah. So mostly around the olive dogs East London sort of area. So I spent a lot of my time working in finance over there. I always liked to live fairly close to work. So it kind of made sense to deliver around that sort of area. Amen.

Aussie Firebug: Clap, clapping myself. And I understand how, how common that is for most Aussies to come to Clapton.

And I was actually in. Well, when I had Peter Thornhill on the other month or so he was, he was living in Claremont many, many decades ago, which, which I found funny. And I was almost going to be like, I wonder evils. He high fire lived in Clapham as well. But yeah, I love dogs. That’s yeah, it’s easier said I actually don’t know too many people out in the East.

I don’t think. Well, you said you lived here at what? Nine or so years ago. I don’t know how, how many ex-pats lived in the ACE, but pretty much everyone that I know is either South or. Like on the North of the river, but not so much East. Yeah. I haven’t really traveled around the East too much. I’m sure it’s enjoyable though, but yeah, it’s definitely closer to the finance sector, which was good for you.

Yeah, definitely. Definitely. For those out there who don’t know who you are, can you give an overview of who you are and where you’re from?

Aussie HIFIRE: So I’m originally from Queensland spent 25 odd years ago living up there and then Dad of two, obviously very happily married and spent most of my life working in finance and still working in Naria finance at the moment.

So yeah, I keep pretty busy.

Aussie Firebug: Yeah. And you are Aussie high fire, which is an interesting name. Now I know what Hi-Fi means, but for those out there listening, what is high fire and what does it mean to you and how does it differentiate itself from the standard. Fire acronym that we see in this space and in this community.

Aussie HIFIRE: So high fire is stands for the high income financial independence retire early. So I think probably the, you know, the big sort of differences that you have, the various sort of fires you have, you know, regular fire, you have lean fire where, you know, you’re living on not a whole lot keeping your expenses to an absolute minimum, regular fire where, you know, you’re probably not doing a huge amount of.

Not necessarily the luxury sort of stuff, but you’re not necessarily going out a lot. You’re not going on big trips or anything like that. Hi fire. I know it’s some times called fat fire or more regularly called backfire. It just, it’s not a healthy sort of sound. I think, you know, you, you, you associate fat generally with you know, not necessarily desirable sort of things.

So I thought, okay, well, let’s, let’s have something which is a little bit more. Desirable, which sounds a bit better.

Aussie Firebug: You changing the Wi-Fi, you changing the image of the fat fire.

Aussie HIFIRE: Exactly. Exactly. So, yeah, I just thought, you know, for me, what I want is not to retire and not be able to go out and do this things that I like.

So a big part of that for me, is travel and travel is, you know, as you well know, it can be pretty expensive. Like it doesn’t have to be hugely expensive, but if you want to do a two month long trip, we’ll. You’re not doing that for 500 bucks or something like that. It’s, it’s going to cost you a fair amount of money.

And if you don’t want to stay in, it, doesn’t have to be the nicest hotels. You know, you don’t need to be staying in the Marriott or the Hilton or something like that. But if you want to stay in a, in something better than a backpackers, will, you know, that’s going to cost you more money. All those sort of things basically add up.

So for me, it’s, it’s a case of going, okay, well, if I’m going to. Want to retire and I’m going to spend the next 30 or 40 years of my life traveling around. I’m going to need more money to do that. And that’s, that’s where high fire comes in.

Aussie Firebug: Yeah. So traditionally we see most of the bloggers out there. I would say you see anywhere between like at the very low end of the scale.

I’ve seen a few people looking to aim on retiring on like 35, even $30,000 a year, which is that’s really pushing the limits of how, how frugal you can be and still live a really great life. And I understand everyone’s different and also circumstances are different. So what would Hi-Fi in your circumstances?

What’s sort of the angle and what is a high fire retirement income to you? Yeah.

Aussie HIFIRE: So for me, I think it’s hard to break all the different sort of brackets down because it’s different for everyone depending on, you know, are they, are they single? Are they married? Do they have kids? So for me, I sort of think, you know, if you’re going for a lane sort of fires, pretty much anyone under say about $40,000 for a single person, maybe a bit more for it, for a married couple or, you know, whatever sort of couple For regular sort of far, I’d say, you know, the 40 up to 60, 70 sort of range and then high fire to me is pretty much anything above that.

So, you know, I’m aiming for around about $80,000 a year for my family. So for my wife and I and the kids are at least part of that when I retired.

Aussie Firebug: And is that factory in a house paid

off?

Aussie HIFIRE: We’ve already got pied off house. So, so it’s $80,000 on top of that. You know, if you’re renting there’s another 20,000 bucks a year that you’ve got to come up with pretty

Aussie Firebug: much.

Absolutely. Because that’s a key distinction. It’s hard to compare numbers without knowing the full picture of someone like someone could say we’re aiming to retire on $40,000 a year versus someone that has a house paid off. That wants to retire on like 50,000. It’s a, it’s a huge difference between factoring in the house paid off and you’re not paying any living expenses like maintenance around the house rates, whatever for someone that’s renting and you’re going to have to cover those rental costs for the foreseeable future.

And then you’re going to have your spending on top of that. So it is a key distinction there. And I would say definitely, you know, 80,000 with a house paid off. That that is definitely what I would consider high fire myself. Because if you think about it, there, there’s plenty of families out there that are only have one income to support the family and who don’t even make $80,000 a year and potentially don’t even have a house paid off.

So. Yeah, I, I would, I would definitely put that in, in the high flyer category. So when did you, when did you discover find w what’s the story behind you stumbling across fly? And when did you say this? I like this concept and this is what I’m going to be aiming for. I

Aussie HIFIRE: think probably like I’ve always thought about, you know, retiring early.

And then maybe in the early 2010 to mid 2010. And started seeing a few blogs out there. I think the first one that I saw was the frugal woods. And then maybe Mr. Money mustache. And I thought, okay, well, that sounds pretty cool, but I want a bit more money than that. You know, I don’t want to be sitting around and, and penny pinching the whole time and you know, just a porridge for breakfast every morning and all that sort of stuff I want to have, you know, I want to be traveling.

I want to be not necessarily, you know, eating out all the time or anything like that, but I want there to be more to it than I just sit at home most of the time. And then I think I started looking at, okay, well, what’s. What’s the same look like in Australia. And at the time I’m pretty sure you were the only one blogging was you were certainly the first one who I discovered.

So in some small part you’ve, you’ve been an inspiration for me in terms of all this. And then the more I looked into it. You know, there was, there was other sort of bloggers out there. You know, Pat life-long shovel and David Strong money and the FII explore and, you know, there’s certainly a lot more out there now.

But I think for me, it was just, you know, it’s always something I’ve been interested in that really sort of switched on probably about five to seven years ago. And then started reading a lot more about it at that sort of time. And then. As well as that are sort of, you looked at the U S scene and there’s so many different bloggers out there and there’s all the, here’s the mathematical breakdown of it.

And I think when I looked at the Aussie sea and there was probably less of the data driven sort of stuff, like, you know, what are the numbers look like? Does this, you know, w we all talk about the 4% rule and that’s great. It’s all based off us data and you’re going okay, well, If that’s where it is going to be based off.

That’s great though. I don’t live in the U S you know, I want to run the numbers myself. So some of, some of the first sort of stuff, which I put out there was about. Okay, well, would it actually work in Australia?

Aussie Firebug: It’s awesome to hear that, you know, you read my blog so, so many years ago and it had some sort of inspiration on you.

That’s awesome for me to hear that. Was there like a burning desire for something that fire would enable you, like maybe more time with your kids or something like that, that, you know, when, when you started riding and when you started pursuing fire, that was a major region or reason, or was it just sort of you like what everyone was doing in the community and.

You thought this is like, that’s achievable for me and I’m going to pursue

Aussie HIFIRE: it both. So, you know, some of it is just, you know, these are what other people are doing and you’re always going to, to some extent base what your goals are, what other people are doing. Like if nobody else is talking about, you know, doing it from this sort of perspective, will maybe you’re not going to think about it from that perspective either.

And you know, it might just be okay, what’d you can only do this. If you you know, Part of a couple, you know, no kids, both high income, all that sort of stuff. And if you, if that’s all that you see in the scene, well, that’s probably you’re going to go, okay, well, yeah, it’s easy for those guys, but you know, it’s, it’s impossible for other sort of people.

So that was part of it. And then, you know, but obviously my own goals were, you know, more time with the kids, as you say, lot more travel. Yeah. Just, just not having to work. I think, you know, having more time to not just with the kids, but more time for yourself as well, because some of the time when you have kids, it’s, you know, you’re spending all the time on the kids than at work and there’s, it’s sometimes it feels like there’s not necessarily a whole lot of time for yourself either.

Whereas if you’re going know, okay, well the kids are at school and I can just, you know, if I want, I can go out for a run, you know, just things like that. Whereas, you know, on the weekends, you’re going okay, well, you know, The priority has to be the kids that are, it should be the kids to my mind until you spending as much time with them as possible.

And it’s harder to, to do your own sort of stuff. So, yeah. You know, being able to travel, but also just being able to spend time with the kids, but having your own time as well, I think was a big part of it

Aussie Firebug: too. Yeah, absolutely. I can. You know, coming from someone, we are in a, a dink couple, my cell phone, Mrs.

Firebug or she’s actually not working at the moment, but she usually is working. So w we’re both usually working full time without any kids. And I can definitely say even now without kids, how much of my time is eaten up by work and I’ve got Ozzy Firebug, which I do on the side and everything like that.

But I found that very on very early in my career that. There was hardly any time for myself. And I couldn’t even imagine how leave you threw kids into that situation, where there would be not a lot of time, but just a decent amount of time to dedicate. To not only looking after yourself and spending time on things that are important to you, but also just having that creativity time to make things that you just would never, ever do.

Like, I don’t know. My mom, she, she, during the lockdown and started to draw again and create, I don’t know if she’s painting at the moment, but. Little things like that. You never ever get to explore if you’re working full time. I believe with kids because when I first started working, full-time I just, my mind, my time was getting sucked from all over the place with sporting commitments as well.

And yeah, I feel like I realized that very early on in the piece that I need to, I need to get some, my time back ASAP and I don’t want to do this for the next 30 or 40 years. So let’s talk about what you actually will be doing in retirement. And when you achieve the financial independence, is there any, anything specific that you look forward to when you get to retirement?

Aussie HIFIRE: Just learning how to do new things and spending more time doing the things that I want. So, you know, I’ve. Lived in Australia for a fair sort of chunk of time. And as you’d know, when you go overseas, everybody goes are, you know, do you surf? Yeah. And when you say no, I’m like what? That’s something that all you guys done.

It’s

Aussie Firebug: like, you’re not, you’re not, yeah. It kills me as well because it’s such a cool thing to do. And it is, I would love to learn how to serve properly and actually go on holidays to be, you know, go on surfing destination holidays. I go to Bali or somewhere where they’ve got some, some surf to actually take advantage of it.

So yeah, I’m totally with you on that.

Aussie HIFIRE: Yeah. And then just things like, you know, I want to get out and I want to go for. I live near some great sort of trials and I’m into trail running, but realistically you get to do it, you know, once or twice a month sort of thing. If you could just go out and hit the trails, you know, a couple of times a week, geez, that would be brilliant.

Things like that. And then, you know, travel, I want to be able to do, you know, we were lucky enough. When we left Hong Kong that we had a lot of spare time and we did a two month road trip around the U S and it was. Absolutely fantastic. Like there’s just so much to see it’s such an amazing place. But it’s kind of you know, if you don’t have that time or if you don’t, if you’re not setting yourself up for fire, it’s a once in a lifetime time trip.

And I don’t want that to be the once in a lifetime trip. I want to be there once a year. So, but I think I think you last year, did you mind sort of going around Europe? I want to be able to do that.

Aussie Firebug: Yeah, pretty regularly. Would you say, because the things that you’re saying so far, like surfing and like trail running doesn’t really cost any money or doesn’t cost a lot of money.

So it, would it be, I have to say that that the traveling is really the, the big luxury in your mind that you’re not willing to give up in pursuit of fire. And you want to actually build that into fire. Hence the high fire. Would that be fair to say.

Aussie HIFIRE: Yeah, I think it’s probably more of a, when I retire, I want to be able to do it.

So along the way, yes, there is going to be, you know, a reasonable sort of amount of travel. It’s not as I’m going to give it up entirely, but I think when I get to retirement, it’s going to be, you know, here’s a, here’s a two months long trip, whereas while I’m still working well, I’ve got kids, who’ve got to be in school and things like that.

It’s, it’s a two-week long

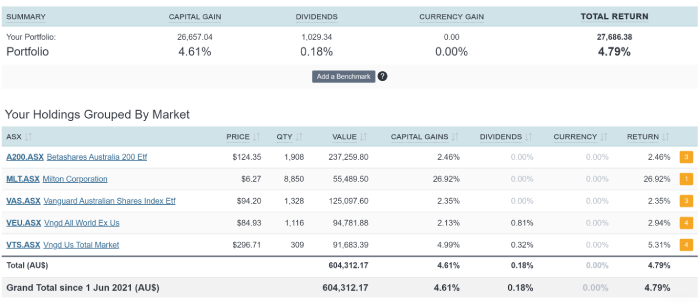

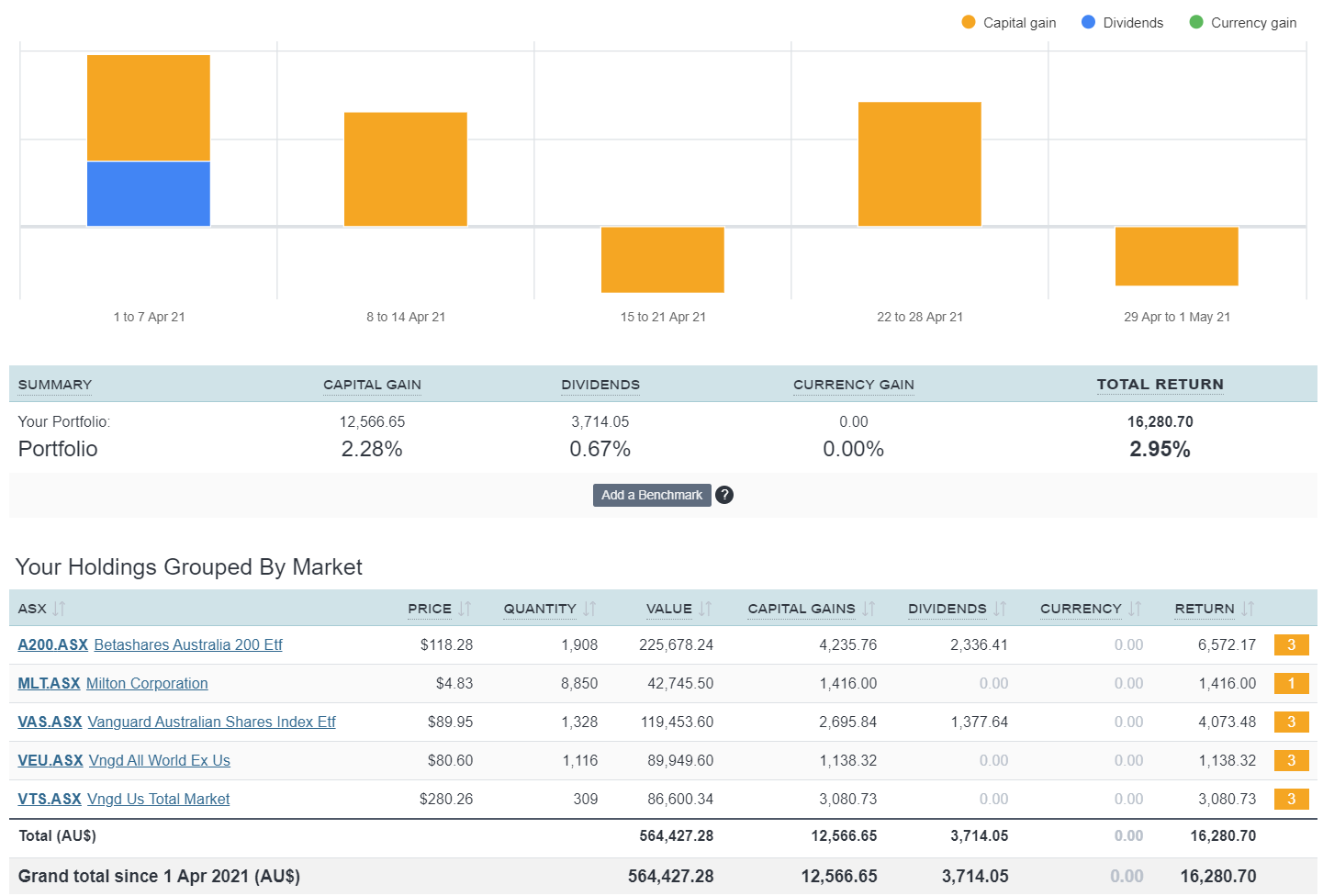

Aussie Firebug: trip. Fair enough. Now let’s Let’s pivot now and talk about how you are going to achieve financial independence. So if I may ask, what do you currently invest in? What is your portfolio portfolio look like?

Aussie HIFIRE: Yeah, it’s a feral mix out there. It’s basically roughly speaking, actually.

I’ve got it here in front of me. If I actually want to look at the numbers on it at the moment, excluding the house. It’s about 80% in shares. It’s about 15%. Contain bonds cash, all that sort of stuff. And then the rest of the 10 property alternatives, like infrastructure, stuff like that. So it’s basically mostly in, you know, chairs.

And then within that to about 40% in Ozzy shares and roughly 60% in international shares, right.

Aussie Firebug: And with the property exposure, are you just using Rhett’s to get that property exposure? Yeah. So that’s all in rates. Yep. Right, right. Cool. And I’m interested because you wrote a great article about bonds and bonds are a very interesting topic in the fire community, because if you look at the Ozzie five bloggers and even I think the U S fire bloggers are more, there’s more of.

There’s more us five bloggers that incorporate bonds into their portfolio. But most of the Ozzy five bloggers that I follow in that I’ve seen are sort of a hundred percent equities and they don’t really have bonds in their portfolio, myself included. So can you explain the role of bonds in your portfolio and why you have them in there?

Aussie HIFIRE: Yeah, sure. So bonds are pretty much in there as a diversifier. They’re there to when their share market goes down, either hold their value or ideally go up in value. And it’s just a bit of a cushion really. I don’t expect that they’re ever going to necessarily give me a huge returns, particularly given where rates are at the moment, but it’s also, well, these aren’t going to disappear.

If something goes wrong, you know, you’re not going to see the shoes sort of falls in bond values or not the type of bonds, which I own anyway, that you might inequities. You’re not going to have those shoes sort of swings. So, you know, you, you talked before about the importance of, of behavior and the psychology of fire.

A lot of people just can’t handle it. You know, here’s a 40% swing in the value of your portfolio. It’s just going to be now I’m out of this. This was insane. What was I doing? Everything’s gone to cash stuff. This for a joke. If you’ve got some bonds in there, then you can certainly reduce how much you afford.

You’re going to have. Now the flip side of that is you’re probably not going to see it run up as much or run up as quickly, but you’re probably going to see a smoother return out of it. And you sort of mentioned, you know, most of the Aussie bloggers who you follow don’t necessarily have bonds in there.

That’s probably also a function of age as well. So the older you get, generally speaking, the more likely you are to have more secure or you want more security in there. When you’re younger, you can just go, right. Well, everything’s air curries, you know, I’ve got a long career left. Well, you’ve got a long time working.

Yeah. Do you want to, hopefully you don’t have a long career.

Aussie Firebug: Hopefully not

Aussie HIFIRE: one sort of thing, but, but you know what I mean? In the U S community. I think you’ve got a lot more people who are potentially a little bit older and then it’s also just a much bigger investment class in the us then. Pretty much everywhere, really, to be honest.

In Australia, the bond market is just, it’s an afterthought at best. Asia, similar Europe, it’s bigger, but it’s nowhere near as important as what it is in the U S so a typical us investment portfolio will be 60, 40, basically 60% in equities, 40% in bonds. Whereas you come to Australia and you look at your default super and it’s supposed to be 70, 30.

In theory, in reality, most of them anywhere between 80 to 20 or a hundred zero sort of percentage wise, but. There’s just not the exposure to it in Australia. Like people, people haven’t heard of them in a lot of cases, it’s like, Oh, okay. What’s that? Whereas shares, everybody’s heard of shares. So Australia has got, and I think this is in part because, you know, we had to Telstra flight, there was a CSL float.

There’s a CommBank float, all the sort of retail ones that people got into and they sort of. It’s not necessarily that they understand shares, but they’re comfortable with them. And so when you talk about bonds and it’s like, okay, well, all you get is, you know, a coupon it’s never going to go up, usually in value.

If the company triples, then you still get the same old interest payments and Tucker. What I want that for.

Aussie Firebug: And, and for those out there listening, because I really haven’t spoken about bonds ever on this podcast or in my blog for those, I, I know how they work, but maybe it’d be handy to just explain what, what are bonds and how do they work briefly?

Aussie HIFIRE: Yeah, sure. So bonds are pretty much you’re lending money to either a government or a corporation. And in return they say, right, well, we’re going to give you a specific rate of interest. We’ll give you this coupon payment on it. And in five years time, we’ll give you back however much money you put in there’s there’s exceptions to all those sorts of rules, but that’s basically the way it works, but because interest rates change because the value of, you know, the, the likelihood of the company.

Paying able to pay back its bonds. All those sorts of things can change. The price of the bond itself will fluctuate in value. So, you know, when interest rates go down, as they have been, the bond actually becomes more valuable. When interest rates go up, the bond becomes less valuable due to a variety of factors.

Aussie Firebug: Yeah. Do you buy and sell bonds on the ASX or is there another market for that?

Aussie HIFIRE: I’d just buy them through an ETF. So there’s about there’s a whole bunch of different bond ETFs, which you can buy buy on the exchange. So Vanguard’s got on my shares. I’ve got Peter shares. I’ve got them. It means

Aussie Firebug: that a basket of bonds from different companies and different government organizations.

Yeah.

Aussie HIFIRE: Yep. So it’s pretty much the same as, or is it it’s an equivalent for bonds? Yeah. When you buy, you know, a vis or an 8,200 or Isaiah or whatever the case may be, in fact, they’ll actually probably be more bonds in there and they will be shares for, for most of the indexes. Yup.

Aussie Firebug: So the key difference, I think from my limited understanding is when you buy shares, you’re buying ownership or part ownership of that company.

But the bonds is really just you’re lending money to either a company or a government entity. And they’re saying, you know, w w we’re taking 10 grand off. Yeah. And we’re going to pay you a fixed interest rate of whatever it is. Three and a half percent. I I’m not too sure what, what the rates are these days, but there’s some sort of rate and then they will pay you that rate.

And then once it reaches maturity at the end of like the five-year deal or something, then they give you, they give you your capital back to you. Is that sort of how, how it works? Did I get it right? Yep. All right. Cool. That’s

Aussie HIFIRE: that’s pretty much exactly. So, yeah,

Aussie Firebug: so it was a lot. Yeah, it’s risky. And it it’s that defensive asset in your portfolio, because like you said, people get to a point in their life.

And this won’t happen to me, you know, I’m not sure I’m still what I want. I like to consider very young in the investment game and everything like that. I’ve got to many decades of compounding to go, but I think you do get to a point where it’s not so much about making more money. You’ve already got that F-you money.

You’ve got the financial independence. It’s more about preserving that capital and preserving your wealth. And you’re not really, you can’t really be asked to. Fight tooth and nail for that, you know, five basis points, extra return or that 20 basis points, extra return. You’re more concerned about, is it safe?

Is it there? Can I rely on it? And I’ve, I’ve seen as it being a few stories about, you know, wealthy individuals not investing optimally, we, and this is back to the numbers and psychology debate, but they’re more just. Preserving their wealth and keeping it in really defensive asset classes, because that’s just, that helps them sleep at night.

And that’s how they feel comfortable investing, which is I find is really interesting as well.

Aussie HIFIRE: Yeah. I think that’s, you’ve hit the nail on the head there. I mean, when you get to, you know, if your money or whatever you want to call it, you basically going okay. Well, do you really want to keep on letting it ride?

You know, do you want to say, okay, well, I’ve got, I don’t know, call it 2 million bucks invested and that’s enough. Maybe. So, you know, any x-ray you make or whatever the case may be, maybe you just go, okay, well, let’s put it into safer sort of stuff now. So, you know, if we have another big crash. Okay, well it’s still going to be all right.

Aussie Firebug: There’s a point of diminishing returns. Definitely. Like I think there’s my life. I could never see a difference between if we had, let’s say I’m just going to go like super, super high fire, just because, you know, I never know what we were aspiring to have kids one day, so I never know how much that’s gonna cost and everything, but let’s say we had 5 million invested in the markets.

I don’t really think my life would change at all between 5 million and 50 million. Like my lifestyle changes. Wouldn’t be different because I know, I know the important things in my life and it potentially, I like to think my spending habits wouldn’t change. And that’s probably been a little bit optimistic because I think as you do get more wealthier, there is a little bit of lifestyle creep and you can’t, it’s hard to avoid that, but even crazy luxuries for me is still relatively conservative for most people.

So yeah, the difference between five mil and 50 mil. Isn’t that much of a difference in my eyes. Like it’s a huge difference in terms of money, but the lifestyle that those two sums would grant me would be, would be very similar. Like I’d have to have a, I’d have to have a major mindset shift for, for those two songs to sort of create two different lines.

Yeah.

Aussie HIFIRE: I can see what you’re going for there. I mean, Yeah, I guess it depends on, is it a case of you won the lotto and you’ve got 5 million versus 50 million, because if you win a lot on, you’ve got five 50 million. Well, you’re just going to go ahead and spend it, you know, like, I’m not saying you’re going to blow it a lot of it, but you’re going to go, okay.

Well here’s what my lifestyle is now. Whereas if it’s a case of, okay, well you’ve got 5 million. You want to get to 50 million. There’s going to be a lot more sacrifice along the way. True. That makes sense. It’s a lot longer

Aussie Firebug: and it might not be worth it. That’s a good point. I think it, it depends really.

Yeah. Good point. Like if you were gifted that extra money, well, then you’ve got it. Like, cause I always look it up, look at it. And I think a lot of people look at it like. And am I willing to sacrifice so much of my youth and my life to get to a net worth of like, let’s say $10 million, which is like, most people will never get to that.

But if I work my ass off and I, you know, get to the CEO position or whatever it is, I could potentially get there. But then at what cost and that isn’t when I look at the numbers, it’s not worth me spending all my time and energy purely just so I can be wealthy. I’ve got to live a great life. During my working careers and during my thirties, forties and fifties.

So yeah. Yeah, I get what you’re saying. That’s a good point. Now, speaking of living a great life and just all the differences in the fire bloggers out there, I really pole polarizing topic recently has been children and the road to fire. Now you currently have two kids. How has that changed your mindset?

And is there anything that people need to, or people that are. On the journey to fire, which is me and Mrs. Firebug at the moment. Is there anything you would say to people that want to have kids in the future and also want to pursue their fire dream?

Aussie HIFIRE: I think the first message has got to be look it’s doable.

It’s absolutely doable to have kids and still pursue fire, but it is, you know, th th the message is pretty clear on it. It’s going to be harder, right. Because kids are an additional cost. And I, and I know you, you know, one of the. The recent podcast, which you had with Dave and Pat, you know, there’s a, there’s a bit of talk about, you know, how much does it really cost to have kids?

Aussie Firebug: I think I know

on, on Facebook, not a shit storm, but it was a massive topic on the Facebook group. It had like over 250 comments because someone brought up the fact that, that I think, I think Pat said on that podcast summit, like You can even make money by having kids because the government incentives that they pay you money to have kids or something like that.

And I think, yeah, a few parents, your parents in the, in the group disagreed heavily with him. But yeah, I’m interested to hear what you kind of say.

Aussie HIFIRE: I mean, the thing is like, it probably is actually possible to do that. It’s just that if you’re doing that well, you’re not going to be pursuing fire because, well, you’re not earning anything almost certainly because the government’s paying all the expenses.

But yeah, it’s, you’re not going to get far if you’re doing that sort of stuff. I can tell you that right now. I think the biggest cost, cause, you know, we always spend a lot of time or, you know, one of the first things that always comes up when you, when people talk about it and I’m planning up post on all this, but you know, people talk about, Oh, you know, the prayer it’s in the car seats and you know, it costs you this much.

And you know, I can’t believe people spend. It was

only

Aussie Firebug: me. That was definitely me.

Aussie HIFIRE: But the thing is like, it’s a one-off cost. Like, let, let’s say you spend, we spend, I’ll be honest here. We spend a grand on our prem. And it is an awesome prayer marking too. We’ve got it’s called a baby’s in yo-yo and it falls up to like the size of a desktop computer, I guess like a tower. So to case you can take it on prem.

It’s sorry. You can take it on. Applying fits really easily in the car. Solid as hell. You know, I love this thing. I go running with it. It’s that good? But it’s only a grant. And you spending at once, like, it doesn’t really make that much difference to you. And it’s the same sort of thing with the car seats.

It’s like, yeah, they’re expensive. Everybody buys them new because you know, you don’t know if something’s happened to the other car seat. If they’ve, once they’ve been in a crash, then they’re useless. So you go, okay, well it’s 200 bucks. It’s 300 bucks. It’s five. A hundred bucks. If you want to get one, that’s going to go for longer, but it doesn’t really make much difference.

The big things, which makes a difference in terms of the cost of kids are number one. What’s, who’s looking after the kids is somebody giving up their job. Are they going part time? Cause if they are well, you know, if you’re giving up. Good job entirely. Even if you’re working minimum wage here in August, that’s roughly $40,000 a year.

If $40,000 a year, isn’t going to put a hole in, you know, when you’re going to hit firewall, I want to know what the other person didn’t come in is because that’s pretty amazing. So I think that’s one of the big things there and if you’re not doing that, so that’s what we do. My wife is is a stay at home mum.

And I can tell you it’s harder work than what I do. By a long way. But yeah, if she was working, if we didn’t have, have kids, well, you wouldn’t have the ongoing cost for a start, but then on top of that as well, you know, you’d have that extra money, which is coming in. So you might be talking about, you know, even if you’re talking know minimum wage sort of job.

Okay, well, you’ve lost $35,000 after tax there. And then you’ve got ongoing costs of. You know, I’m writing the numbers at the moment. As I said, I think it’s around about $4,000, $5,000 for each of our kids, roughly speaking per year and they’re young. So yeah. No, it’s mostly just food things. Like we’ve got swimming, lessons, clothes, all that sort of stuff.

And it’s not a huge one, but it all adds up. Right. So yes, Joe told me a $40,000 swing between those things. Well, that that’s, that’s pretty huge. That’s that’s going to delay when you’re hitting it by a long way. If you’re saying said, okay, well, You’re going part time. Well, okay. Yeah. Then you’re doing childcare or after-school care or whatever it is, all those sort of things add up as well.

No matter which way you do it, like it’s going to cost you a fair amount just in that cost, which you’re not necessarily seeing to some extent

Aussie Firebug: yeah. That, that, that opportunity loss that doesn’t actually show in the expense column, but is costing you a lot of money without you knowing it. Yep. Yep.

Aussie HIFIRE: Exactly. So know it’s a lot easier if you’re both working full time, you don’t have any extra costs. I don’t think at the age that our kids are out at the moment, I can’t really speak for what it’s like as they get older. I think it gets a hell of a lot more expensive just in the food bill, apart from anything else.

Then, you know, it’s. It’s going to add up pretty quick, you know, is that, that, that amount of money that you’re missing out on is just huge.

Aussie Firebug: Yeah, that’s, that’s sort of cost it’s fair point. And I think, well, a major reason, you know, we’re on this journey and I’ve spoken about this many times is to have the time to spend with kids when, when we do have them, which isn’t too far away, hopefully touch wood.

And. I think the power of fire and the power of having a passive income, especially when you’re in your thirties, is that ability to have that secondary income or have that how that income, that isn’t reliant on someone working. So, you know, we invest through a trust and the plan will be when Mrs.

Firebug finishes work and. W she’s gives birth and I was on maternity leave and all that good stuff. A lot of, pretty much all the income from the portfolio portfolio will flow into, into her. And that will be a huge tax advantage because she will be under the, what is it, 18 and a half thousand dollars a tax-free threshold.

And any extra money will be taxed at a really low rate that comes in from the portfolio. Now I understand that not everyone will be in that situation, but I think it is. A great thing to aim for, if you want to have kids and you do want to fire to have that portfolio build up to a, to a certain level that you can take advantage of stuff like that when someone isn’t working.

And it was really interesting to read the comments on that post, that how expensive kids are in the fire group, the Facebook group. And I am interested because we have spoken a lot about. All the expensive things that can happen and all the costs that are associated with kids. But do you find like, is there surely there’s areas of having kids where you see other parents spend ridiculous amounts of money and.

There’s there’s some low hanging fruits that can save you thousands of dollars a year, that people that are free will, can take advantage of and not sort of just succumb to the norm and spend all this money on their kids. Like, is there examples of that? And I’d love to hear them. If there are.

Aussie HIFIRE: I think a lot of it is just probably the stuff which you’re doing already.

Like, you know, if you’re being smart with your shopping and your, you know, you’re shopping the specials at Coles and Woolies and Aldi and all that sort of stuff where you’re saving a lot of money there. When it comes to clothes, like I know that there’s a lot of people out there who don’t like secondhand clothes.

I don’t like to get them from charity shops and stuff like that. Yeah, look, it’s personal preference, whatever sort of suits. We tend to buy a lot of our stuff out of season. So, you know, we wait until, okay, summer’s over. Everything goes on sale at target, came out, whatever it is. And you’re buying stuff for a couple of bucks that, you know, if you bought it in six months time, it’d be pretty much exactly the same or near enough to it.

It costs you a hell of a lot more, you know, it could be 20 bucks, it could be 30 bucks. So to start, so just buying stuff. No two seasons ahead effectively. So that’s something which really sort of factors into it. I’ve been to some bios day parties, which are better than any birthday party I’ve ever had.

I’ll tell you that there’s there’s the cake and you look at the cake and you go, well, I bet you that cost, you know, 50 bucks, a hundred bucks, and then you look it up online. Cause I was looking at cakes for some work stuff. It’s like 250 bucks. I’m just like jewel drop. Yeah. I mean, I think we baked ours from a packet mix or something like that, but nobody is flying dried.

I mean, nobody. Okay. Don’t get me wrong. This cake looked awesome. And I’ve seen a few cakes like this and great. Okay. It didn’t look quite so flesh. So what delighted the parents delighted didn’t didn’t matter, you know, birthday parties, one of those things where you just see people spending. What I would call the ridiculous sort of amount of money in, and we’re just sitting there going okay.

As costs like a hundred bucks for food for everyone, you know, she lost

Aussie Firebug: that. The thing, like that’s the thing that I find, I find that the people that spend a whole bunch of money on their kids, is it really for the kids or is it too. Make yourself look like the best parent at the party or something like that.

Like honestly, they get it. They, there comes an age where like cool brands and clothes and stuff sort of matters for like a social status. And that’s a whole nother debate about children, you know, getting teased because they’re were in like, not the best brands or something like that. That’s a whole nother debate, but when they’re really young, like, do they really care if they’re dressed in.

A secondhand shirt or, you know, a brand new nice shirt for a kid that costs like 20 bucks or something like that. I dunno. Like, it just seems crazy to me. And it’s almost, that’s

Aussie HIFIRE: where you’re pointing it. That’s a pocket. Oh, I

Aussie Firebug: don’t know. I deal with kids’ clothes. Kids’ clothes were cheaper, but obviously not, but yeah, I feel like it’s a, it’s a bit of a pissing contest between the parents at a lot of these events and even just with.

A lot of these purchases and it’s going to be really interesting for me when we have kids to see that firsthand, because we’re not in that circle when we haven’t, we’re not in that stage of life yet, but we’re very close. I actually want to get someone on the podcast specifically talking about this, so that is coming up.

Cause I know it’s such an interesting topic and a lot of people want to hear about it, but yeah, it’s, it’s very, it’s very interesting and. I it’s hard for me to know, like the specific numbers for children, because we haven’t had them. And I, I love to dig in to the specifics of how much everything costs and from what area they’re in and stuff like that.

But I feel like that’s another podcast, but it needs coming up. Very pole polarizing topic amongst the community. That’s for sure though. Now tell us about, you’ve got, you’ve got a blog, Ozzie Hi-Fi dot com. Tell us a bit about that. How did that start? And what’s it all about?

Aussie HIFIRE: So the blog is sort of, it pretty much tells my story and then it pretty much just comes up, whatever, whatever sort of hits my mind at any sort of given time.

I mean, for a while there, I had a series on sequencing risk and just talking about you know, It has it all work out because, you know, whenever you see all these compound interest calculators and things like that, it always just says, you know, you have a smoother return at 7% per year and whatever it is everything goes along and then 11.13, nine years, then you’ll hit your fine number.

And. The reality is it doesn’t sort of work like that. You know, markets don’t give you smooth returns. They give you really lumpy sorta one. So, you know, I did a whole sort of series on that. And then, you know, after that, it’s, it’s pretty much whatever sort of works for me. So a lot of it, as, as we talked about is data driven.

So. Yeah, I think one of the, one of my posts, which you very kindly re blogged or retweeted or whatever the terminology is, was on imputation credits back when seems like a lifetime ago, I think it was probably about a year ago now really when label was proposing to change that. So, you know, I wanted to look at what the numbers are.

Around that. And then yeah, just, just wanting those sort of vein. Another one I had was, you know, what’s the difference between, you know, you see it on Reddit all the time on, on the FIS Australia, sub Reddit, people are talking about, Oh, you know, I should, should I have 8,200 or should I have vests?

Or should I have iOS ed? Or, you know, w which of these, these low cost funds should I have? And yeah. Yeah. When I crunch the numbers on it doesn’t matter. I could really, any of them is fine. They’re all coming out with almost exactly the same result. Once you get down to, you know, we’re talking about a couple of basis.

This point’s different. It’s irrelevant. Really isn’t and people are spending huge amounts of time talking about, and you’re just going, I just got sick of it. And I was actually talking to that other fire blogger because I was working on a post and it’s just like, I had a 4,000 word monstrosity and I didn’t feel like I’d actually said any.

Yeah. And you just go and nobody’s going to read this. Like, I can’t even read it myself at this point in time. He said, well, why don’t you break it into two? And I thought, yeah, I guess, I guess that could work. Eh, and it sort of out of that is, okay, well, what are the main sort of points? And one was about, you know, cutting costs on, on your living costs and the other one was cutting costs in your investment.

And, you know, we sort of came to, okay, well, He’s the big one that everyone’s always talking about. What’s it look like in terms of that? And the post just sort of blew up it’s by far my most popular post out

Aussie Firebug: there. Yeah. It’s a really great post. I’ll put that in the show notes as well. It’s it’s the 8,200 verse VAs and what’s my weapon debate.

It’s a brilliant post I’ll. I’ll put it in the show notes for people that want to read cause it’s really good.

Aussie HIFIRE: Yeah. And then sometimes I’ll just talk about, you know, whatever sort of is on my mind. Reviews of what I’m up to, you know, how things are going in terms of my saving all that sort of stuff.

And I mean, as you, as you said earlier in the show, look, a lot of this is behavioral as well. You know, for me, the numbers side of it is the easy part and the investment side is easy part. I’ve been doing this for 20 odd years in terms of investment, like I’ve been in the market for I’ve owned shares for nearly 30 years now.

I think the, you know, I worked in, in this on the institutional side where you’re talking to hedge funds, you’re talking to asset managers, all those sort of guys, and I feel like I’ve career really, really good sort of grasp on it. Most people don’t Unfortunately, because you know, I’d look, it’s not what they do.

This is what I did for a living. I don’t know anything about, you know, God, if you handed me a ranch, I don’t know what sort of damage I do, but you don’t want to be doing that. That’s for sure. So I just took, you know, for me, that sort of part of things is easy. For a lot of people it’s not, but. I think a lot of it, as well as just talking about the behavioral sort of side of, okay, well, what are the things which are important?

What are the things which aren’t important? What is it that’s going to help you, you know, stay the course. And so some of the posts might be about, you know, the importance of diversification, because if your, you know, if you’re going to, as we talked about earlier that you see the, the value of your investment fall by 40%.

Well, Some people just, aren’t going to be able to handle that. And there’s just, there’s nothing wrong with that. I mean, Jesus, it’s, it’s not necessarily even. It’s very understandable. Okay. Well, you know, something just fell by 40%. What’s to say that can’t go to zero necessarily, you know, your primal fear takes over at that point.

But then also I’ll talk about, you know, these are the things which I think are important that not necessarily everybody is talking about. So emergency funds, you know, is probably, to me, probably one of the first things which people should be looking at, it should be instead of RK. Well, I’ve managed to save up $10,000.

What do I do with it? It’s like, well, you need to put that into your emergency fund. First of all, because if something goes wrong, well, what do you do? It is staffed pretty much. And then, you know, personal insurance, cause again, the same sort of thing, you know, if you can’t work again for most of us know, particularly for you, you’ve got another, well, you don’t have, hopefully you don’t have another 20 or 30 years, but if you were the average sort of person out there, you’re going, okay, well, I need to have this income coming in, you know, and if I’m not protected, then what am I going to do?

And everyone goes, Oh, well, you know, I’m in the fire. It’s not a big deal. And it’s like, yeah, but you’re starting. Like, it’s not a big deal when you get to the end. Yeah. You know, if you box in the bank and it’s going to provide that, you know, 70,000, 80,000 bucks worth of income, whatever it is, great, happy days you’re set.

But if you all, you’ve got $20,000 saved up and all of a sudden you can’t work again for whatever reason, then what are you going to do? Like, you’re just going to leave off settling for the rest of your life because you can’t work. Like it’s not, it’s not your fault necessarily that you can’t work, but what, what’s your plan?

Yeah.

Aussie Firebug: It’s about protecting probably your most important asset, which is the ability to have a. Income and compare it comparable to the returns of your portfolio, especially when you’re starting out. It’s your income is everything, you know, it’s, it’s the one that’s driving the whole ship or pairing the whole ship.

And it’s not until you get to the very end that you can really switch, switch pilots and change to the portfolio. And I have to admit that’s something that I. Probably have neglected during my journey, which is seriously looking at income protection and stuff like that during the journey. Cause we don’t have anything whatever’s in our super is sort of everything that we have and we don’t invest in any sort of insurances other than house, house insurance and car insurance outside of what’s in super.

But it’s very. Very interesting topic and something that probably isn’t talked enough about in the fire community. Yeah.

Aussie HIFIRE: It’s just one of those things where everybody, you know, there are either I don’t need it and you go, well, yeah, you kind of do or . Yeah, exactly. Well, it’s like any insurance, right?

Like. The crazy thing to me is, you know, everybody goes, Oh, you know, as he current short. Oh yeah, of course it is. You know, this is your house in short. Okay. Yeah, of course it is, you know. Okay. How much is your house worth? 500,000 bucks. Okay. And how much is your future income worth? I dunno, I will. You earn a hundred thousand bucks a year?

You’re going to be working 40 years. It’s worth 4 million bucks.

Aussie Firebug: Isn’t that funny? When you say it, when you say it like that, it sounds like it makes a lot of sense, but it’s just. I dunno what it is. There’s some sort of psychological thing about not like maybe it will never happen to me. Like, I don’t know the statistics about how often you, how, how many people crashed their car in their lifetime versus how many people will potentially have a major.

Accident that will impact their income. Severely I’d love to see the numbers like speaking to data-driven because I’m like, I’m going to be like that

Aussie HIFIRE: myself. When I looked at it, like one of the insurance companies was basically saying you’ve got a one in three chance of being out of work due to illness, injury, whatever it is for more than three months.

During your working life. And then I was looking at something else and it was something along the lines of roughly 20% of the population is actually disabled.

Aussie Firebug: Really?

Aussie HIFIRE: Yeah. A lot of those are going to be old people, right. It like it, sorry, not the working age population, the whole population. So a lot of that’s going to be in that, but if you go, okay, well, Well, that’s three quarters of it.

It’s still 5% of the rest of the population yourself.

Aussie Firebug: Way more than I thought

Aussie HIFIRE: so. And, and you just don’t see it, right? Because you know, when you’re at work, you would, everybody else is obviously capable of working. So it’s, self-selecting to a large extent, the ones who, who can’t work anymore, when you’re not seeing them at work, you’re not seeing them at 40, you know, you’re not seeing them at.

No, they’re probably not necessarily going out off a whole lot. And I just become invisible and you don’t see them because, well, they’re not there.

Aussie Firebug: Mm. Yeah. It’s not, not at the forefront of your mind. Is it? Whereas like you might say, you know, car accidents happen every day, it’s on the news. It’s in the papers.

No, it’s rarely. Yeah. And even when people see someone losing their income, it’s, it’s sort of that. You know, invincible attitude when you’re young, it’s never gonna happen to me sort of thing. Yeah.

Aussie HIFIRE: And there’s a great Ozzy, you know, she’ll be right, mate sort of had a tutor as well, which doesn’t really help, whereas that guys.

So now it’s interesting because you see this huge difference between, you know, because when I was writing the blog, I sort of looked at, you know, what’s it look like for the U S versus Australia and it’s just night and day. Like, it really is, you know, lots of countries are just so much, you know, it’s just.

Here’s one of the things that you do. Whereas in Australia it’s like, no, why would I need to add, or, you know, it’s in my super and you’re going okay, well what’s, how much is it? I don’t know. Well, how it enough then? Yeah, yeah,

Aussie Firebug: yeah, yeah, absolutely. It is. It’s an interesting topic, probably a whole whole nother debate.

A bit about that and you know, what’s right. What’s wrong. And how much, you know, a lot of people do say it’s in their super, but you know, how, how good is it? What sort of coverage is it? Stuff like that it’s probably worth something. You know, to look up I encourage anyone listening to check it out, what they’re covered for and to see if they’re happy enough with that coverage wrap, wrapping things up, mate.

Cause we really coming on to an hour. Now what’s one piece of advice that you’d give to any Ozzie out there that is pursuing high fire.

Aussie HIFIRE: Just one, you just got a little it to the middle one here.

Aussie Firebug: You can say me, you want but I usually say one because. Well, I was gonna say usually there’s, there’s a, a really important thing to have, but, you know, surprise me if you’ve

Aussie HIFIRE: got multiple.

I think that protect yourself on that we’ve just talked about is probably one of the more important ones. Like that’s huge, just making sure that, you know, if something goes wrong, you’re going to be a ride. It is a massive sort of thing on top of that, I guess, just knowing what you’re actually spending your money on.

If you don’t know what you’re spending your money on and like, it’s great. If okay. If you’re going okay, I’m saving 50 grand a year, no problems, you know, then, okay. You don’t need to worry about it for most people when they actually do the real sort of numbers, when they, you know, Download the bank statement or, you know, they use whatever sort of app it is that, that does all this stuff.

I think most of the banks will now tell you, you know, this is what you’re spending the money on. And all of a sudden, there’s this eye-opener of Holy hell. I’m spending 10,000 bucks a year on eating out or something like that. I think somebody was telling me that had Brendan for Vola that the IFL player, X IFL player, he ordered something like a thousand different Uber eats meals over the course of the year.

And you get on individually individual meals. Like, I don’t need that many meals over the course

Aussie Firebug: of a year. I’m pretty sure Molly. That’s like more than that, that’s like, Oh, it could be

Aussie HIFIRE: numbers there, but it was yeah.

Aussie Firebug: Three meals a day or just under or something like that. And

Aussie HIFIRE: you get away. People are obviously like, it’s not to that sort of extent for, you know, everybody goes higher.

We just, we don’t add how much, you know, once a week sort of thing. And you go. Well, hold on. Yeah, you ate out for lunch every day and then you ate out three times. It’s not once a week. There’s always something like that. It might be, you know, the people just don’t think about you do this every single day or.

You know, you do it a bunch of times a week, but you think you’d do it a lot less, or you just don’t sort of look at what those numbers add up to. It’s like the classic example is always the, you know, the cup of coffee and you go, okay, well you have this cup of coffee and you don’t have the course, you it’s a thousand bucks or whatever.

A cup of coffee doesn’t really make that much difference. But you know, there’s always some sort of expense out there or, you know, buying clothes or shoes or sporting equipment or computer games or whatever it is. There’s always know what you’re spending. It’s probably the big thing there. It’s very

Aussie Firebug: important.

Yeah, no, the, you never know your financial independence number, unless you can accurately gauge how much you spend to maintain your current lifestyle. So that’s always, yeah. Huge, hugely important. Couldn’t agree anymore. Well, mate, it was an absolute pleasure having you on the pod. Thank you so much for making the time and Yeah, I really enjoyed it.

Thanks

Aussie HIFIRE: for having me.

Aussie Firebug: Well, there you go guys. Aussie high fire himself talking about the high fire lifestyle. I’d be interested to know what you guys think. Does the high fire lifestyle appeal to you? Maybe you’re the opposite. Maybe you want to pursue lean fire or barista fire, regardless. I think it’s an interesting topic and I hope you guys enjoyed that one as much as I did making it.

As always Eve gloss like these podcasts, one of the best things you can do to help me out is give me a review on iTunes. I checked the other day and we’re up to over 300 reviews, which is awesome. I appreciate all of them so much and it helps to bump up the podcasts in the algorithms are much appreciated.

That’s it for today? Hope you guys enjoyed it. I’ll see you on the next episode. Thanks guys for listening to another episode of the Ozzy Firebag podcast for links to all of the resources, plus an entire transcript of this episode, head over to Aussie fireboat.com. Make sure you never miss out on another episode by subscribing now on iTunes or SoundCloud.