by Aussie Firebug | Aug 31, 2016 | Podcast

Subscribe on Itunes Subscribe on SoundCloud

Subscribe on SoundCloud

Summary

I invite the founder and CEO of the Australian robo-advising company Stockspot to chat about entrepreneurship, investing and how traditional fund managers are ripping you off!

Chris Brycki holds a Bachelor of Commerce, was the national winner of the ASX Schools Share Game three years in row, a highly experienced trader spending most of his career as a Portfolio Manager at UBS investing the banks’ capital and more recently an entrepreneur, founding his own company Stockspot.

Show Notes

Transcript:

Aussie Firebug: Hi guys, welcome to another episode of the Aussie Firebug podcast, the financial independence podcast for Australians where I interview clever people who have already reached or are on their way to financial independence. I’m really excited to introduce our guest today. Chris Brycki holds a Bachelor of Commerce from the University of New South Wales, was the national winner of the ASX School Shares games three years in a row from 1999-2001, three times national winner of the JP Morgan’s University Portfolio Competition, a highly experienced trader, spending most of his career as a portfolio manager at UBS investing the bank’s capital so this is serious, serious stuff you guys. But most importantly and the reason he’s our guest on today’s show is because Chris is the founder and CEO of a relatively new robo-investing company, Stockspot. Chris, welcome to the show.

Stockspot Great to be on the show.

Aussie Firebug: It’s quite an impressive resume you have there and I’ve got to ask, with the ASX School Shares games that you won three in a row, I think I run one of those- they do it annually I believe but I think I entered it one year- is it basically that you just pick stocks for like six months and the best return wins, is that how it works?

Stockspot Yes, there’s more to that. So some of your like listeners probably would have played if they’d been there at school– I think they’ve actually been running it since the 1970’s is what I understand that back in the seventies and eighties, it used to be a paper based thing so you never actually have to submit your stocks by paper or I think later on it became fax and when I started entering and it was in the late 90’s actually and it was one of the first years that we’d become an internet-based thing which is pretty exciting so it was a live trading game I think it was for 6 or 8 weeks and they allowed you to trade you to trade the top 100 or 200 stocks and gave you like a $50,000 nominal portfolio to trade and then yeah, you could basically trade as much as you like. They made it as realistic as possible so they charged you brokerage and commissions and I remember at school I’d go basically to the library whenever I had spare time at lunch times and after school to do research and spend a lot of my spare time doing it because back then, the prize money which I think was $1000 was huge money for us and was a big incentive to put all your spare time into that rather than getting a job at Woolworth’s.

Aussie Firebug: Yeah, definitely. It’s quite impressive actually because it sounds like the game that I played on the same site- I think I signed up for it last year or something- but it is very hard to pick stocks and come out ahead so for you to do that three years in a row, it’s actually really impressive. Did you win by much or was there a top 10 or something or?

Stockspot I think it actually varied quite a bit every year so I think I first entered in year 7 and I think that year I might have gotten to the top 20 or something and it was just kind of learning but then I kind of worked out with a short term game like that. The strategy you have to take is very different to what is like a sensible strategy over the long term or maybe [00:03:24], you really just have to take a very high risk strategy and focus on those stocks that are most volatile so I think a lot of students actually build very sensible portfolios, you know bought a few bank accounts, whereas I think that the first year that I won it was actually– or one of the years I won it- it was when the twin towers came down, sadly, but one of the shares that was very volatile and was struggling around that period was GB insurance because they actually insured the twin towers and I think the share price of JB crashed something like 80% and you know it was sort of that volatility that created ‘for better or for worse trading opportunities’ and so in short term trading games like that or just trading in general like volatility is your friend, but obviously long term if you’re an investor, it’s actually the opposite.

Aussie Firebug: Impressive nonetheless. Now, before we get to Stockspot, I just want to dive a bit deeper into your backstory and how you got to where you are today. As we’ve already talked today, your resume is really impressive; growing up, were you always interested in finance?

Stockspot I think from probably around the age of 12 or so I became interested so the story behind that was when I was– yeah I was 11 or 12. My dad who really has nothing to do with finance, he sat me down because he thought it was an interesting thing to teach me and my brother and said, “look, this is how the stock market works: creates like when companies want to raise capital, they basically go out and ask investors for money and then after they’ve raised that money, there’s a secondary market basically where people can buy and sell you know a piece of that business,” and so I was [00:05:03] you know an amazing concept that you could actually own parts of businesses that you’d actually have dealings with day to day whether it was Woolworth’s or back then Billabong was a good share, you know shares that you know you would kind of buy their merchandise or use their services and you could own part of the business. So back then dad actually sent me and my brother, here’s $1000, go and screen the newspaper and find a stock to invest in or do some research and whichever one you pick, I’ll invest on your behalf and then you can watch it and then you decide when you want to buy or sell it or change your investment so that’s how it started and I think with that first $1000 I think- and I actually kept a diary which I still have, I think that was back in the late nineties, around ’97 or so- and I chose Ashton Diamonds back then, which isn’t listed anymore but it was one of Australia’s larger diamond explorers and producers and I bought it I think it was 50 or 52 cents if I remember correctly and about six months later- I was tracking it on a day to day basis and getting very excited because it kind of ground up from about 50 cents to I think $2- and then it got taken by the by dubious diamonds at $2. So I was very, very excited as you would be as 12-year old that thinks that they’ve sort of made a few $1000 but then when I went to cash in and told dad I wanted to sell my Ashton diamonds investment, he broke the news to make that actually, it was just a hypothetical thing and he didn’t actually buy the shares for me in the first place. I was just so furious I was like I’m definitely going to learn this stock market thing and do it myself because I don’t trust dad.

Aussie Firebug: Well suppose he was trying to do the right thing that he didn’t want you to waste your money but that’s quite funny–

Stockspot Well, yeah I think he thought I’d pick some garbage that would go to zero and then it would actually be a nice thing to tell me I didn’t actually lose his money but it worked out the opposite where I was furious and then I basically said, ‘okay, that’s it, like I want to earn pocket money and then I want to invest it myself and I’m going to be sure that I actually do have my investments because like you know dad’s basically tricked me here.

Aussie Firebug: That’s a funny story. So your dad taught how the stock market works you were really just thinking you know that you could own a business that you deal with day to day, did that- and this was when you were 12 or 13 years old- so were you just really fascinated with trading and finance in general or was there another motive for earning that money or was it mainly just you interested in how it all worked?

Stockspot No, I think as a kid like it was like any other hobby so yeah, some people like computer games, some people like difference sports, I also played a lot of sport but whenever I had spare time at home you know between doing homework or on the weekends, I just loved researching companies and tried to understand– I mean really for me like the stock market is a bit of a game but also just a great challenge to kind of try and understand how companies are valued and how people kind of to determine the price of a share and like I think it’s a great sort of combination of you know somewhere where kind of a science meets a bit of art because there’s actually no kind of perfect way of doing it and so I think an [00:08:34] was very fascinated in learning how to beat this game and understand it to the point that yeah, you can grow your wealth and then earn money from it but also it was a challenge where when you make a good trade or make a good investment, you get this sort of feeling that is very difficult to describe, it’s kind of a feeling of satisfaction that you kind of solved a riddle almost.

Aussie Firebug: Yeah, great. So, you take that enthusiasm and the passion to learn into law school and I’ve already touched a bit on your qualifications, I did some LinkedIn stalking there, but when did you know that that’s what you wanted to do as a career?

Stockspot I think probably quite earlier on. So like you mentioned, I used to always enter those ASX games at school and then at university, there was a similar game that JP Morgan sponsored which I would always enter I think that was a great like training ground to kind of learn how markets work and it was a cheap way of getting experience because I think in any sort of- well especially when investing like losing money or not going well is the best way of actually learning- and so it helps when that money is like hypothetical. You probably learn more when it’s your own money but being able to like practice in those competitions was a great way of just honing in on your skills. Probably like anything else, you need to put those 10,000 hours into actually learning so I probably got out a section of those 10,000 hours done while I was in high school and more while I was at uni and then I was fortunate at uni when I won that JP Morgan game one year that I– the company that sponsored it as well as JP Morgan was a little hedge fund that ran out of Sydney and a hedge fund is basically a bunch former [00:10:22] traders that had set up this business to basically trade ASX listed stocks and commodities and currencies together and then seeing how I’d performed in the game and they thought it would be– I think it was partly philanthropic but they offered me to come in and do a bit of work with them and learn about trading and then eventually from there, they gave me like a small book to actually trade so they gave me some money to trade which is pretty exciting as that I was still at university at the time at and then it all kind of went from there.

Aussie Firebug: Yeah, great. And so you progressed through your career, now what was the moment that caused you to break the 9-5 ground and start your own business, what was the cause behind that?

Stockspot Sure yes, well following on then from that stress job I was again fortunate. I had applied for a lot of the graduate jobs that the investment banks offer in Australia and mainly because we’re at the top of the boom so this was the 2006/2007, all the banks were hiring a lot of people and I managed to get a job on the UBS trading desk which is probably quite uncommon for like a graduate because it was a big responsibility job and–

Aussie Firebug: Yeah, highly competitive market, isn’t it?

Stockspot Yeah, very competitive and typically something you need a lot of experience to get onto but I started as the junior on the desk where I was supporting a few of the other traders and them eventually grew my book to be trading a decent amount of capital but in working on the institutional side of the world, you kind of learn a lot that you don’t see on the retail side of the road when you’re just trading for yourself or you know what mom and dad taught investor and a lot of the things I saw working on that side kind of opened my eyes to how the industry actually works and a lot of those kind of quirks in the industry I thought were very unfair for retail investors and actually put people in a huge disadvantage to the industry–

Aussie Firebug: What were some of the things that you were seeing?

Stockspot Well, one of the things that really got to me with the industry and still does that is that in Australia, there’s this is huge equity mentality. People love owning shares in Australia which is a great thing but I think I’m historically- I know my parents’ generation, a lot of the older generation- had spent a lot of time trying to pick stocks because I think that’s the way to grow the money and certainly I believe there’s a few people out there that are able to pick stocks and do quite well but it’s very, very difficult and unless you’re doing it full time like I was doing in the hedge fund at UBS, then you are very unlikely to succeed over long term just because there are so many people doing it full time these days so it’s such a competitive industry that as a retail investor to beat the market, it’s very difficult as–

Aussie Firebug: And also you got those people that are doing it full time like you say but still don’t beat the market.

Stockspot Yeah, and that’s what’s become more and more evident over the last 20 years in developed markets like Australia and Europe and the US is that even professionals now on average underperform the market because it’s so competitive so something that hurt me is that the whole industry loves to tell investors ,whether it’s retail investors or anyone else, that the more active you are in shares or the more you do, the better chance you have of making profit so there’s a lot of trading programs out there that are trying to convince people to pay for subscriptions or the trading newsletters or your financial advisors but the whole industry is geared to making people think they need to do more when in reality, to actually succeed in the stock market it’s actually about doing less, just having the right sensible long term strategy and then not doing anything and I think it’s a bit counter intuitive because you know a lot about the areas of life, [00:14:14] and fitness is a good example, you know that if you’re lazy and you do nothing it’s actually bad so you actually need to be active to succeed whereas in investing, a lot of people are tempted to be trading a lot or making a lot of decisions but that actually harms them mainly because of the costs and because of that of the behavioral biases that people have so I always don’t like that the financial industry basically takes advantage of the fact that people aren’t that literate when it comes to investing and think that I need to do a lot which is great for the financial industry because the industry makes a lot of money off that through commissions, through advice but the reality is that people really shouldn’t be paying a lot of those cost because they’re not just necessary.

Aussie Firebug: It’s a great analogy use with fitness because I even invest in real estate but I’m leaning towards– I’m going to buy a few ATFs this month and going forward, the more and more that I educate myself, the more and more these are passive song of investing make sense to me but it is very– it sings backwards like you said because you think when I first started, I had to read– I must’ve read when I first found out about financial independence and it was a real thing and you could you know retire early and all that, I must have consumed about 20 books within the first month and a half, I just read everything I could get my hands on and I felt like if I wasn’t doing something, I was letting it slip away so I was trying to be active and I was trying to research everything I can but yeah, it’s a good analogy that you use with fitness; it’s like that. You know you’re not doing something–

Stockspot Yeah, you feel like you’re behind and I think that’s the issue, a lot of younger people who actually avoid investing in shares because they think ‘well because I don’t have time to do all the research, I’m going to lose, I’m not going to succeed so I might as well not do it at all which is really sad because the reality is that those sorts of people have probably an even better chance of succeeding than the people that are reading the news every day because the people that are just in there for the long term avoid all of that short term noise that causes those people that are in the newspaper every day to make the wrong decisions.

Aussie Firebug: Yeah, great. So, you start your career, it’s really impressive, you’re investing capital, the bank’s capital I believe, and you’re going through your career, you start to see these things are happening that don’t sit well with you, how long until you decide that you’re going to break away from the industry and start something else because it’s quite a leap, what you’re doing with Stockspot, did you see another product maybe overseas that was doing it better that you said there’s nothing like this in Australia and you can start one here or how did that come about?

Stockspot Bigger picture. So I used to trade the retail sector, that was one of the sectors I used to trade at UBS, and I saw in the few years that I was trading in that sector immense changes in how the different companies were operating and the new competition that was coming into the industry you know a lot of online retail was starting to emerge and so it’s very interesting to see how that sort of developed and consumers over time became more accepting of online retail and there were a lot of skeptics at the start saying, “no one will ever buy shoes online, like you have to try them on.” But what I saw is a lot of big businesses like DJs and [00:17:52] sticking their heads in the sand saying, “these things are never going to take off,” while businesses like [00:17:57] were having huge success acquiring a lot of especially younger customers who were prepared to purchase their retail items online if the price was right and the quality was right and they had trust in those companies. So I am translated that to the financial industry and thought ‘this industry that I work in, the reality is that it’s still kind of like the traditional retail industry where you know they’re old school instead of DJ’s where you go in someone helps you try on a pair of shoes and it’s historically great service although I think the service has probably been deteriorating in those retail stores but basically people come to expect a high level of service but it’s face to face service which is very expensive and as a result, you know in Australia if you go to DJ’s, you pay probably 40% more for issues than you would if you bought them online through Amazon and I think the same thing I was singing financial services: people spend a lot of money basically for face to face type advice and like high cost advice but the reality is that they can get better outcomes by doing the same sorts of things online and cutting out a lot of these people who can add a nice sort of service types but in reality not everyone wants that.

Aussie Firebug: Yeah, fantastic. Alright let’s get into Stockspot, the company that you’re the CEO of and the founder. So for those that don’t know, why don’t you just tell people a little bit about Stockspot and what you guys do?

Stockspot Sure, yes. So Stockspot was a business I started about 3 years ago now. It was a business I thought of while I was working in the investment industry and spent a lot of time thinking of how it would work but the idea is that we aim to make it very easy just for anyone in Australia to invest in a diversified portfolio that’s tailored to their own personal situation and the whole process is online which makes as convenient as possible for people and so they don’t need to worry about all of the hustles of investing that they’d have to do if they managed their own portfolio. So the business originally I set it up, had a founder and we’ve grown now to eight people over the last three years. It’s a very technologically focused business because something I saw that was missing in the traditional industry was that the typical experience of getting wealth management advice was really lacking a really nice user interface and a really nice experience for users so we’re very tech- focused. We try and make the experience quite seamless with people because a lot of our customers are professionals who don’t have time to manage their own investments and the aim is to really just give people the right advice about what they should be investing in and avoid a lot of the conflicts of interest in the industry that cause people to do the wrong thing and invest in our high cost funds or trade too often.

Aussie Firebug: Right. Now, I’ve actually had a go myself and I’ went through like the robo wizard and stuff like that but the people listening, so your company is basically offering in a nut shell: if you have some money that you want to invest, now I think there is a minimum that you guys take, is that right, is there minimum amount that you can invest with Stockspot with?

Stockspot Yeah, that’s right. So our minimum investment you can invest with us is $2000. We decided to make it as low as possible because it’s something again I saw with the industry is usually to say some sort of broker or a financial adviser, you need a lot of money to kind of make sense for them so most of those actually turn you away if you don’t have let’s say $100000 or some even higher so I basically saw a big opportunity where there are a lot of my friends like younger people who might’ve saved up $2000, $5000, $50000 and don’t know what to do with it and are deciding between maybe saving up to buy property in a few years’ time but they actually want to be able to keep up with rising property values so they can afford it when they get to that point and obviously with interest rates falling, it makes it very difficult to keep up–

Aussie Firebug: Yeah, good point. So it’s basically a minimum of $2000 so I went through the wizard and for people listening, it’s basically like you have some money that you want to invest in, you’re going to the site, you sign up, the robo investor advice will run you through like a wizard and it will get your risk tolerance, how long you want to invest for and a whole bunch of other things that put you into a certain asset class or one of the portfolios– I think you’ve got like four, is that right? Four or five?

Stockspot Yes the process is similar to that so basically people come to our website, answer a few questions about their personal circumstances and that’s things around when they’re going to need the cash, how long they’re looking to invest for, what their acceptance of risk is so how they’re likely to act if there’s volatility in the market–

Aussie Firebug: So typical things that you would find if you went to someone that was going to manage your wealth like face to face?

Stockspot Yeah, exactly and I think something that like I saw in industries, the industry really over complicates that side of things but the reality is that if you have a reasonable time horizon and you know don’t need cash in the next couple of years, then the best strategy for someone with $2000 is actually very similar to the best strategy for someone with $3000000 and that is just by a very broad, diversified mix of different assets including shares and bonds and what we do is make sure those assets are combined in a way that helps to reduce risk so you’re not exposed to like individual companies.

Aussie Firebug: Yeah, and let’s get into that a little bit. What exactly does Stockspot invest in? When we hand over the money, what are you guys doing with it?

Stockspot Well, what we do is we invest in a broad mix of different ETFs (Exchange Traded Funds) and what these are–

Aussie Firebug: And for people that don’t know– yes, so are you about to go into it for people that don’t know what those are exactly, do you just want to touch on that?

Stockspot Yeah sure, so exchange traded funds were a type of product that first emerged probably 20 or 30 years ago but really has only just started to be used in Australia over probably the last five years realistically. But they’re basically a financial product that you invest in through the stock exchange, they trade throughout the day just like any other share but instead of buying a share, you are basically buying a listed managed fund that owns lots of different shares or any other asset class. So you could buy an ETF that tracks Australian shares, you could buy an ETF that tracks American shares, you could buy an ETF that tracks metal like copper or gold or you could buy any ETF that tracks a different asset like bonds. And so the basic principle of the ETFs is they are like managed funds but whereas managed funds are unlisted, ETFs are listed and then they trade on stock markets and track a certain asset class.

Aussie Firebug: So you’re basically buying a slice of– if an ETF tracks the index for an entire country like Australia, you’re basically buying the Australian economy, is that what you’re doing?

Stockspot Yeah, you’re buying the Australian stock market essentially so you buying a piece of– we buy in our portfolios a part of the ASX 300 which is the 300 biggest companies in Australia and you buy a piece of all of them but instead of having to buy all the companies individually so going to buy some Commonwealth bank shares and BHP and [00:25:36] all the way down to 299, 300, you just do one trade and with that one trade, you get exposure to all of them.

Aussie Firebug: And you mix so that’s really powerful and you know on I’ve read beyond the research behind this as well and the general idea is it’s really risky of you buying one company. Companies have gone bankrupt before, it’s not out of the ordinary for a big company to go bankrupt but it’s pretty unlikely if you have ETFs in multiple countries that are covering multiple markets and precious metals and what not that for all those to collapse at the same time the world would pretty much have to be exploding or something like that so my understanding– sorry continue, you’re the expert, I’ll let you explain it better than I can.

Stockspot Yeah I think you’ve described it very well so the benefit of– and you’re basically describing the benefit of diversification which is something you learn in finance but the industry over-complicates it for the average person but you know in your sentence, diversification means that you don’t need to take any risk on any one particular company and you shouldn’t want to so when you invest in shares or in the stock market, there’s two types of risk: There’s what’s called systematic risk and non-systematic risk and systematic risk is just the risk of the stock market so the stock market goes up and down that’s a risk that when you buy shares, you can never really get rid of. You get compensated with a higher return if you’re taking that risk but that’s just the risk of investing in shares. The type of risk that you should be able to get rid of is, as you described, the individual company risk so the risk that you know a company in your portfolio might go bankrupt, will have a profit warning. If you’ve already invested in 2 or 3 shares, that’s going to have a really big impact on your returns whereas if you’ve invested in hundreds of thousands of different companies, if Apple has a profit downgrade for instance, if Apple is only 1% of your portfolio then it’s really not going to have enough impact to make a huge difference so I think the problem a lot of people have faced in Australia and is particular apparent in their financial crisis was Australians typically have very concentrated portfolios in a few shares so I know my parents’ generation typically that would have a few bank shares maybe some [00:27:58], Woolworths, West farmers and maybe some BHP but the problem with that sort of strategy is it’s not really diversified very well and so if there’s a problem with the banking sector for instance or material prices pull then it has actually very big impact on you portfolio and that’s a risk people shouldn’t take and shouldn’t need to take so our aim is to help people reduce that type of risk so you get exposure to the market without the risk of individual shares.

Aussie Firebug: Yeah, fantastic. And the different portfolios, as I understand it, match your risk tolerance bit as well as your time frame so if you tell the robo investor when your signing up for Stockspot, “you know I don’t care if I can’t withdraw my money in 10+ years that’s fine, then Stockspot might allocate you to a portfolio that’s a little bit more risky but with a return that might be a bit better than some like it’s more conservative, is that right?

Stockspot Yeah, that’s about right. So what we try and do is match people based on their answers to what we think is their optimal portfolio and to work out the optimal portfolio, there’s lots of different factors but one like you explained is your investment horizon and the general principle is the longer your investment horizon, the more exposure you can have to great assets like shares because short term volatility won’t impact your long term outcome as much whereas if you’re only planning to invest for two or three years, that short term noise or volatility in the market can have more impact because you don’t know if you know there might be a recession next year that causes your shares to fall but then if you need the money out next year, you’ve got a bigger chance of suffering a loss so generally when you’re investing, your ability to take risk- and it’s not necessarily risk-tolerance, I actually probably prefer to call it risk capacity- so it’s your ability to take risk is actually mainly dictated by a couple of things but one is your investment horizon, two is also your cash flow needs over that period as well so if you need cash in one year to buy property, then you probably shouldn’t be buying shares at all because over a year, there’s probably only like a 60% chance that shares are going to go up so you’re more or less flipping a coin if you’re investing over a short period of time.

Aussie Firebug: Yeah, a quick side note, because you were in the thick of it when the financial crisis hit, what was that like working at the bank when 2008 rolled around?

Stockspot I think it’s a pretty phenomenal time to start a career when the world’s basically exploding in your industry and coincidentally a lot of the people that are on my team them they started their careers in 1987 so they could share a few stories with me but yeah, I mean it was a huge change in terms of how the whole industry operated and I don’t think it’s really fully recovered. I mean as a graduate, it was exciting but very frightening because you know I’d just started my career and within a few weeks, they basically told me that that they were halving the size of my team from 14 to 7 people and that I was a 50-50 chance of being made redundant within basically at the start of my career. Fortunately, I think I was the lowest paid in that team and so that was a good reason to keep to do all the ground work so I think I was saved by that but yeah, I think it taught me a lot about risk and understanding risk but also understanding that you do you don’t always understand all the types of risk so it’s about accepting that you don’t understand risk in many cases and trying to protect against different types of scenarios that even the biggest, best experts in the world can’t predict.

Aussie Firebug: Okay, now moving back to Stockspot, how much does Stockspot charge for the service?

Stockspot So we charge essentially two fees: one is like an advise fee which we limit to people that invest more than $50000 a year and that’s $50 plus GST per year and that basically covers the cost of us providing financial advice to the people. So one of the differences between our product and just buying stocks on online brokers that we actually are providing what is considered personal financial advice to clients. So we have an obligation to always make sure that clients are invested in the right strategy for them and that involves us every year or whenever clients tell us that their circumstances have changed. I’m actually reviewing their strategy to make sure it’s appropriate so we charge a flat fee for that and we think that’s you know a pretty good fee considering if you see a financial adviser, you’re probably likely to pay thousands of dollars for just an upfront consultation and then seamlessly on an annual basis and then we also charge a management fee on the funds the clients invest which varies from about 0.5% per year to 0.8% per year. And then the only other costs that clients will pay but they don’t pay to us is the actual cost of the ETFs themselves. So ETFs, like managed funds, have what’s called like embedded management fee. The beauty of ETFs though is the management fee is much lower than buying a managed fund where there is a firm manager and a big team of analysts. Where on average you might pay probably 1-2% for a managed fund, ETFs on average would charge about a quarter of that so about a quarter of one percent.

Aussie Firebug: Yeah right, so just to recap and I’ve just crunched a few numbers just for the audience so if your balance is under $50000, it’s just the management fee, there is no advice fee, is that right?

Stockspot Yes, that’s right.

Aussie Firebug: Yeah and as just an example guys, if you’ve got a balance of $100000 with Stockspot, the advice fee is $55 so you’re going to pay that per year and then management fee is .055% per month so it’s not a lot, not a lot. We’re talking here– it actually works here to be $100000 is $55 a month so then that’s $660 a year. Does that sound right Chris?

Stockspot Yeah, it sounds about right and I think that the best point of comparison is probably- and where we compare ourselves to- is traditional managed funds platforms which as I was talking before about some of the things I don’t like about the industry managed fund platforms as a great example of a technology that’s now outdated and very expensive. If you’re going to invest in a product on a managed fund platform these days, you play a few layers of fees: you pay an adviser fee which will be something like 1% a year, you pay a platform fee which is probably another 0.5% a year and then you pay a fund fee on top of that which is usually about 1-1.5% a year so the all in cost of investing in a fund in Australia these days is is about 3% a year which is pretty ridiculous when you think that the average return your probably earning might only be somewhere between 6-10% a year so it’s a huge percentage of your returns that the financial industry is taking off you and we actually did a study which we repeat every year which is called that ‘fat cat funds report’ where we actually try and analyze exactly what percentage of their returns people are paying away and a couple of years ago when we did it, it was actually 45% percent of all returns that were made over a five year period were paid away in the fees.

Aussie Firebug: Unbelievable. Now, a common question that gets asked in the forums. Stockspot has been brought up on a few forums that are in here, a common question especially from my audience that might be a bit more financial savvy, I believe you can actually see which ETFs that you guys invest in each portfolio, is that right when you when you do that sign up or are they hidden?

Stockspot Yeah that’s right so again like one of our philosophies is to be very transparent with clients and so they know exactly what they’re getting and what they own and so we show exactly what we’re investing in.

Aussie Firebug: So the question is, and it always comes up, if you can say what you guys are investing, what is stopping someone from just going to the source [00:36:41] for example, and investing in the ETFs themselves and avoiding the fee that you guys charge? What’s the benefit of going through Stockspot for someone that might be thinking about that?

Stockspot I think that’s a great question and it’s one that our business gets as well as our sort of similar business overseas and I think an analogy to probably to give you it would be like saying you know, instead of getting a personal trainer, why wouldn’t I just go onto YouTube and find a personal training plan and do it myself and I think a lot of people you know would do that. The benefit of using a service like ours over doing it yourself is kind of there’s probably a few elements to it: first of all if you just, let’s say you use a [00:37:22] fund, the problem is that in order to work out which funds you want to use, you have to it continually research the whole universe to kind of workout what is the right funds to choose and as part of our process is we’re continually analyzing the whole universe of ETFs to work out which are the best ones to use. Secondly, the [00:37:47] is quite important so if you just statically buy some ETFs and leave them, the problem is that if your personal circumstances change your strategy should actually be changing, you’ll never know and I think that’s a trap a lot of people fall into is they’ll buy an investment if they’re managing it themselves and just leave it without really reviewing whether that strategy is still appropriate for them if their life circumstances change so that’s a you have a family or you decide that your time horizon is actually shorter because you want to buy a property, that will actually change the strategy that’s right for you but you probably won’t know it if you doing it yourself. And then I think that the last results say which is probably the most important is that people that invest for themselves, as much as they have good intentions at the start, the problem is most people actually don’t have the discipline to do it properly themselves and they fall into a lot of traps which mean that their actual returns will really undershoot what they could’ve earned if they just outsourced it to someone else. To give you some examples, the traps that people often fall into when the market falls, the people that are managing their own money they tend to panic and sell thinking that the market’s going to continue to fall but that’s usually not the right decision and equally when the market rises, that’s often when people are chasing the market and buying more when in reality that’s probably not the best time to be buying and so the benefit of an automated service is actually a lot of those human biases that everyone exhibits like even I know I exhibit it as a trade. We get to iron out and make sure that people aren’t harming themselves and there’s been some great studies actually. There was one in the US, I think it was run by a group called Dalberg which looked at the average rates how brokerage account so average sort of equivalent of a [00:39:40] or an A trade account in the US and the returns that the average investor would get in those accounts versus an average index fund or just investing on automated basis. And I think this study was five or ten years, they found that on average, people underperformed the market by about 7% a year and a lot of that under-performance was due to the behavioral biases of overtrading, of chasing markets when they’re going up, panicking when the markets go down so I think– I mean automation is beautiful in that it can actually help people avoid biases that will harm their returns.

Aussie Firebug: Totally and does Stockspot charge a brokerage fee every time you want to buy?

Stockspot No, I mean that’s a separate benefit as well if you’re going to be a disciplined person and actually top up your account on a regular basis especially if your balance is quite small, what you’ll face is paying a brokerage fee every time you trade. That’s a cost that we absorb and we include in just the management so we don’t charge clients extra if they want to top up $1000 a month or if they just want invest one large amount at the start, we charge the same.

Aussie Firebug: I think that’s the important thing to note as well because not only getting all the benefits that you mentioned, if you’re making 10-20 that’s going to add up and it comes to I think around $20 so it’s just one thing to be aware of if you sign up for this service that you can buy in as many times as you want, I actually think you can bill pay like you can set up a schedule [00:41:19] to do it just on autopilot if you want so I think it’s reasonably pricey for a balance of $100000, you’re looking at $715 including the $55 advice fee, not bad. $715 on limited trades with the advice fee is definitely a lot cheaper than any financial adviser I think you’ll ever find.

Stockspot I think a separate sort of thing that people need to consider whether investing themselves is ETFs particularly, they’re actually quite complex from a tax perspective. And so if you’re trying to prepare your own tax or you have an accountant preparing your tax, it actually takes quite a long time to do all the calculations because you basically need to get a tax sheet of the ETFs that you’ve invested in, compile all the different tax columns and then make sure that you’ve calculated your franking credits and all of those aspects directly. Part of the technology we’ve built is actually automating that process and so at the end of each tax year, we give everyone just a single statement that they can either give their accountant which will take them five minutes for them to add into your tax return or you can do it yourself–

Aussie Firebug: I’m sorry one thing to know because I own properties in this context here it’s a pain in the ass doing it all so that’s definitely a benefit.

Stockspot Yeah, that’s something I mean I’m sure with your properties you have to then factor that into your returns, the money you have to pay your account every year in actually managing the properties you own.

Aussie Firebug: Yeah exactly.

Chris some of the other companies overseas that I see a lot they have one of the one of the features of investing in the company’s– tax loss harvesting, is that something that Stockspot offer?

Stockspot Well first I can probably explain very quickly to your listeners what tax loss harvesting is, what it basically is is every day, they basically look at everyone’s portfolios in any ETF that they’ve invested in that is going down, they actually sell and buy another ETF that’s very similar. What that does is crystallize losses that then you can use on your tax return to reduce your income so it’s a way of basically continually crystallizing losses and [00:43:36] which is said to be a tax efficient strategy. Unfortunately, or for better or for worse in Australia, that’s actually not allowed. The ATO very specifically prohibits making any sort of investment decision to optimize your tax in that way so unfortunately it’s not a feature that we can offer.

Aussie Firebug: Damn ATO. [Chuckles] Another thing as well that some people might be a bit weary of, Stockspot sounds fantastic but it’s still a startup. What’s going to happen with my hard earned money if something were to happen to you guys and you guys go bust?

Stockspot Yeah, another great question and I think that’s one that all people have when you’re dealing with a new business but especially one that’s managing your money. We’ve set up a business in a way that makes it as safe as possible for people and the way that we’ve done that is when we invest for clients, they actually always own all of their cash and investments in their own name on their own individual HIN (Holder Identifier Number) at the registry so basically at that 6 registry which means that if anything ever happens to our business it wouldn’t actually so basically at the ASX registry which means that if anything ever happened to our business, it wouldn’t actually affect the client holdings at all and clients would be free to move their holdings to another broker and we basically have no ability to touch anyone’s investments a apart from the rebalancing and investing process that people allow us to do. There’s a few benefits of that: one is we actually allow people– if they do decide that they want to start to manage their investments themselves, we allow them to transfer their investments to a broker free of charge and that helps them avoid necessarily realizing capital gains or other tax implications but it also means that people can be confident that the money is always safely owned by them and we can’t ever touch it and regardless of whatever happens to our business.

Aussie Firebug: That’s fantastic. And you’ve actually answered my second question I had there which was if for whatever reason you didn’t want to use Stockspot anymore and you wanted to either do it yourself or go with another company, did you have to cash out there and start again and get hit with capital gains or what not or could you just transfer it like to another name which I think you’ve just answered.

Stockspot Yeah, and I think it’s a big problem with the industry as well and something I never liked is if you buy a lot of these managed funds on platforms, not only are you basically stuck in them forever because you don’t want to risk capital gain eve if their fees are high but a lot of them actually have a huge exit fees like a lot of them like a 4% exit fee if you leave within four years. Yeah, that’s something– it really hurt me because I think a good product should stand up on and its usually a sign of a bad product if you try and create friction to leave a product so something I’ve always focused on is making sure our product has zero friction to people leave because I think that really gives people confidence to try it because they know if I don’t like it, they’ll able to leave and it will be easy and cost-free to do that.

Aussie Firebug: yeah, sure. Now a lot of our audience will probably be in the early crowd but let’s say I don’t want to retire early, I love my career, why would I choose Stockspot over let’s say Super which has the tax benefit of investing in Super. Is there a reason that I would choose Stockspot over Super or do you just want to talk a bit about that?

Stockspot Yeah, I mean there’s a lot of considerations to that– that’s actually not a decision that we make. We only make the decision once people come to us and decide that they want to invest outside of Super but some of the things people would need to consider is obviously you mention the tax benefits of putting into Super so you have to weigh up that side of things and I would say you’re weighing that up against the ability to actually use our money earlier if you don’t invest in Super so obviously if you put your money in Super, and you make a contribution to Super above the 9.5% then the benefit is you get a tax benefit but their disadvantage is if you’re 20 or 30 or 40, you’re not going to be out to touch that money for decades basically.

Aussie Firebug: Only the government can change the rules whenever they want.

Stockspot That’s exactly right as we’ve seen over the last year so the problem is that you might think that’s great, you can get a big tax advantage but if you wanted to buy a house in 10 years and you thought you might need that money for that, you’re not going to be able to touch it to do that so the benefit of not investing in Super is that you do have more flexibility of when you use that money and what you use it for. And obviously, as you mentioned, the benefit of investing in Super is that tax benefit so it’s just something people have to weigh up and decide which one is more important.

Aussie Firebug: Good points, good points. Do you want to talk a bit about Stockspot themes? I’ve seen them on your website and they look interesting, do you just want to walk us through those?

Stockspot Yeah sure so what we found is actually a lot of the starter investors we had especially people that are in the finance industry or aren’t really paying too much attention are very happy just to have a very well-balanced long term portfolio but then we have a different subset of clients are a bit more experienced, probably more like your listeners who wanted to a bit more involvement in the investment process and we wanted to have a slightly different offering for that group of people because we realize they want to have a bit more say in how their money is invested but at the same time we didn’t want those people to have so much say that they could stuff up their investment strategy by taking too much risk and so the way that we balance those two out is actually by allowing people to add what we call themes to their portfolio and the basic concept is everyone gets the same basic ‘core portfolio’ which includes five different ETFs including Australian shares, Global shares, bonds, gold in emerging markets but then if people have a particular opinion about an asset class or an industry or a country they like, they can actually add it to their portfolio as a theme so to give you an example if you are sitting there and say, “look I want a diversified portfolio but I think technology stocks going to go well in the next year and the US has more technology stocks,” then you could add US shares as a theme to your portfolio or if you think Japanese stocks are going to go well over next year, you could add Japanese shares or if you’re worried about shares and you actually think you’d rather have a bit more in cash or in fixed interest, then that’s possible too. So it’s just a way for people to be able to tailor their portfolios a little more towards their views on the market while at the same time, we control the risks so people can be confident that they’re not taking too much risk.

Aussie Firebug: Cool, great. That sounds really interesting, and that’s only for people with a balance over $50000, it’s only available to them, is that right?

Stockspot Yeah, that’s right. So themes because we actually don’t add a huge percentage of your portfolio in the themes just to make sure you’re not taking too much risk. It really only makes sense if you’re investing more than $50000 otherwise it’s just such a tiny dollar amount in that theme. Yeah, at this stage we’ve only offered it for people that invest $50000 and more and we’ve had a pretty good take up especially from people that do want to have a bit more active involvement. You know we also offer things like socially responsible shares so people that have a certain set of philosophy around socially responsible shares are often choosing that as a theme to add into their portfolio.

Aussie Firebug: Sure, cool. Can you invest under a trust in Stockspot?

Stockspot Yes, you can. So the four different ways you can invest in Stockspot or as an individual which is the majority of our customers, we also allow people to sign up as a joint account so you know yourself– usually yourself and a partner, someone that you’re either married to or some sort of partner. We also have the ability for trusts to sign up so we’re usually saying like family trusts and discretionary trusts usually because people have set up trusts for tax reasons or other strategic reasons and then the fourth way that people can invest is if they manage their own Super so in self-managed Super funds.

Aussie Firebug: Okay cool, just wrapping up, what’s the ultimate goal for Stockspot? Where do you see Stockspot in ten years?

Stockspot Well I think there’s going to be a huge amount of change in wealth management and especially wealth management technology over the next 5-10 years and so I mean the way that we’re trying to position the businesses is to be that the leader in that area in Australia and really to offer the best choice of investment strategies for people that are looking to get an investment portfolio. So I think our product will probably continue to evolve as we learn more from our clients and what they need. I think other areas of wealth management roles that are going to be interesting for us like potentially in the future, we see a lot of our customers looking to buy a house with the money that they’ve saved up with us so we’d love to be able to help them access the best mortgage possible and I think that area will probably change quite a lot over the next five years so over a long period, I think we’ll be looking at all the areas of your personal finance where we can help people but over the short term, we’re really just focused on creating the best investment product.

Aussie Firebug: Fantastic. Entrepreneurship, it’s one of the fastest ways to reach financial independence. It’s so impressive what you’re doing with the company in such a short amount of time. If you could give one bit of advice to someone that’s looking to go into that entrepreneurship path, what would it be?

Stockspot I’d probably say that entrepreneurship is rather than the fastest way to grow [00:53:33] and the slowest and most grinding way [00:53:35] and I think you probably hear people say on TV that the very few fortunate people that manage to make a lot of money very quickly in entrepreneurship but the reality is that they are the rare cases and most people that have built business, all the ones I’ve met, before they’ve become well known or media faces, they’ve actually worked very hard in the background for many, many years so I think like for me like the type of person I think that you would enjoy entrepreneurship is the sort of people that enjoy chaos I guess and not having like a structure to their day. You know if you’re the sort of person that likes to come in and have your list of things to do and then leave, entrepreneurship is probably not the right thing for you because like what we’ve seen in our business and probably similar trading as well as every day is different and every day you have different challenges that are thrown up and it’s all about being able to respond to those different challenges but that said, if like I love it, like for me that’s the sort of job I’ve always wanted to do, something where you get to do build something and then say, “hey look at look at this awesome thing that I’ve built and it’s helping people with a part of their lives” so for people that actually want to make a difference and bring something to the community and bring something to the world like bring a little baby to life basically and then I think entrepreneurship are a great way to do it.

Aussie Firebug: Fantastic and would you say because you had a and successful career before you had the start-up, would that be something that you’d accredit to your success to have a solid foundation before you make that leap into a business or a company?

Stockspot I think from the people I’ve met like other entrepreneurs, we work in a co-working space here in Sydney called labs where there’s about 70 different companies and I would say it’s probably a commonality a lot of the founders actually do originally have some sort of corporate experience and I think corporate experience teaches you about the importance of structure which is still important in a start-up so it’s not all just chaos, it’s about setting up the right structure but also allowing enough flexibility to be creative and actually build cool stuff so I think like what corporate world taught me was I think corporate world where I came from was way too focused on the structure which really stopped creativity and stopped really cool products being built and so what you learn is where you think that line should be drawn or where that balance is about. And without actually having like some sort of corporate background, I think people often in entrepreneurship lack the ability to set up the right frameworks and the right structures.

Aussie Firebug: Great. It’s an incredible company that you and your team are building, Chris. I just want to thank you so much for being on the show. Stockspot sounds like an amazing company and if you’re looking for a hassle-free investing be sure to check them out at www.stockspot.com.au. I’ll put a link in the show notes. If you enjoyed this podcast and want me to make more, make sure you drop me a comment and rating on iTunes. It’s hard for me to keep making these shows without knowing what you guys want to listen to so make sure you provide that feedback so I can keep giving you what you want. Just search for Aussie Firebug on iTunes and you will find me. I’m also on Sound Cloud www.soundcloud.com/aussie-firebug. A transcript and show notes of this episode can be found on my website at www.aussiefirebug.com. Again, thanks for your time, Chris.

Stockspot Thanks for having me on the show.

Aussie Firebug: See you.

Download a reader friendly PDF version of the Transcript

by Aussie Firebug | May 22, 2016 | Podcast

Subscribe on Itunes Subscribe on SoundCloud

Subscribe on SoundCloud

Summary

Our guest today bought his first shares of News Corp at 12 years of age. Realising later in life that money through investing and business ventures would be his escape from conservative country living in rural NSW.

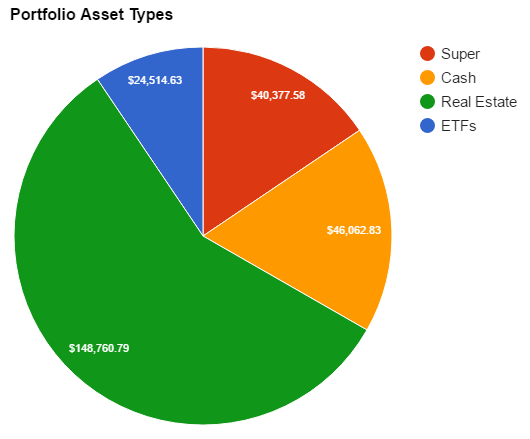

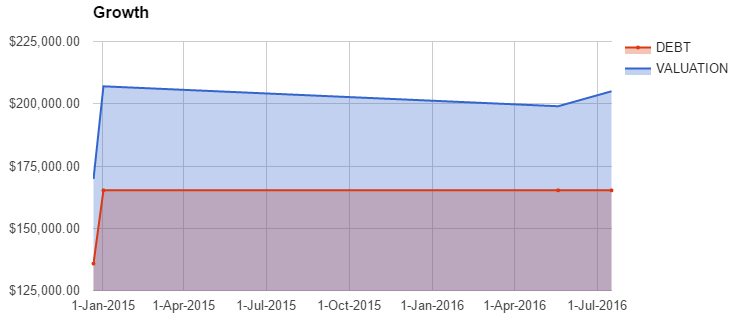

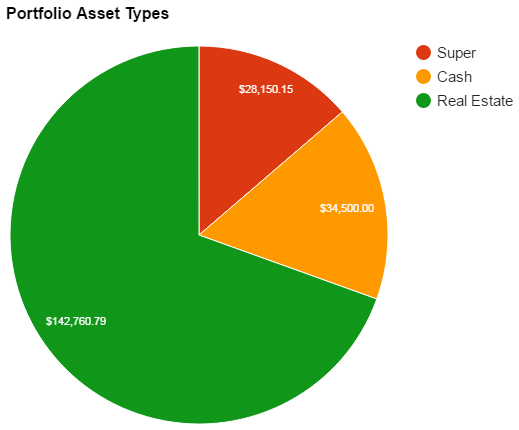

Investment properties in Australia and the US along with his own company are propelling Detrimental12 to reach financial independence in his early 30’s! With a net worth of over $800K he is well on his way.

Show Notes

Transcript:

Aussie Firebug: Hey guys welcome to another episode of the Aussie Firebug podcast the financial independent podcasts for Australians where I interview people that have already reached financial independence or are on their way. Now today’s guest is slightly different because it’s a guy that I haven’t done too much research on yea, his name is Detrimental but he goes by detrimental on the foreign boards. First of all I would just like to say welcome Detrimental and thank you so much for being on this podcast.

Detrimental: you’re very welcome, great to be here.

Aussie Firebug: now I guess we’ll start with, for the listeners that don’t really know your story and that’s me included really because I would try to go to a couple of your older posts

Detrimental: you tried to stalk me

Aussie Firebug: Laughing that’s exactly what I did I tried to stalk you just to see if I could get some good questions but why don’t you just take us back to the very beginning of your journey and how you got to where you are today.

Detrimental: yeah sure well interestingly I started on the path to financial independence long before I knew what the term was, so I was probably about 12 or 13 I grew up in a small country town in country New South Wales, yes I was probably about 12 or 13 when I wasn’t very happy i was quite depressed growing up and I knew I needed an escape and I knew the kind of money that would be my escape. so, from a very young age I was very interested in saving money, investing just trying to sort of escape from that……..unclear audio…

Aussie Firebug: did that come from influences in the family; was that a result of your surroundings at the time?

Detrimental: I was in a small rural town and it was just hard for me in high school and I just wanted to sort of get out. So I started for me when I was about 12 or 13. My parents had their own business; they had a small take away shop. I’ve had several uncles owning all sorts of business and investing in all of that as well. so I guess that’s where is all started for me I knew I knew that I wanted to just work and I didn’t know what financial independence was I just knew that I needed to get out and that’s where it kinda started for me, where it really picked up and where I really started researching financial independence was when I started a full-time job which was really just an office job strait out of university so I ended up moving to Canberra and my first office job straight out of University I was just incredibly depressed that first week I just kind of thought well this is my life now you know I’m stuck in this office job, what for the next you know 40 to 50 years and I just knew that I had to get out and that was when I really started focusing on getting out of the rat race.

Aussie Firebug: okay now so let’s rewind a little bit so, you are at high school and? You’re in this small country town and your escape that you are sort of think of is I need money to get out of this country town. So I guess your first idea was not so much because you didn’t really know what financial independence was right?

Detrimental: yeah that’s right.

Aussie Firebug: at that stage yes, so you just knew you needed money to live a better life which was outside this country town which you were not too happy in of course, and then you graduate, what year did you graduate in?

Detrimental: so, I graduate in I think it was around 2005 or 2006 am 27 now, yea 2005 to 2006 and the reason I guess is not because I was bullied in high school it was just because I was gay in a small country town

Aussie Firebug: all right

Detrimental: and from quite a religious family so that’s why I wanted to get out, yes I graduated in about 2005 to 2006 and my way of getting out was actually to go to University.

Aussie Firebug: was that in Canberra?

Detrimental: that was in Canberra yes.

Aussie Firebug: oh, cool and what was that experience like, because depend on what your definition of small country town is but I definitely ……..country town but I know that would be tough man definitely like I could definitely understand how that could be rough, so you go to University in Canberra and what was that like?

Detrimental: yeah it’s great like just what I expected and you know it was a great time and I don’t use my university degree now but I definitely don’t regret going

Aussie Firebug: yeah

Detrimental: yes so it was good, it is good and I am still in Canberra at the moment so after University like I said I got this office job and it wasn’t for me, I just could not see myself working in an office for Forty –to e 50 years regardless of what I was doing so I ended up moving into the hospitality industry or back into the hospitality industry

Aussie Firebug: yeah

Detrimental: so I ended up moving back into the hospitality industry, the physical side of hospitality as well as sort of the management side of hospitality

Aussie Firebug: yes.

Detrimental: and I definitely preferred that than working in an office but it really helped me to focus on achieving financial independence early in life.

Aussie Firebug: yeah, so if you graduated in 2005 depending on how long your university course was it made you started full-time work, what? 2010 2009 or something like that?

Detrimental: no because it took me a little longer than usual I think I started 2010

Aussie Firebug:

2010 okay cool.

Detrimental: full-time work so it’s been five years now

Aussie Firebug: yeah and so were you saving, did you have like part-time jobs leading up to this point?

Detrimental: yeah absolutely I was a very unusual child, so I bought my first lot of shares when I was 12 years old.

Aussie Firebug: yeah right, what did you buy?

Detrimental: I bought news Corp. News Corporation when they were listed in Australia, no idea why my dad read the paper and subscribe so I thought that’s a good investment I would buy news Corp.

Aussie Firebug: that’s funny so 12 years old spend his money on shares

Detrimental: absolutely

Aussie Firebug: any influence from your parents at all?

Detrimental: no no

Aussie Firebug: so you just always had that mindset, you were just always a good saver and you wanted to just grow your money and at this stage were you still thinking at this stage even as well that you needed money to get out and was that sort of another push to by those shares or was it just a fun thing with you just wanting to dip your toes in?

Detrimental: it definitely wasn’t a fun thing I mean it turned out to be fun but it was a more I need money how do I make money let’s see if I we can make some money and I am going to become rich from the share markets.

Aussie Firebug: ok, cool

Detrimental: in truth I have probably lost more money than I made in the share market because I don’t know what I’m doing but that’s how it started when I was 12 moving to Canberra when I was at Uni I actually had about four or five different jobs I was working nonstop it actually help me get through University. I completely paid off my x debt.

Aussie Firebug: nice

It helped pay for my life and…………….. savings and I went traveling every year

Aussie Firebug: cool

Detrimental: so I’ve always been, some of my friends say I work too much.

Aussie Firebug: yeah right, so you’ve always been good with money?

Detrimental: yeah, yeah

Aussie Firebug: right so I can definitely relate to that brutal first week of work in an office, I have been working in an office for 4 ½ years and that first week probably even that first year is pretty brutal. I spoke about this on the other podcast you always you know sort of the hours you meant to be working full-time but it’s not until you start doing it and waking up and going to work and coming back and getting into the routine that you realize how much time you actually spent at work and away from the people that you love so I can definitely relate to that.

Detrimental: yeah absolutely

Aussie Firebug: so, yes you do the first week at work you realize is not for you, if you don’t mind me asking so we are talking 2010 at this stage?

Detrimental: 2010 that’s right.

Aussie Firebug: 2010 what’s your net worth? At 2010 if you don’t mind my asking?

Detrimental:

No no no, it’s no problem at all just off the top of my head it would be very hard to tell you but I would say it would be probably a good saving probably about 20 or $30,000.

Aussie Firebug: where?

Detrimental: it’s a pretty decent amount considering I have……………… for Uni

Aussie Firebug:

Absolutely

Detrimental: I just paid off my hex debt so 2010 my net worth was about 20 or $30,000 and I was just gearing up to buy my first house as well around that time

Aussie Firebug: great okay. Tell us about that

Detrimental: My parents were into property renovation and remember while I was growing I use to go to auctions with my dad buying houses renovating them and renting them out.

Aussie Firebug: right so he was a real estate investor?

Detrimental: he was a real estate investor? Definitely not on Sydney and Melbourne level you know this was this was a small country town don’t forget.

Aussie Firebug: sure

Detrimental: but it’s just weekends I spent at auctions with my dad he was a real estate investor along with his own business and it is always ingrained to me as a child as I think it was many Australians to buy a house, you must buy a house or if you’re going to buy a house save for a deposit buy a house so it was just always ingrained into me that I needed to buy a house.

Aussie Firebug: the great Australian dream

Detrimental: yeah absolutely so, not many weeks ago, by the way my dad would not send me links to these houses available for sale in ………. That he thought were good so.

Aussie Firebug: sort of drilled into you at a young age buy yourself a house, set yourself up for life you know as I’m sure my parents would definitely said that as well and I’m sure a lot of people listening would have the same view it’s definitely an Australian thing I’m sure that other countries do it as well but buy a house set yourself up for life you know

Detrimental: yeah

Aussie Firebug: so Australian so I have continued

Detrimental: It’s an Australian dream and I think that is one reason that helps to prop up the property market so you have all these economist and everyone saying that the property is overvalued and there’s a bubble and all of that they do actually and while I think there’s is a bubble they do actually failed to take into account that there is that Australian dream to own your own property and everyone wants to get into the property market.

Aussie Firebug: definitely, that’s going to be one of my questions to you so……….. laughing

Detrimental: sorry

Aussie Firebug: we will definitely get to that in a minute but I just wanted to stick with your journey so that’s an incredible net worth I have to say straight off the bat first of all to be in the positive to begin with. Once you are straight out of University not many people can say that they were positive straight out of University so credit to you.

Detrimental: thank you.

Aussie Firebug: so talk us where you went from there

Detrimental: so I was a bit unhappy being in this office job, from there I went to one of my previous employer when I was working casually during Uni it was a hospitality job as I said they were actually looking for a manager, function manager to take over catering operation in their business

Aussie Firebug: Yep

Detrimental: I sort of approached them and funny thing it was actually slightly less money than what I was making at the office, so I actually went backwards a little bit and I approach them for a job and I ended up getting the job there with them so I was doing hospitality management I guess you could say

Aussie Firebug: Yep

Detrimental: and I was in that role for about four years in that time I again worked a lot, saved a lot I got I guess promotions you could say because I was doing a great job still working a lot of overtime so I was in that job for four years and then from there I actually went into business with my former employers and open up my own café and catering business with them. so that’s what I’m doing at the moment and that was two years ago.

Aussie Firebug:

Right and you are still working in that?

Detrimental: yeah that’s right so I’m actually managing that business as well.

Aussie Firebug: cool man so that brings us up to today. Now I know because I have thought of it… Laughing has read other comments, so your 27 you say?

Detrimental: that’s right

Aussie Firebug:

And you are on track to be financially independent at 30 is that right?

Detrimental: I am on track yes to be financially independent at 30 but I did set my goals at 32

Aussie Firebug: 32?

Detrimental: so I’m still on track within three years to be financially independent

Aussie Firebug: well now that is incredible, talk us through to your investment. So obviously in 2010 your network is 30 grand then you started this job at this catering company?

Detrimental: yeah

Aussie Firebug: talk us to what you buy from then on and how you got to this point now and what is your net worth at the moment and how did you get to that point?

Detrimental: okay so as I said back in 2010 I bought my first property in a small country town

Aussie Firebug: New South Wales?

Detrimental: yeah that’s right that was my first investment

Aussie Firebug: Yep

Detrimental:

From then I had always been buying and selling shares but as I said have probably lost more money than I’ve made you know I just thought of it i love for buying shares basically.

Aussie Firebug: so you pick shares right, like you do the research on the company and you try to pick individual shares?

Detrimental: yeah my research probably involves about five minutes of reading about it online and then buying a company. But I have changed now to ETX………….. [14:42.9] but Conversation

Aussie Firebug: so you do like a conversation, yeah sure sure

Detrimental: then I did something really interesting and I actually bought a property in the United States

Aussie Firebug: wow cool.

Detrimental: So I ended up studying the United States market for about six months and I really did my research. my first holiday from my full-time job, my very first holiday most people would take it off and go traveling I actually travel to the United States in order to set of my United States company and a Bank account.

Aussie Firebug: wow!

Detrimental: in order to purchase a property over there because as you know there was a massive property crash

Aussie Firebug: yeah

Detrimental:

And you could pick up a good property at a very good price

Aussie Firebug: definitely

Detrimental: and back in 2010 the Australian dollar was actually buying $1.09 US so any money that you transferred over you got basically 9% extra to spend.

Aussie Firebug: yeah and I remember because, sorry to interrupt you, I was on holiday at the end of 2012 in America and I remember going there and I’m thinking man this is such a good opportunity I just didn’t have the capital at that stage in my life to really do anything but I remember thinking like so many people can clean up here the dollars is over party it was like a dollar $1.03 when we went and I remember looking, because I was always interested in real-estate myself and I remember looking at a few houses in California and basically everywhere we went and I’m thinking oh my God! You know it’s basically a dollar for dollar at the moment and check out these houses it’s like a $130,000 it’s like a mansion

Detrimental: yea

Aussie Firebug: it’s oh my god

Detrimental: it’s crazy

Aussie Firebug: yea that is one of my biggest sorts of regret but I just didn’t have the money, like I didn’t have the money saved.

Detrimental: and I mean you can’t I mean there’s opportunity all the time it’s not, people say you’re so lucky no I wasn’t lucky I actually studied for six months

Aussie Firebug: yeah definitely

Detrimental: opportunity happens all the time

Aussie Firebug: Yep absolutely

Detrimental: so buying the that US property, I still actually own it at the moment it have not increase in value that much, it has increased in value a little bit but as you know Australian dollar is now $.75 so on the currency exchange alone it has increased by 30%

Aussie Firebug: wow!

Detrimental: it hasn’t been without its struggle is definitely a lot of work

Aussie Firebug: yeah

Detrimental: sort of………. [17:15.6] International property

Aussie Firebug: yeah so what does that involved I wouldn’t even know because I’ve got half sided ………. [17:22.8] Company entrusts in Australia before but I wouldn’t have the slightest idea how to purchase a property in America, can you just walk us through that a little bit, did you have an agent over there?

Detrimental: yeah okay so I studied up a lot I read a lot online. Actually I wrote a small blog about it it’s probably still out there I could probably find it for you

Aussie Firebug: yeah I’ll put it in the show [17:42.3]

Detrimental: yea no problem I will find it for you on how to buy a US property and basically you have to go to America first of all, you need to set up a Bank account in the United States

Aussie Firebug: in person?

Detrimental: you can only do that when you’re physically there, yea something to do about some new legislation that they introduce post-9/11 you physically need to be there to open a Bank account

Aussie Firebug: that’s a good excuse

Detrimental: absolutely yeah

Aussie Firebug: I think you could probably claim it on tax, can you as a business expense?

Into

Detrimental: well you can claim it against the income from the property.

Aussie Firebug: ok, yeah cool.

Detrimental: as an expense of property maintenance.

Aussie Firebug: yeah

Detrimental: and then you need to find yourself an attorney, so an attorney over in the US is what we call a solicitor

Aussie Firebug: yeah

Detrimental: you need to set up a company over there so you need to find an accountant

Aussie Firebug: so how come you need to set up a company?

Detrimental: you don’t need to set up a company you can purchase it in your own name it’s just a lot easier, yea the accountant explained it better that’s how most of them do it over there.

Aussie Firebug: okay sure sure.

Detrimental: they set up a limited liability company to buy properties and things like that and then I actually found what’s called a turnkey agency.

Aussie Firebug: I’ve heard about these yeah

.

Detrimental: so it’s an agency in the US that buys…. and they sprung up a lot during the financial crisis in the property bubble, they by old properties …. Renovations, foreclosures all of that, they actually renovate it themselves and then they turn key it and sell it on to an investor

Aussie Firebug: right

Detrimental: so that’s how I bought the property. What that meant was I got the property that was already renovated so I did not have to worry about that. In a good location I just had to pay slightly more than market value for it because obviously they need to make money

Aussie Firebug: sure

Detrimental: and I didn’t have time to search for properties you know search for painters and carpet people and people to renovate for me. I could just buy a property that was already renovated and then rent it out from there. So it was a lot of work but it was definitely worth it

Aussie Firebug: did you get a loan from an Australian Bank or in an American Bank?

Detrimental: I got a loan in an American Bank.

Aussie Firebug: what’s the deposit on that, how much did they make you pay?

Detrimental: So it was a bit different so I had to pay for the property value in its entirety $60,000 dollars

Aussie Firebug: the whole property 60 grand laughing, laughing

Detrimental: yeah, I had to borrow about $15,000 which I did from my parents, I know not everyone has the same opportunity as me to borrow that money from my parents, they are definitely not wealthy at all they are middle-class people but they allowed me borrow that money and I have completely paid them back. So I had to buy the property as a whole first and then go to the Bank and get a loan and I actually got a loan for 60% of the property’s value.

Aussie Firebug: sorry to interrupt. So you have the purchase the property completely so you have to put down a 60 grand is that what you’re saying?

Detrimental: that’s right there may be ways to get a loan I just did not go down that path because I thought it might have been a big struggle.