Podcast – Mrs Firebug

Summary

A big part of the journey towards financial independence is finding a partner along the way who has the same goals and aspirations as you do towards your finances.

It’s more common to find a partner who has no idea that financial independence even exists!

I invited Mrs Firebug on the podcast today to chat about what it’s like on the other side of the relationship and dealing with someone who is obsessed with reaching financial independence.

Show Notes

Transcript:

Aussie Firebug: Hi guys welcome to another episode of the Aussie Firebug podcast, the financial independence podcast for Australians where the clever people who have already reached or on their way to financial independence. Today’s guest is an attractive schoolteacher who learnt the value of the dollar at her first job at Domino’s wobble boarding on the highway for five dollars an hour. Christina’s interests are cats, Netflix and anything U.S related but most importantly and the reason she’s on the show Chrissie is the better half of the Firebug couple. Welcome to the podcast Mrs. Firebug.

Mrs. Firebug: Thank you. I like the introduction.

Aussie Firebug: What? Did I get anything wrong?

Mrs. Firebug: No. It’s pretty good actually.

Aussie Firebug: The Domino’s wobble boarding is quite a funny story. Do you just want to like quickly go the background behind that?

Mrs. Firebug: Sure. So basically, I think you know it, and there was an ad in the paper for a new Pizza shop opening up. So me and my friends we went to the job and all of us got it. It didn’t say that we had to wobble board on the side of the highway and so I didn’t really know about that and then…

Aussie Firebug: So we’re talking wobble boarding is, it’s literally like we’re talking someone holding the sign, you know, like two pizzas for, ten bucks mobile boarding like.

Mrs. Firebug: Shaking.

Aussie Firebug: Shaking a board on the highway.

Mrs. Firebug: Yeah. So I had to basically do that and then one day, I think my friend was doing it and a car like got distracted might crash up the back of like another car. So they cut it. So yeah it was pretty happy when that happened.

Aussie Firebug: Because you were water boarding really and they’d get distracted, yeah? So why don’t you just tell the audience a little bit, a little bit about yourself. Just anything that you want you want to mention.

Mrs. Firebug: Netflix is correct. I love to just hang out. I’m a teacher so like by the end of the day I’m pretty much like no one talk to me anymore. Poor Matt has to go silent for a couple of hours.

Aussie Firebug: just silent mode.

Mrs. Firebug: I know. I’m just simply close to my family. I like to go to the movies and shopping, such kind of stuff.

Aussie Firebug: Just a normal country girl.

Mrs. Firebug: Country girl. Chilled life.

Aussie Firebug: So we’ll get into the proper questions now. So when did you first notice I was a bit weird about money. Well, first of all let’s just say so we’ve been together for what five and half years now?

Mrs. Firebug: Six and a half.

Aussie Firebug: Edit that out, six and a half years. Time flies when you’re having fun. So we’ve together for a while now and anyone else that’s in the fire realm, for me anyway, at the very start you sort of, you know, don’t hide it. It’s like you do things that you probably stop doing six months into it. So when did you first notice that this guy is a bit of a weirdo?

Mrs. Firebug: Probably on our first date.

Aussie Firebug: Oh no.

Mrs. Firebug: You set yourself up the big plan.

Aussie Firebug: I did set myself up, I’ve never lived this story down.

Mrs. Firebug: So after a few disco passes, Matt decided to ask me out on a date. So I get a message saying do you want to go bowling and I was thinking I hate bowling but I feel bad so alright let’s do it. So he picked me up in his… What was it called?

Aussie Firebug: 1995 ford falcon.

Mrs. Firebug: Wagon, family car and off we went to bowling. We got there and I had not been like on an actual proper date before I was only 18. So I was a bit of a newb.

Aussie Firebug: She’s 18 and she’s never been on a date thought she had leprosy or something. I was like what how’d she not have a boyfriend before.

Mrs. Firebug: I’m just quiet girl, anyway so we got to the bowling and we’re standing there and getting our shoes and what not and the lady says the price and I was it off better offer to pay you know. I get out my twenty dollars. I was like oh yeah here you go and Matt goes thank you takes it and pays for it. So I ended up paying for our bowling date.

Aussie Firebug: You didn’t pay for it, you paid half.

Mrs. Firebug: Yeah half but still it’s pretty embarrassing for you.

Aussie Firebug: Alright. Yeah.

Mrs. Firebug: So since then I remember like going home being like, ‘I had to pay’ and my sister was horrified. That was definitely the first indication but I don’t know just little things.

Aussie Firebug: I’ve never lived that down as well.

Mrs. Firebug: Yeah, I mean that’s being…

Aussie Firebug: Like that has been the story that gets told every single time our anniversary’s brought up or you know something. With me being a tight-ass, I definitely dropped the ball. So everyone’s listening like you hundred percent should pay for the first date even if she offers you one hundred percent pay, I stuffed up. I’ve been paying for a lot of things since then I can never, that’s like you can never repair that one.

Mrs. Firebug: Yeah, you can’t redo that.

Aussie Firebug: It doesn’t matter if you’re on the fire journey or not, you pay for the first date. You only pay for the first couple dates. That’s definitely my stuff up. But other than that was there like…

Mrs. Firebug: I feel like everyone wasn’t like tight ass back then so I don’t think it was so much that you were really over the top with it or anything like that. Not that I notice more probably when you got your full-time job.

Aussie Firebug: What happened when I got my full-time job?

Mrs. Firebug: Things started to… We didn’t go out as much anymore.

Aussie Firebug: I hadn’t really discovered fire for like the first year of my working full time. So I saved heaps of money that year.

Mrs. Firebug: Oh yeah maybe that first year.

Aussie Firebug: Compared to how much we spend out but…

Mrs. Firebug: Yeah but like definitely. We did go out together for a while then too we didn’t go out as much anymore and go to dinner and dates and stuff, but we had our own money. So I don’t know it didn’t really affect me per say that much.

Aussie Firebug: So when did you first hear about the whole financial independence concept? It would have been from me.

Mrs. Firebug: Oh 100%.

Aussie Firebug: Like can you remember how long?

Mrs. Firebug: How long? I don’t know, since you started reading all those books I guess which one was that probably like three years ago.

Aussie Firebug: Yeah three and a half years ago

Mrs. Firebug: Probably like you read like heaps and heaps of books. I remember being right into it. That’s when i first heard about it. Initial thoughts were great let’s do this. I don’t want to work for long.

Aussie Firebug: Did you have any doubts because I thought that you had doubts and I’m always telling you about this epic thing that people were doing, you know, all over the world I thought like she doesn’t really believe it 100% or…

Mrs. Firebug: Yeah. I think it was more than like you were so into it and I was just kind of, oh yeah sounds good.

Aussie Firebug: Yeah, you like the not working bit.

Mrs. Firebug: Yeah. That really got me good and I think that just because I hadn’t heard about like all my friends and family like worked right up until retirement age, like my parents are still working. So I just hadn’t heard of it before so I think I was like, oh surely it can’t be that good if no one else is doing it. But now that we’ve kind of dealt further into it I know a lot more and I’m all about it.

Aussie Firebug: And was there a moment where you actually felt like this is a real thing, like we could get there?

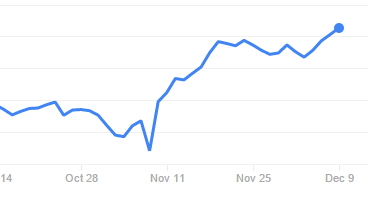

Mrs. Firebug: Probably not a specific like moment but just the further you kind of got into it and with your investing in your properties and then going into like the shares and stuff and I started to think, this surely is going to eventually work out for us.

Aussie Firebug: What’s been the hardest thing to adjust to once you we were trying to get to financial independence?

Mrs. Firebug: Probably just like having to make those sacrifices. Obviously, we wanted to travel overseas into a big Europe trip. So probably having to like wait for that because it’s been I think we originally wanted to do it like

Aussie Firebug: No.

Mrs. Firebug: Not that one?

Aussie Firebug: Last year

Mrs. Firebug: America

Aussie Firebug: Yeah? You?

Mrs. Firebug: Know that’s when we first wanted to do it.

Aussie Firebug: What?

Mrs. Firebug: Like that’s when we had the idea and like knowing back in like 2013 or something that it was going to be three or four years away with hard work and having to be like patient about it and that’s why I kind of did my own little trip to kind of tide me over.

Aussie Firebug: So we still want to do a Europe trip. So Europe trip is on the cards. Like a big Europe trip but we had it planned originally for 2016 but I sort of…

Mrs. Firebug: You pushed it back?

Aussie Firebug: I pushed it back at 2014. In 2014 I was in a really good job relatively speaking and I didn’t want to leave it in two years because I thought and I’ve just discovered this whole financial independence and I was like, oh my god, like the 20 in your 20s you have to earn like the 20s is the golden time to get ahead in life. I was still live in a home back then I was like we need to save you know as much money as we can because if we don’t save in our 20s and 30s it’s so much harder and at that’s the time of your life. So I was like look, and I remember breaking it to you like it was a big thing.

Mrs. Firebug: Yeah.

Aussie Firebug: I don’t want to quit my job in 2000 and, I think it was 2016. I think we were planning for three years.

Mrs. Firebug: Yeah.

Aussie Firebug: And you got really upset because?

Mrs. Firebug: Yeah I was. I didn’t like my job.

Aussie Firebug: Yeah. Chrisy was first year teaching and she had a rough first year.

Mrs. Firebug: Yeah. So I think that was her escape. She knew that she had to get to that.

Aussie Firebug: I only have to get two more years of teaching and then we could go on a Europe trip, but then I broke the bomb that was that we were not going to the Euro trip anymore. We’re pushing it back and you got really upset. But you kept America.

Mrs. Firebug: Yeah then I did get America for myself but yeah I guess. What was the question?

Aussie Firebug: Yeah it was the hardest thing and you said sacrifice.

Mrs. Firebug: Yeah. I did say sacrifice. Waiting on this trip like that’s been a big sacrifice.

Aussie Firebug: That’s definitely being a big sacrifice.

Mrs. Firebug: Yeah.

Aussie Firebug: Because we’ve been talking about this trip for years and when I said like, I’m going to push it back like two or three years you were devastated.

Mrs. Firebug: Yeah I was like what!

Aussie Firebug: All our friends were going on euro trips and stuff. So that was rough and plus you wouldn’t like any jobs. But we don’t sacrifice like…

Mrs. Firebug: Not really.

Aussie Firebug: Like we leave a great life.

Mrs. Firebug: I think like for me as well I’m not one of those people that just spend spend spend anyway.

Aussie Firebug: You were pretty good but not me good. But you were pretty frugal.

Mrs. Firebug: You would to and send nothing. So I have to live. A girl’s got to live.

Aussie Firebug: Oh yeah, but I think we have a fantastic lifestyle.

Mrs. Firebug: Yeah, I think its fine. I got a job straight away when I was like in year nine. So from then I like save save save, anyway, I had that.

Aussie Firebug: I think you save more money you know than what I save but you go to your parents

Mrs. Firebug: Hey. Shhhhh.

Aussie Firebug: She got a car so that was the reason she saved more than I did. I’d like to buy car but she’s a rich girl but that was a rich girl thing to get done a car.

Mrs. Firebug: I needed it. I was going to university. I had to drive.

Aussie Firebug: Yeah, keep telling yourself that. We had a look at the our finances the other day and I think we’re on track to be under 50k, well under 50k. I think was we’re going to end up around about 45 or something.

Mrs. Firebug: Yeah

Aussie Firebug: And that is you know you’ve been up…

Mrs. Firebug: Yeah

Aussie Firebug: That includes multiple times going to queens.

Mrs. Firebug: Oh yeah.

Aussie Firebug: In that 40-46 k whatever it’s going to be.

Mrs. Firebug: It’ll be three trips.

Aussie Firebug: That’s three trips to Queensland that’s you know weddings that’s you know I think we’ve, we’ve had a very expensive financial year.

Mrs. Firebug: Yeah.

Aussie Firebug: I know we haven’t like it’s not being outrageous but I could definitely live like this forever.

Mrs. Firebug: Oh, yeah.

Aussie Firebug: We go way out, would be now we go to the pub and everything like that so our lifestyles fantastic, I think you know correct me if I’m wrong so I don’t think we sacrificed too much. The euro trip was probably the biggest sacrifice that we ever made and I think that’s what will get us ahead or what has gotten us ahead more than anything

Mrs. Firebug: Yeah, it was definitely the right thing to do it was just hard to say at the time.

Aussie Firebug: Absolutely. I went so far. I was pushing it back when I said you know in 2013 and I’m like we’re not going to go to 2018 {13:00}

Mrs. Firebug: That’s like coming in. Hey, were you…

Aussie Firebug: You weren’t too impressed.

Mrs. Firebug: I wasn’t.

Aussie Firebug: What advice would you give others to try to get their partner on board with financial independence who are into it as much as they are?

Mrs. Firebug: Um.

Aussie Firebug: So you would have been in that position?

Mrs. Firebug: Yeah. I was pretty much in that position just because I didn’t know about it and you’re very passionate about it. I’m like go get that into it.

Aussie Firebug: This is probably the number one question I get. So people have emailed me before like comments about an episode like this you know interviewing you because that’s probably the, and you see it on forms all the time as well but where someone’s right into it and they might be unlucky where they have someone that likes spindle you know,

Mrs. Firebug: Yeah that’s

Aussie Firebug: Whereas we never, I never had that problem with you but I can’t totally understand you know, and they had like successful partners, you know, people that are really career orientated. So I like to work hard but then I like to play hard. I’ve spent a lot of money like how I’d be so hard what like what .

Mrs. Firebug: Yeah.

Aussie Firebug: What’s the best thing I’ve done to sort of…?

Mrs. Firebug: Steer me.

Aussie Firebug: Steer you in that direction without being like forceful?

Mrs. Firebug: Too much.

Aussie Firebug: Yeah.

Mrs. Firebug: Yeah. I think that’s a good like point try not to like ram it down your partner’s throat even though you’re like so passionate about it but like easing them into it maybe a little bit also I think like trying to like help them see the bigger picture is important as well even though, you know, it’s hard to think. I’ll you know 10 years down the track will be financially independent and might make sacrifices now trying to maybe get them to see that would be a good idea because then they’ll get on board hopefully. Other advice um, I don’t know just.

Aussie Firebug: Well here’s one for you so that’s like the positives of that idea.

Mrs. Firebug: Okay.

Aussie Firebug: Was there anything that I didn’t go over that well with you and that made you, you know, push further away from you know wanting to go down this path with me?

Mrs. Firebug: I mean the only thing I could really think of is the pushing back of the trip maybe not trying to like, like doing little things like maybe going out to dinner and stuff like that not cutting everything out like you’ve got to make some compromises. I think that’s important like we still go out with our friends. Not maybe every week but you know every couple of weeks and we might go the movies and things like that. I think it’s just maybe compromising with your partner and start small like try and cut back little bits at a time and then slowly hopefully they’ll come on board especially if they are like someone that likes to spend a lot but…

Aussie Firebug: Was reviewing the spendings weekly?

Mrs. Firebug: I was good yeah well I think it is good because I, I think you try to make me do that myself before we kind of combine our finances and I went on there once I was like okay and then i got like over it but we have like a ‘well i kind of don’t love them all the time but a weekly you like capture.

Aussie Firebug: We have weekly catch up on Sunday not when Mrs. firebug is real meet up mode because she’s got the whole week of work coming up. She is the worst time to do it but that’s just the time I do it, the laptop out and we’re sitting around said okay sweetie we’re going over the transaction for the week sit down, let’s try to remember everything we spent.

Mrs. Firebug: And I’m like terrible my memory I don’t know what that is and I eventually figure it out but yeah I think that is good because I do go oops I probably should you know be a bit more careful or what it just like it’s good to see.

Aussie Firebug: I think I always tell people that is my number one people. I feel or say like how do I save money I always tell them track your spending that is the biggest I’ve not even it was a opener for me when I first did and I thought I was like had no leaks in my budget was everything was white and then you track your spending for a couple months oh my god what is this, what is that. So track and we use pocketbook.

Mrs. Firebug: Yeah.

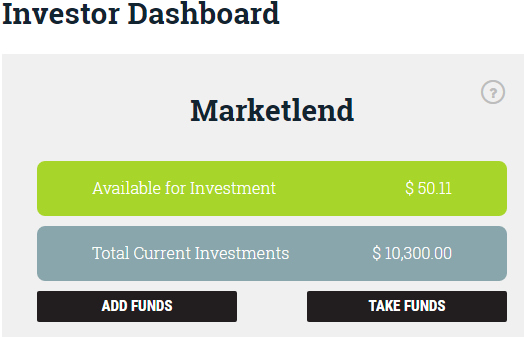

Aussie Firebug: And probably another thing that I get asked a lot as well is how to us that we had we set up our finances together. so we don’t have a joint bank account we don’t, we keep the our bank accounts separate because there’s no really need to have a joint bank account or not at the moment there isn’t. so I have money in my account Mrs. Firebug has money in her account and I look after some bills, she looks after others and we’ve come to just that understanding of what hers is mine and what what’s mine is hers. so I usually pay a lot of things out of my account and then who’s whom her income comes into piles up and when you’ve got pocket book if you haven’t used pocket book before I’ll put it in the show notes it’s a really good tool. You can link multiple bank accounts to the one accounting pocketbook so i can log in and I can see how much money Chrissie’s got in her account and i can tell much I’ve got in my account across the multiple accounts that i have and I can say you know well you’re you know you’re nearly at five thousand dollars savings that’s really good can you transfer me two and a half and I’ll use what’s in mine and we’ll buy 5,000 bucks of ETS or something like that so that’s how we’ve worked at the last year so I think that separation is a good thing and yeah I don’t see a real reason why you have to have joint accounts. That’s a bit of an old-school method I think having it in with this pocketbook you know you’ve got the app install in your home yet you can see you know what’s in mine and I just don’t see a reason to join accounts yet. So that’s how we do it and it’s really good come Sunday night because we can go through all the transactions that have happened across you know multiple cards; credit cards, debit cards whatever we’ve used to spend money and we can categorize it and we can put a little note to it and then we, yeah we review it you know. I usually, we usually have a budget of every month and one week got we’re going near it will be like okay we really need like tight me about the last couple of days but it’s been pretty good like I think that’s a good way to work it.

Mrs. Firebug: Yeah think it’s a good tool.

Aussie Firebug: And this we only, we only joined finances last year in which you might know you would have seen the post I’ll link it in the show notes but I’m really excited to when the end of financial year comes to do a new post and just to see you know what we spent for the whole entire financial year on you know where our money went basically. I think it will be an eye-opener again and we can address it when we go over it. Alright. What’s your dream goal once we reach financial independence? What do you picture your life being like in our mid to late 30s and beyond?

Mrs. Firebug: Well, definitely not working but so easy girl. Definitely like even going down to like two or three days a week in when we hit our thirties I guess would be great and then eventually plays that out.

Aussie Firebug: I think you’ll still work.

Mrs. Firebug: I don’t know.

Aussie Firebug: I think you’ll pick up something else.

Mrs. Firebug: Maybe I don’t know I think I cope well with like three days a week.

Aussie Firebug: I would totally, I would cope.

Mrs. Firebug: That’s a dream.

Aussie Firebug: So, well with three days a week that I could yes I like my job.

Mrs. Firebug: Yeah you like enjoy it.

Aussie Firebug: If I work three days a week right now oh my god I could do that I feel like I could do that for everyone.

Mrs. Firebug: Yeah, I think that is like sustainable whereas teaching full time as well and you’re worth ASG not as much as.

Aussie Firebug: Yeah, teaching the teaching hard shout out to.

Mrs. Firebug: I mean do you get a holiday that’s good shout out to all the teachers hard work for me financial independence. I really like the idea of picking how many days a week to work.

Aussie Firebug: And I think that’s a very freedom.

Mrs. Firebug: To you probably would enjoy work a lot more seem like I’m doing it because I want to know…

Aussie Firebug: Yeah, after. Absolutely. I think about like there’s been a few weeks this last couple months where I’ve had an audio and then there’s a public holiday and I do only work three days a week and it’s just like…

Mrs. Firebug: Oh yeah.

Aussie Firebug: You know we have four days off a week. The amount of town visits he could do it. Absolutely. I just a might. When you know I think about when kids roll onto the scene and like people at work have got kids and they’re so tired they come and work. Remember me like five hours sleep. Yeah. I’ll wait to work on what… How great would it be to only work three days a week, you know.

Mrs. Firebug: Yeah, I think.

Aussie Firebug: During that time.

Mrs. Firebug: Especially at thirties like hopefully we’ll have kids so definitely not working as much during that time being able to go and watch their sport and all that kind of stuff because they will have I’m sure commitments in life and I think actually see without.

Aussie Firebug: The most realistic thing as well dialing back the days worked you know I said before we live an awesome life style for less than 50 grand a year now I know when kids are all honesty thing expenses are going to jump up and everything but assuming we get to a point where we paid off the house and we’ve got all these investments and it’s and it’s generating you know X amount of dollars we you know the first 18 and a half thousand dollars income is tax-free and then you know you only tax so much you know up to what is it thirty six thousand dollars whatever but we could totally make way more than 50,000 by working less than five days a week both of us you know to get there. So I just think that is a really trying to work, to work towards and it’s well within our grasp as well look very realistic goal go. I don’t have any grand plans of you know making five hundred thousand dollars cash flow each year because we don’t need to like to get to that point would be so hard and we take it be so much sacrificing and everything but we are well on track to make enough money in your mid-to-late 30s to reach financial independence and at worst only work a few days away so pretty excited about when we get there.

Mrs. Firebug: Bring it on.

Aussie Firebug: Bring it on? What’s your favorite of the Firebug post of all time and why because I know your avid reader of the blog and you’ll have an epic answer to this?

Mrs. Firebug: I will admit sometimes I do get the emails and not Reba I’ve seen that I can actually go into the analytic and see who’s got a

Aussie Firebug: She’s opened it was and she hasn’t clicked on the link.

Mrs. Firebug: Something okay um one that comes to mind as I did like so sometimes proof read them as well so this one sticks out there about the renting versus the buying one.

Aussie Firebug: Yeah, rent versus buy.

Mrs. Firebug: That’s it, yeah.

Aussie Firebug: I’ll put a link in the show notes because that’s actually one of my most visited posts of all time well they get um yeah so I liked that just because for me as well.

Mrs. Firebug: I was always kind of under.

Aussie Firebug: So do you want to tell the audience just a little bit of what it’s about and why you liked it so much?

Mrs. Firebug: Well, from memory it’s about why it is better to rent than to get sucked into buying and having this huge mortgage and things like that. For me like I always just thought that’s what everyone did like my family my parents, my brother’s, my sister all just bought a house and just pay it off. I don’t know. I just thought everyone did and that was what it was everyone was supposed to do and then Matt. He kind of opened my eyes to the idea of like renting instead of buying like renting to as your main house kind of thing. So I don’t know. I just thought that article is really interesting because it kind of pointed out some of the positives over buying a house and getting locked in. The only thing I would say like would be when we come back from our trip life, I don’t know about renting forever especially when we have like kids and stuff like just because it would be annoying if you keep daddy property and things like that and having to move every few years. But I’m yeah right now it works for us perfectly like.

Aussie Firebug: And so we’ve been renting for nearly a year but I was room sharing for a while here and I, it’s good that you bring that up because that’s probably enough a like mind setting thing that um what we went against the grain big time yeah and family feels oh my god with us my mum would not stop saying to us like we have to buy house she’s almost like embarrassed there’s…

Mrs. Firebug: Yeah, I think that was insane i think like people look down upon with the rent like it’s like you’re anything like it isn’t yeah what’s wrong I think that is like the culture of our parents generation as well that they do think that renting isn’t as good as buying but then you’re like well but why…

Aussie Firebug: Yeah, well, actually we crunch them all and like even without the number-crunching wheat like we’re moving in like a week and how much harder would it have been if we bought either, like where we come from yeah to where we went to and now we’re going back to where we come from so like it just would have been so difficult. The renting, the flexibility of renting is awesome for us and we’re not going to have to worry about selling a house renting it out doing anything when we go on our trip so renting is just it’s worked what we brought a lesser and that the housing market by the way mum has actually gone down a little bit. she wanted us to buy like in 2013 and I we can get a place cheaper right now then it was gone for in 2013. Eve not the same so it’s factoring inflation there you know we’re better off we’re you know and my parents are well and truly in the you know property never goes down people like well entrenched into that metro. So yeah you can imagine the disappointment when we haven’t bought a house but I agree when we move back from our trip will probably buy like I wrote in the post as well like the biggest advantage I see for blind is the stability and if you don’t if you don’t have a reason to be stable like we don’t real reason like we could get another job or go live somewhere else or go oversees there’s no reason that we want like a hundred percent sure exactly how and I just think like kids obviously I wouldn’t be want to be renting with kids but other than that like I’m cool, I’m cool to rent you know be annoying if the landlord kicked us out by it’s not the end of the world when you’re two single people so I’m glad you enjoyed that post.

Mrs. Firebug: I read that one.

Aussie Firebug: I think you might have a word check, spell check that one.

Mrs. Firebug: I read there I did do a few of them

Aussie Firebug: Because I’m horrible with grammar and you can tell.

Mrs. Firebug: Terrible.

Aussie Firebug: Terrible life sentence I’m actually I think I’ve been told I’ve got a mild case of dyslexia like and it’s like a bit of a family joke. So if you ever see spelling mistakes or grammar mistakes on my post, you know, don’t tease me, it’s a disability.

Mrs. Firebug: Go easy on him.

Aussie Firebug: Go easy on me. I’m sensitive about it um look we’ve reached the end of what I had as the podcast sorry is there anything else that you can think of that um you want to say or mention because it’s been a pretty you know been a pretty exciting journey so far well it’s me why what…

Mrs. Firebug: I know really I mean just yeah go easy on your partner’s I guess to try and lure them into the idea of financial independence especially hearing it for the first time it does seem like oh is this legit and…

Aussie Firebug: She’s crazy it does I don’t know I first read over it is shit actually achievable now that was my I was buried yeah I just think skeptical until I met people.

Mrs. Firebug: until yeah I think that’s true to you need to like actually meet people who have done it to actually believe that it can be done because I was very skeptical to start with so yeah what about it I think.

Aussie Firebug: awesome, awesome insight from a partner of Ozzy Firebug. Thank you as well for coming on I know you’re a bit nervous to come on to the podcast so I appreciate that, you’ve been fantastic. If anyone want as a specific question for Mrs. Firebug that we miss because I’m sure I miss something just put in a comment of the post and I will ask her and I’ll put a reply so contact her through the post.

Mrs. Firebug: I hope it was helpful.

Aussie Firebug: yeah I really hope it was helpful to guys because i know a lot of you, you know wondering about it or struggling to get your partner on board i was very lucky that Mrs. Firebug was pretty frugal to begin with.

Mrs. Firebug: So lucky.

Aussie Firebug: She yes so lucky she, you know she was wobbling that board at a young age knew how hard it was to earn the money.

Mrs. Firebug: You knew how to work hard.

Aussie Firebug: So I was I was very lucky if you enjoyed these podcasts I want me to make more make sure you drop me a comment and rating on iTunes. Just search or the Firebug and on iTunes and you’ll find me. I’m also on sound cloud at www.soundcloud.com/aussie-Firebug. A transcript and show notes of this episode can be found on my website at ww.aussiefirebug.com thanks again for your time this is Firebug.

Mrs. Firebug: No worries.