by Aussie Firebug | Sep 7, 2015 | Classics, Investing

Unless you have been living under a rock I’m sure you have heard of the term negative gearing. Some swear by it, others say that it is responsible for the outrageous house prices in the Sydney and Melbourne market. At the time of writing this, the current median house price in Sydney is $1,000,616 and Melbourne is $668,030! But what is Negative gearing, why do I think it’s for dummies (most of the time) and why doesn’t Negative Gearing’s cooler brother Positive Gearing get as much attention?

Negative Gearing Explained

The first thing to understand is the term ‘gearing’ which simply means to invest on borrowed money. Why would someone invest on borrowed money? Because investing on borrowed money allows you to get bigger bang for your buck (technical called leveraging), for example:

If I invested $50K straight into an Exchange Traded Fund that returned 10% annually I would make $5K in one year. But if I used that $50K as a down payment for a house worth $250K that increased in value to $275K over the course of one year I have successfully used leverage to my advantage. You see, even though the ETF had a better return on investment (ROI) of 10% compared to the house ($250K to $275K is a 9% ROI), the leveraged investment was able to return $25K compared to $5K from the ETF. This is possible because you are investing the same amount of capital but are acquiring a much larger asset.

Of course I’m leaving out a ton in the above example but that’s just to explain the basics and how gearing is meant to work.

OK so now you understand what leveraging\gearing is and how it’s meant to work. If we continue with the above example and break down the costs associated with holding the asset for one year and the income it produces (rent) it might look something like this

| Expenses |

|

Income |

|

| Management fees |

$1,000 |

Rent p/w |

$235 |

| Water Bills |

$600 |

|

|

| Interest Repayments |

$10,000 |

|

|

| Insurance |

$600 |

|

|

| Rates |

$1,600 |

|

|

| Depreciation |

$7,600 |

|

|

| Total |

$21,400 |

Total |

$12,220 |

Which would mean that the investment is negatively geared because the outgoings are greater that the income produced by the asset. You are basically losing $9,180 dollar a year to hold this asset. Why would anyone buy something that looses them money? Because they think they can make it back through capital gains. Which in the above example is correct since the house gains 25K and only loses around 9K.

While some people like to invest like this, it ain’t for me. The reason I don’t like this way to invest is because every year you loose REAL money out of your account and it affects cash flow position which impacts your lifestyle. You might not be able to go on that holiday every year if you were consistently having to fork out 9K on the investment property. You never see the capital gains money until you sell the house, your gains are only on paper until you actually sell. The house might be worth 25K more after year 1 and then 25K more again after year 2 but then the market slumps and your house is suddenly worth 40K less after year 3. Meanwhile your negatively geared asset has consistently been draining you of 9K yearly. It comes back to the basics of investing and for me my light bulb moment. You buy assets that make you money. Negative gearing is buying assets that loose you money with the hope of making that money back and more when you sell… No thanks

Pay Less Tax

What is unusual about negative gearing in Australia is that the law allows you to offset the tax you pay on your wage with the losses from an investment. Not all country’s allow you to do this. I’m not going into a lot of detail about taxes because it’s just too hard with so many different situations but the gist of it is that you can claim a deduction in your tax return from the loss you made on an investment property.

For example, if you earned 70K a year and you lost 9K with a negatively geared investment property the tax man looks at that and allows you to offset your salary of 70K by 9K thus your real earnings that financial year is 61K and not 70K. And this difference is the reason you can get a big tax return at the end of the financial year. Because you paid tax on the whole 70K throughout the year the tax man refunds you the tax you would had paid on the 9K which equals $2,925* using the income tax rates 2014-2015.

BUT!!!! You have to remember that even though you paid less tax and got a tax return of near 3K, you still lost 9K to do so. When you hear people bragging about ‘My tax return was $12,000 dollars this year how smart am I!’ just remember that they would have had to have lost a heaps of money in order to offset their salary to get that big of a return. The aim in property investing is not to pay no tax at all. It is to make the most money possible in the shortest amount of time with the least aggravation. There are ways to minimise the amount of tax you pay but your goals should never be paying not tax at all. Ideally you want to be paying loads of tax each year, because if you’re paying heaps of tax that means your making bucket loads of money. If you live in this wondering country of Australia you’re going to have to pay tax. Get over it.

When is it OK to Negatively Gear?

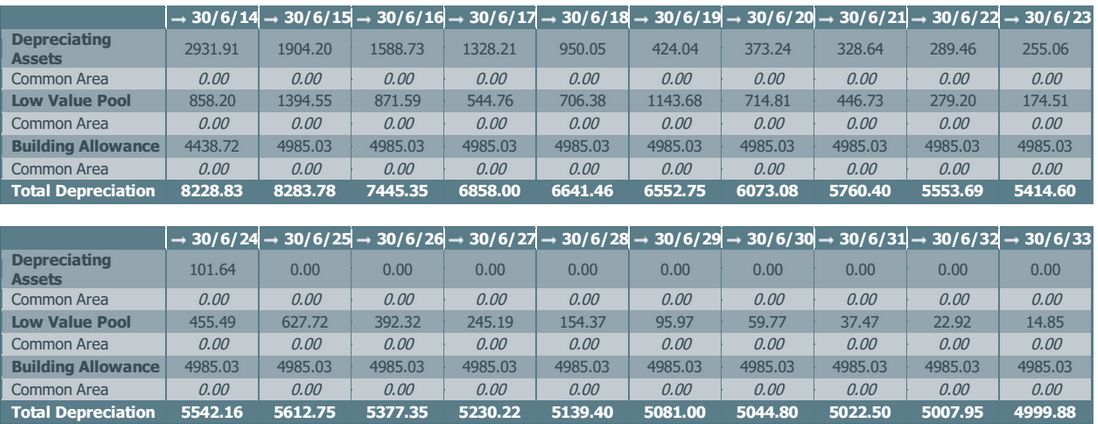

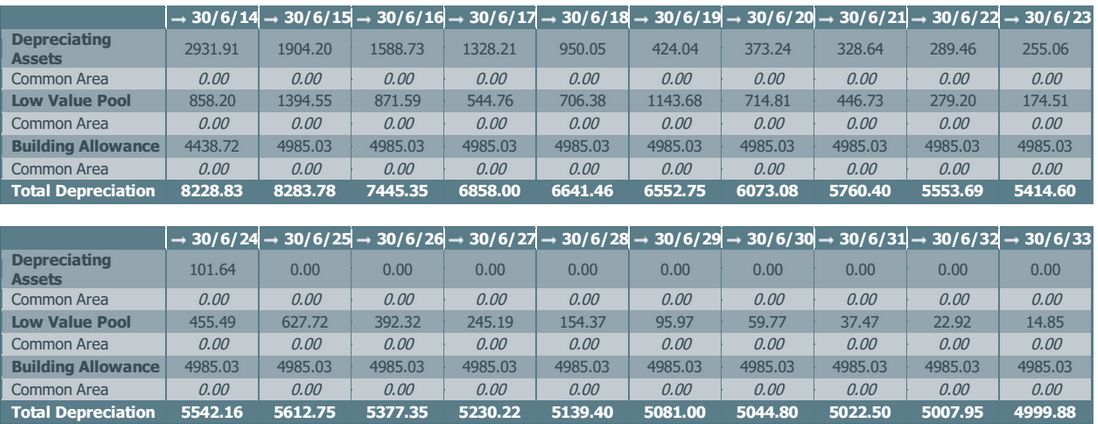

I’m going to sound like a massive hypocrite right now but all my properties are negatively geared BUT have positive cash flow increasing my ability to save cash for the next deposit. Huh? Didn’t I just say that negatively geared properties lose you money each year? Yes I did but there is one key category to the expenses of a property that makes it different from the rest. Depreciation! When you buy/build an investment property you should get a depreciation report made. This is basically paying a professional depreciator to come to your property and work out how much value things are going to depreciate by each year. The carpet might lose $200 value each year for the next 15 years, the deck might deteriorate by $400 a year for the next 20 years and so on. They value everything on the property and give you the value that the property loses throughout the next 20 or so years. Below is from a report of one of my own properties

The total depreciation at the bottom of every financial year is what my accountant is after to use in my tax return. The reason why depreciation is different to every other expense is that it does not affect cash flow. I technically make a lose on paper but I don’t actually have to give 8K to anyone, it’s simply what the property has lost in value during that time. My own cash flow position with my properties is that my rent covers ALL expenses and leaves me with a little left over. But when you factor in the depreciation I’m technically negative gearing even though I have a positive cash flow. For example:

| Expenses |

|

Income |

|

| Management fees |

$1,000 |

Rent p/w |

$350 |

| Water Bills |

$ 600 |

|

|

| Interest Repayments |

$10,000 |

|

|

| Insurance |

$ 600 |

|

|

| Rates |

$1,600 |

|

|

| Depreciation |

$7,600 |

|

|

| Total |

$21,400 |

Total |

$18,200 |

Technically I am losing $3,200 dollars holding this property. BUT the big difference with the above is that if you take out the loss from depreciation I actually have a positive cash flow of $4,400 dollars. Deprecation puts me in the negatives which is OK because that means I can then claim the loss on my tax return and get even more money in my pocket! The entire time I’m holding this asset I am having $$$’s flow into my bank account and not out of it PLUS I’m not even factoring in capital gains which may or may not be occurring. Capital gains is the gravy on top for me though, as long as an asset is cash flowing I continue to buy more of them.

Positive Gearing

And now finally onto the my favorite way to invest, Positive Gearing. You may have figured it out by now but just in case you haven’t. Positive gearing is when the rent you collect covers all costs including depreciation and leaves you with a surplus. You have to pay tax on this surplus but that’s OK because it’s extra money in your pocket and for me it’s better to be earning $1 dollar more and paying 37c tax than it is to be losing $1 and saving 37c tax.

So if positive gearing is so bloody fantastic, why is everyone doing it? Because it’s not easy to find positively geared properties straight off the bat. You can find them in places like mining towns and in the country but mining towns are usually extremely reliant on one industry and if the mine shuts you’re screwed. Country towns are OK but often lack that capital growth seen in the capital cities.

There are only two way to make money from Real Estate. Having positive cash flow from the rent (positive gearing) or having the price of the asset increase from when you bought it (capital growth). Nirvana is purchasing a positively geared property that will have big capital gains in the future. The thing about capital gains though is that you can’t really control it from the market perspective. Sure you can do a reno to increase the value of the house or something, but if outside factors come into play such as China slowing down, Australia going into recession or Europe going down the drain and the buyers market gets spooked and stops buying. Economics 101 ‘supply and demand’ tell us no matter how much you’ve improved the property it may be worth significantly less than what you’ve paid for it. In a rough time like this your cash flow will either help see you through so you can hold the asset until the market rebounds or it will cause you significant grief as you continue to fork out $$$ each week for an asset that is continually losing money. Cash flow is more manageable and easy to predict. You can see roughly what the properties similar to yours is renting for, work out the costs for repayments, rates, water etc. and get a rough idea if the property will be negative, neutral (doesn’t lose or make money) or positive. Outside influences that affect cash flow are usually less volatile too (interest rate, rent prices etc.).

Negatively geared properties should eventually turn into positive over time as rent rises. Realistically, neutrally geared properties in a highly sought area with good potential for growth are the ones I’m interested in. They don’t drain your pockets as the property looks after itself and with every rent increase you are slowly turning the property into the positive area while also having a property with great upside for growth. I would love to get a positively geared property with big upside for growth but the bottom line is they are extremely hard to find in a capital city without lucking out somehow. It is very possible to get neutrally geared properties in up and coming areas which will turn positive over time.

Wrapping Up

Negative gearing saves you paying tax but you lose more than you get from you tax return. If you are negatively gearing you must be 100% confident that the property is going to go up in value whilst your holding it. This is the only way you can make money through negative gearing. Next time you meet someone who is paying little to no tax using negative gearing just be aware that they are actually losing money until they sell and most likely don’t realise this. I only advocate negative gearing if you still have positive cash flow which is the method I’m currently using.

Positive gearing is where it’s at and all investors should be striving to get to this state because there is no good reason not to. The asset produces more income than expenses. Simply investing really, buy things that make you money. Positive gearing does this. Yes you pay tax but if you’re planning to become rich through Real Estate guess what? You’re ganna have to pay tax!

Thoughts, feelings, questions and emotions in the comment section below.

*Assuming that this person falls in the $37,001 – $80,000 tax bracket and is paying 32.5c for every dollar they earn

by Aussie Firebug | Aug 19, 2015 | Financial Independence, Investing, Retire Early, Saving

It doesn’t matter if you’re 16 or 60. You are never too young or old to start planning for retirement, and if you’re crazy like me then you would have wished you had started planning from your early teen years. But how do you know when you can transition to retirement? To answer the common question of ” How much do I need to retire ” there are basically two things that you need to measure before we can use the retirement calculator.

How much do you spend?

And I don’t want to hear rough estimates here. In order to accurately measure and plan for retirement you gotta know exactly how much money you spend each year in order to live at your current life style. This does two things. Firstly it will give you a quantifiable number (needed for the retirement calculator). You can now accurately say that I need $X.00 amount of dollars to live my life as it is right now during this time in history. Notice I mention this time in history because inflation matters, for example someone living in 1970 might have been able to live off $5,000 that year. But they might struggle to buy just coffee for a year with that sort of cash now days.

Secondly you will become aware of where every dollar that you earn goes. And this is going to really open up your eyes trust me on that! Even for someone who has been financially responsible their whole life. When you track your spending religiously you see just how many holes you have in your pocket and that money is constantly flowing in the outwards direction for heaps of shit that doesn’t really improve your life, I’m looking at you alcohol/smokes/designer clothes. Plugging these holes is another post altogether so lets just stick with tracking money for now.

So how does one exactly track their spending accurately? Well there are a few different methods depending on how trust worthy you are. The first is to simply keep an excel spread sheet/journal and fill it out as you go. Export your bank statements to a CSV file and add each transaction on your statements to your spreadsheet with a date, transaction detail, amount in $ and a category column so you can break down what you spent your money on. Something like this will work

| Date |

Transaction Detail |

Amount |

Category |

| 05-Aug-15 |

BP Petrol |

$ 54.36 |

Car |

| 05-Aug-15 |

Safeway |

$ 26.10 |

Groceries |

| 07-Aug-15 |

Revolvers PTY LTD |

$ 281.52 |

Entertainment |

| 08-Aug-15 |

McDonalds |

$ 24.20 |

Food |

| 08-Aug-15 |

Safeway |

$ 35.10 |

Groceries |

|

|

|

|

| Total |

|

$ 421.28 |

|

And with a bit of excel magic you can create a pie graph of your 3 day bender.

The other alternative (my preferred method) is to get browser based software to do this for you for free. There are a number of different Australian options you can choose from: Pocket Book, ANZ Money Manager and for any US readers I’m sure you have already heard of Mint. They all do basically the same thing when it comes to categorizing your transactions. You can log into your online banking and export data between two different dates and then upload it into the software. Once there the software will automatically try to categorize transactions based on common names in the transaction details. For example if the transaction detail has Woolworths in the description than odds are that this transaction should be categorized as groceries. You can always manually go through them to make sure that they are right, and the software is smart enough to remember your changes in case it gets it wrong first time. The only down side to this is that you have to export your data and upload it every time you want up to date info. To make this easier you can add you banking details to the software that enables it to have read only access to your data. This means that the software is always up to date with your transactions without you having to export/import all the time. If you are worries about security you can read up how it works here.

Once you have all your transactions in the software and categorised correctly you can really start to paint a picture on how much you spend and what you spend it on. Pocketbook has a great feature called ‘Analyse’ that creates a pie chart for you between two dates and splices it up based on categories. You can then deselect certain categorie and the pie chart will automatically re-size and show you what your spending would look like without that category for that week/month or whatever the time frame is that you’re measuring. It’s a really easy and quick way to sift through all the junk and find out how much you can actually live off without all the bells and whistles.

Now the last part to this question is all about that cash flow baby! How much does your investments make you? This can be a bit tricky because it depends on what you invest in and how volatile it is. Lets just assume that you are getting a solid return of 9% per annum forever with no fluctuations. Highly unlikely but for the purposes of this example lets just go with it. How much will you have to have invested before your portfolio generates your annual expenditure? Just plug in your figures to the following formula

E / R = FI

E = Yearly expenditure

R = Return rate as a percentage

FI = Financial Independence

Example: I spend $45,730.87 dollars and my rate of return from investments are 9%

$45,730.87 / 0.09 = $508,120.77

So based on the above I would need a portfolio valued at $508.120.77 that returns 9% per year and I would never have to work again!… Not quite. Inflation is the silent killer here. The Reserve Bank of Australia’s (RBA) inflation target is 2-3 percent, lets just use 2.5% for our calculations. We need to minus this percentage from our return rate of 9% and redo the formula.

$45,730.87 / 0.065 = $703,551.84

God dam inflation. Factoring inflation in has just increased our hypothetical FI number by nearly $200K 😐 … This is an evil necessarily though because it will enable your portfolio to grow along with inflation, enabling you to have the same purchasing power in 30 years time as you do today.

I have not covered everything* here but it should give you a basic idea of how to start calculating your FI number. Have a play with the retirement calculator below and see how drastic some simple changes can be such as lowering your living costs by as little as 5K or how much an impact your FI is affected by rate of return.

[CP_CALCULATED_FIELDS id=”6″]

*All calculations have not factored in tax because it’s just too hard to cover all aspects. You should be calculating using after tax money

by Aussie Firebug | Mar 10, 2015

G’Day!

I’m an Australian in my mid, late twenty’s, early mid-thirties and a major goal in my life is to become Financially Independent and Retire Early (FIRE). But what exactly does FIRE mean? Well, I’m sure you can figure out the retire early bit (my favourite part). As for financial independence, one definition defines it as:

‘Having sufficient personal wealth to live, without having to work actively for basic necessities. For financially independent people, their assets generate income that is greater than their expenses.’

FI basically means that you have income-producing assets that generate enough money for you to live off…forever. This, in turn, gives you the option to retire early (RE) and pursue your interests without relying on a paycheck to keep a roof over your head. Pretty sweet right?

I definitely think so. But before we venture any further I’d like to rewind to the start of my journey many years ago…

Early life

I have always been responsible with my money even from an early age. I accredit this attribute to my parents but particularly to my father. Being a typical WOG he was a tight arse and I hated it.

When I was young and needed new footy boots, off to the store with Dad I would go. Back from the store, I would come with the no-brand, pov, ugly football boots that I would be embarrassed to wear to training the following week.

I can now appreciate how utterly ridiculous children’s football boots and clothes, in general, are priced. Especially when you grow out of them in less than a year. Nevertheless, this does not cross your mind when you’re a child and all you care about is having the coolest shit possible to show off to all your friends.

Dad taught me that smart people saved their money and only suckers parted ways with theirs. Whenever I would buy anything he would ask me how much I paid for it. No matter how much of a bargain I got on the item the response was always the same.

“Ripped off”

It was sort of like when Darryl Kerrigan would ask his son “How much does he want for it?” and the response would always be the same “Tell him he’s dreaming”. It was almost like spending money on anything other than a necessity was being ripped off.

Observations

I have always had an interest in money and wealth. I’m not sure where it comes from but I took notice of it from an early age. When visiting friends who lived in really nice houses I would always be interested in what their parents do for a living.

When I would watch a reality TV show some of these people would be living in multimillion-dollar mansions. I would be less interested in the main ‘stars’ and wanted to know more about their parents and how they obtained these enormous fortunes, often resulting in me reading their wiki page for hours.

The connection I made early on was that most of my ‘rich’ friends parents didn’t have normal jobs. They either owned businesses, land, real estate, shares or did something that wasn’t your average 9-5 day job. There were a few that held high positions in companies but even then it seemed that the wealthiest people owned things that made them money.

Lightbulb Moment

If you live in Australia you might be aware that we have a love affair with real estate. God forbid you move to Melbourne and start renting. That would be like throwing your money down the drain.

What you need to do is buy a house and ‘set yourself up’.

I was once engraved in this mantra too. I knew that smart people bought investment properties and I wanted to be smart! So when I had saved up enough money for a deposit I bought my first Investment Property in 2013.

Towards the end of that year, I started to think to myself :

“Shit. You actually have this massive debt to your name and 90% of the reason you bought it was because you were told it was a clever move. You need to actually figure out yourself if that was true.”

So I set out to discover as much as I could about investing in real estate and not too far into the journey I discovered the term financial independence.

I believe it was from Robert Kiyosaki’s famous book ‘Rich Dad, Poor Dad’ which is not specifically about real estate investing. I remember reading a section of the book that roughly said all you have to do to reach FI is to keep buying assets that make you money. It will be slow at the start but thanks to the powers of compounding interest the more you buy the more you make and the easier it is to buy again. You eventually have so much money flowing in from the assets that you can live off the stream of income.

MIND. BLOWN.

It seemed so simple. Just buy things that make money, that’s all there is to it. Buy enough of those things (assets) and voila you’re finically independent!

I had my doubts, I didn’t think what they were describing in these books was really possible.

I mean really?

You’re telling me that if I save my money each paycheck and invest it, eventually I would not have to go to work 5 times and week?

I must have read somewhere between 15-20 books in 6 months (which is a lot for me). I started to subscribe to online blogs of people who had already reached FIRE. I went to seminars in Melbourne on the weekends to meet people who had achieved financial independence. Anything I could get ahold of to do with FIRE I would absorb it.

I BECAME OBSESSED.

The light bulb went off in my head and I was now fixated on achieving this goal.

Now I have to admit, I don’t actually mind my job. I actually quite enjoy it. But I HATE having to be there for 38 hours each week. It’s not the work, it’s the time I feel I am forced to give up. My precious time that I can never get back. And as I eventually move up the ladder of adulthood that precious time is continuingly taken away from me. It seems like I don’t have enough at the moment, what happens when I take on more responsibility at work and move up in my career? Move out with my partner? What about KIDS? Yikes!

This blog is going to track my journey from $0 net worth to FIRE with detailed information and analysis on saving $$$, investing, mindset, struggles and anything else that is relevant to reaching FIRE.