“Are you still renting? Why don’t you buy yourself a house already. Rent money is DEAD MONEY!”

If you rent, I’m sure you have come across one of these people at least once in your life. And it’s most likely coming from a loved one who genuinely cares about you. It’s easy to understand how they come to this conclusion too. At the end of every month you have to fork over hundreds (sometimes thousands) of your hard earned dollars for nothing more than the privilege of having a roof over your head. If you were to buy a house however, at least your payments are going towards something you can call your own. That’s the common theory amongst 99% of Australians (especially parents) at least. If you have the deposit ready, is it always better to buy than to rent?

Why You Should Buy

*Let me just make one thing clear before we delve into this debate. I’m going to be looking at this purely from a financial point of view. There are many intangibles that come from buying a home that you can’t measure in dollars. Your home is your castle that you raise your family in. There is an emotional attachment when buying a home which varies greatly from person A to person B.

I personally only really see one major benefit from buying a house to live in.

Security

It’s a pretty major benefit too. When you rent you are always at the mercy of the landlord. Rent could be raised at the end of your lease. Leaky pipes may never be fixed. You’re not allowed to buy a cat because it’s against the rules. And what happens if the landlord decides to sell to home owners who want to move in and kick you out? You have to find another place to live, and anyone who has ever moved or helped move someone can attest to how they would rather take a bullet than do that shit again. Ok it’s not quite that bad but it sucks trust me (have been involved in 10+ moves).

Forced Savings

Some people just can’t save money.

If it’s in their account and disposable, they just can’t help themselves and must spend it. I don’t have this problem personally but I understand that for many people it’s an issue. So how can you save money when you spend every spare dollar you earn?

Forced savings.

Unless you’re on an interest only loan, you will be paying some principal in your repayments each month. It’s the principal that actually pays off the home, the interest is just how the banks make their money.

The principal payment therefore are sort of like a forced savings mechanism. I say ‘sort of like’ because it’s a bit more complicated than thinking about it purely as savings. Theoretically if you bought your house for $X amount of money and sold it 30 years later for the same price after paying it off, then yes you would be essentially receiving a lump sum of all your principal repayments you have made during those 30 years (not factoring in buying/selling costs and inflation).

But! What happens if you never sell? What happens if the house goes down in value? What happens if no ones wants to buy your home?

It’s is extremely unlikely that you’re are going to have your house go down in value over 30 years but it could happen (see Japan). And it’s for this reason that savings via equity is not as straight forward as you think.

Regardless of these situations though, for people who struggle to save when they have disposable income, a forced savings plan might be a good thing for them. And the banks do a mighty fine job of making sure you ‘save’ every month. They are even kind enough to visit you if you miss too many ‘saving’ payments.

Why You Shouldn’t Buy

LOCKED IN!

Since already establishing what I consider the single and biggest pro when buying to be security, if find yourself in the dilemma of choosing between renting or buying you must ask yourself, why do I need security?

There is merit for people who need the stability that buying comes with. If you have pets, children, elderly parents who you take care of or something else that would be greatly disrupted if you ever had to move. Then I could 100% see the importance of security.

BUT! With security there also comes restrictions!

When you buy a home, suddenly you can’t just pick up your things and leave. You could rent out your house but that’s a pain in the arse. You could sell your house. That is also annoying and it costs money to do so.

Really, really expensive

Buying a home usually means taking out a mortgage. Having debt on something that does not produce any cash flow is a liability. Some people say your home is an asset, I disagree.

But lets push aside some negatives for the time being and imagine that you are someone who needs stability and believes that they are not going to want to live anywhere else for the next few years. Now you actually need to buy the house and pay it off over the next 30 years. Lets crunch the numbers.

How much does it actually cost to buy a house?

Everyone is different but lets just go with the standard formula of 25% of the purchase price (20% deposit and 5% buying costs). On a $600K house this works out to be $120K for the deposit and $30K for buying costs. The loan amount is $480K and even though interest rates are at historical lows now, they will eventually go up so lets just go with 7% fixed interest rate for the entire 30 years of the loan.

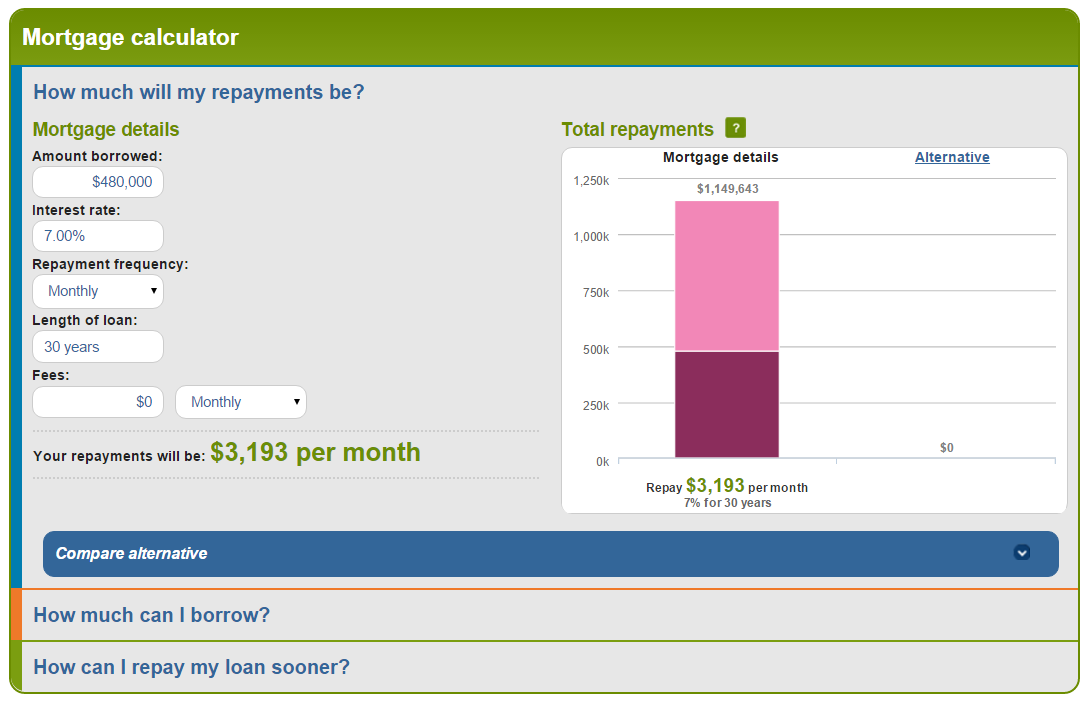

Using money smart’s mortgage calculator we can graph the repayments.

A few things instantly pop out at me.

Firstly you may notice that the total cost of servicing this loan amount for 30 years equals $1,149,643.

Wowzers.

Secondly, the dark pink area represents the principal amount of the loan ($480K) and the light pink is the interest. You end up paying more in interest than you do for the actual loan amount… Just think about that for a second. Some say rent money is dead money, well the same can be said for interest too. YOU JUST SPENT $670K ON ‘DEAD’ MONEY!

It’s hard to even think about. If we break up that interest over the 30 years it works out to be $429 a week or $1,861 a month. You could rent a really nice place for that kind of money.

But because you have chosen to buy you have to pay the interest repayments PLUS the principal, which comes to $3,193 per month. That’s a shit load of money leaving your account each month. I don’t know about you, but that would severely impact my lifestyle if I had to make those repayments each month for the next 30 years.

So far we have $120K for the deposit, $30K buying costs and $1.15M for servicing the loan over 30 years. That comes to around $1.3M!

So far we have covered how much it’s going to cost you to buy the house, but we haven’t covered how much extra it’s going to cost you to keep it running.

Here are just some extra items that come with the privilege of buying:

– Rates

– Home Insurance

– Water Fees

– Body Corp Fees

– If anything breaks in the house (plumbing, electrical wires, air con etc.) YOU have to pay to fix it

In a publication from the RBA, they estimated that on average the running costs for a house is 1.5% of its value.

That’s $270K over 30 years to keep a $600K house up and running.

Combining the buying costs with the running costs comes out at a whopping $1.53 MILLION DOLLARS to buy and maintain a $600K house for 30 years.

Forget about Equity!

The other big benefit that a lot of people seem to bring up in this debate is that buying a home will make you money somehow? Last time I checked, buying a home TO LIVE IN does no such thing. You can’t collect rent when you live in your home (unless you have kids). And even if the house goes up in value, it is irrelevant because you can’t live in your house and sell it too. If you withdraw equity then I am of the opinion that you’re selling yourself short of the major benefit of buying a home in the first place (security). You could sell and buy another home BUT this was not the original purpose of buying. If you INTENTIONALLY bought a home only to sell it later in life for a higher price then you are actually investing and the ATO investigates these occurrences where couples may buy and sell every couple of years and take advantage of the CGT exception.

When you buy a house to live in, your goal should not be to sell it later for a higher price. Factoring this into account, I stand by my statement that you will not make money when you buy a house to live in. This removes any investment type gains home owners might be privy to when trying to compare to renters. We want to compare apples to apples as closely as possible. When you start talking about how much the house went up in value it should not be factored into the equation because if someone is happy living somewhere and never sells, then the equity gain is void.

Why You Should Rent

Flexibility

Other than your lease period, renters are free to jump from one place to another.

Don’t like the cost of rent? Move.

Don’t like the location anymore? Move.

Landlord not fixing things around the property? Move

I know that moving is a pain in the arse but do you know what’s more of a pain in the arse? Trying to sell your home AND moving.

It seems to be a growing trend among young people to spend their 20’s travelling around the world, studying and trying new experiences. And that’s awesome! I think that your youth, particularly between the ages of 23-29 is an extremely precocious and unique time in your life when you’re not tied down and most likely have finished your trade/degree and working full time.

You have full time money coming in, are young and can do what you want. Why would you want to tie yourself down by buying a house? You are in such a unique position to be able to drop everything and move/explore/discover the world.

Renting can provide you with the flexibility needed to live this kind of lifestyle.

I personally don’t intend to buy a home to live in until I’m ready to have kids, but that’s me and everyone’s different.

Usually Cheaper

If you think rent is dead money, then you must certainly see interest repayments on a home loan to also be dead money. You can work out the percentage of interest repayments quite easily because they are set by the bank. But comparing that to rent repayments is a bit trickier at first but is easy once you realise how to compare the two.

To work out if you are better off renting and saving money than you are buying and forcing savings (through principal repayments), you must know the rental yield of the property. To calculate this you have to know two things;

- How much the place you want to rent is worth?

- How much does rent cost?

For example:

The place you want to rent is currently being advertised for $400 a week and you think it’s worth about $600K because the place next door is nearly identical to it and is for sale for $600K. Rental yield is calculated using the following formula:

Rental Yield = R/PP

Where R = Rent (Per Year)

And PP = Purchase Price

In our above example this would be

Rental Yield = $20,800/ $600,000

Rental Yield = 3.5%

Can you find a bank with a lower interest rate than 3.5%? Right now the answer is no. The average interest rate for a standard variable loan is 5.1% and that’s with today’s historically low cash rates.

Considering today’s rental yields are 3.5% and 4.4% for houses and units respectively in all Australian capitals, you would either have to be paying above market rent or find a killer bargain for it to work out cheaper to buy than to rent.

It’s simple, is the rental yield you’re paying more than the interest rate you would have to pay if you bought? For the vast majority of Australians I would say the rental yield is going to be lower. There are a few places I have seen in the country where the rental yield is quite a bit higher but I have yet to see it in the capital cities, especially Sydney and Melbourne.

And this is not even factoring in all the other crap that comes along with buying (stamp duty, rates, insurance Etc.)

To compare to our example above. If we rented at $400 for 30 years and factoring in inflation at 2.5% we end up paying $913,176 in rent. This is being pessimistic too because I didn’t factor in inflation for the rates, insurance, body corp etc. above so it would have actually been even more to keep the house running over 30 years.

Still, this means that renting over 30 years come out over $600K cheaper than to buy.

However, the person in the above example now owns the assets outright and at worst is sitting on about $1.23M of equity ($600K over 30 years at 2.5% inflation rate) where as the person who rents has no equity.

** 27/03/2018 EDIT **

There seems to be a lot of comments about me using 2.5% in the above calculation. Australian property (all of Australia not just Melbourne and Sydney) has risen by 2.8% (real rate of return) during the last 30 years (SOURCE)! You could even put the return @ 5% and renting would still come out ahead.

I can’t account for all rates of returns. These are the numbers I have used with a source to back them up. Obviously if the return for properties increases in the future the results are going to be different.

** /EDIT **

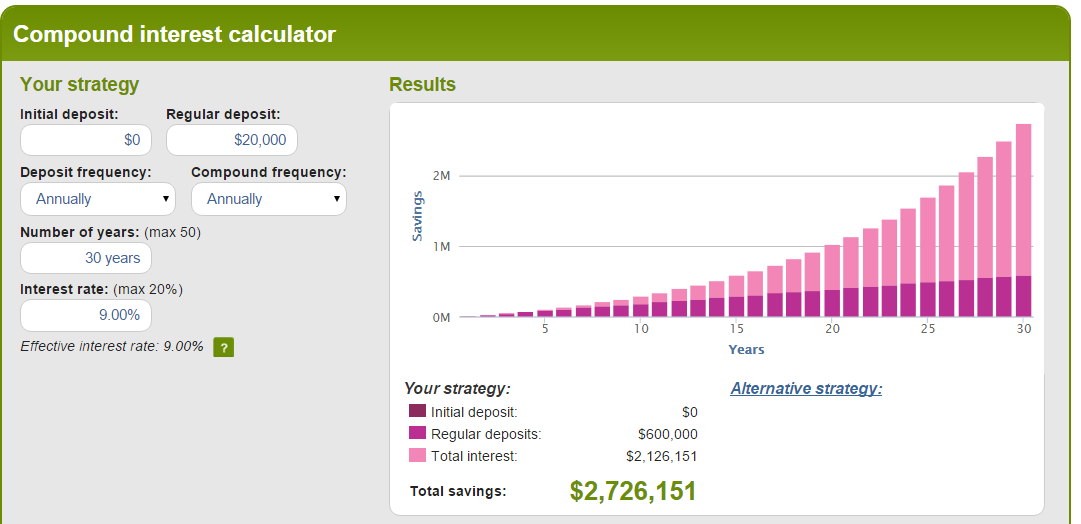

BUT! The person who rents has a far greater cash flow position than the person who buys. The renter should have just over $600K (total cost to buy over 30 years minus paying rent for 30 years) extra over 30 years if they managed their money and saved the difference. This works out to be an extra $20K per year the renter has up their sleeve.

Lets assume that the renter realises this advantageous position and instead of blowing the extra $20K, they invest it yearly in a diversified portfolio. Suddenly something strange happens.

At $20K per year over 30 years with a rate of return of 9% (historic average) can you believe that the renter can amass a net worth position of $2.7M!!!

Sweet baby Jesus.

I don’t know about you, but I would much rather have $2.7M invested in income producing assets and have no house to my name than having a money draining house paid off with around $1.23M of equity that you might never tap into after 30 years!

Why You Shouldn’t Rent

Landlords, Leases and Leaks

Have you ever had that real asshole of a boss that is always checking up on what you’re doing, invading your privacy and never fixing the things that are broken at work?

This can be what it’s like when you rent. There are good landlords out there but there are also terrible ones.

Since you are sort of borrowing their house to live in for a while (renting), you can’t make changes to it as you please. For some people this is not an issue but for others (my old man included) it can be hard because they like to tinker, fix things and customize their home to their liking. You can’t exactly knock down a wall to expand your living room without receiving some sort of angry letter from your rental agent. Even if you’re helping to fix the property you can get into trouble. This sucks when there are issues with the rental, like broken heaters, leaky taps, out of service hot water systems Etc.

I hope you didn’t have your heart set on this place either. Because the landlord has just decided to sell the property when your lease period ends to the higher bidder. There is a chance that the next owner could want to rent it out too but there is also the chance that it’s a new family who want to move in straight away. Which means you will have to move out!

Luckily the new owner does intend to rent this pace out. You have lived there for 3 years and have a great history looking after the place. The new landlord offers you another lease and at first you are very happy, that is until you read the fine print which says they have just upped the rent per week by $20 bucks!

Ouch.

Might be time to move places, which of course means attending multiple open days, submitting application after application in hopes that you land one that suites. When you finally find one that you have been offered it’s now time to have a weekend from hell carting all your crap around town to the new place.

FINALLY settled you now sit back and relax in your new abode. 10 months pass and you receive another letter saying that the owners wants to sell… FFS!

No forced savings

If you have a hard time sticking to a budget than renting might not be the smartest move. It’s definitely possible to come out ahead when renting if you are discipline and can invest the money saved while you rent. But not all people can do this.

They see spare change in their account like an expiring gift voucher becoming invalid on Sunday afternoon. They MUST SPEND IT on the weekend with no time to spare! And even though it may be better financially to rent and invest the savings, not everyone has the will power to do this.

Final Thoughts

I think too many people (especially younger people) get caught up in what is ‘normal’ and buy homes young when they don’t even know what they want to do in life. If rent money is dead money than so is interest repayments, which are much higher than rental yields for the majority of Australians.

You do not make money when you buy a house to live in. You may get lucky and sell it at a profit later in life, but you never hear about all the people that sell at a loss, only the ones that triple their money in 4 years (bullshit artists). You shouldn’t be thinking about making money when looking at a home to live in anyway. It’s first and foremost your home to make your own and to raise a family in. If you want to make money, look at actually investing into income producing assets (stocks, bonds, rentals).

Don’t get caught up in the stigma and shame on renting, break down the numbers and work out what actually costs more. If it’s cheaper to buy then by all means go ahead and buy, if it’s cheaper to rent, ignore the misinformed who try to make assumptions that you can’t afford to buy or that you must be doing it wrong.

Try to break out of the Matrix and look at what is best for YOU not what others think is best for you.

Please feel free to share this article around if you know someone who may be tossing up between the two, it may help them decide.

Photo credit: Phil Sexton / Foter.com / CC BY

Awesome, thanks.

This is further confirming my suspicions about how much buying a house sucks balls.

I’m 22, and renting makes completely sense. EVEN MOAR money for Index funds!

Yeah buddy!

I live in the country and it STILL makes more sense financially to rent (although not by much). If I lived in a capital city it would be a no brainer.

Thanks for sharing your insights. There are pros and cons for both of them. I think that renting is better in other cities where real estate is really high. And like you said, you can always move to another place. 🙂

I fundamentally agree with this position, however wouldn’t it be fairer for rent to increase at the rate of capital growth of the property for those 30 years in your calculation i.e so the rental yield remains relatively constant throughout the time you are renting the property?

Hi Pat,

I actually have factored that in. See this paragraph:

To compare to our example above. If we rented at $400 for 30 years and factoring in inflation at 2.5% we end up paying $913,176 in rent. This is being pessimistic too because I didn’t factor in inflation for the rates, insurance, body corp etc. above so it would have actually been even more to keep the house running over 30 years.

Still, this means that renting over 30 years come out over $600K cheaper than to buy.

However, the person in the above example now owns the assets outright and at worst is sitting on about $1.23M of equity ($600K over 30 years at 2.5% inflation rate) whereas the person who rents has no equity.

I also didn’t factor in inflation for all the costs associated with holding properties which makes the argument, even more, one-sided.

No forced savings

If you have a hard time sticking to a budget than renting might not be the smartest move. It’s defiantely <– Definitely

Great article, just a small grammatical error 🙂

Yep agreed Tim.

Ah man I’m so bad at grammar. I get messages all the time lol. Cheers mate

Hmmm – 50 and no house. Should I invest outside of super or inside super and then just pay cash for a house when I retire – can’t decide.

Not sure PP.

Hard to tell without all the information. You should speak to a financial advisor though.

All the best

I like the idea, but your math and finance calculations are so flawed with bias and misleading information. e.g a house increaseing by 2.5% annualy. whereas historically its 100% every ten years.

600,000

1,200,000

2,400,000

4,800,000

Another major flaw in some of these calculations is you have not factored in tax considerations which will likely make a big difference. The major advantage of home ownership is any capital gain is tax free! Whereas your share market investment is taxed which means that after tax yields are likely less, and this does not appear to be factored in to your calculations either. So suggest redoing calculations factoring in in tax, and slightly more home ownership capital gain from home ownership, will present a VERY different position. Note : I would not blindly factor in doubling every 10 years, because that is about 7% pa compounded. This might happen with the right purchase, but is unsustainable indefinitely, and certainly far from true for a LOT properties. But do think of home ownership as an important investment, and like all good investments, pick 1 that is,likely to go up for some reason, rather than having some blind faith that property always goes up, and it has a better chance of being a good tax free investment over the long term.

I also can’t agree with statements like “You shouldn’t be thinking about making money when looking at a home to live in anyway”. If you don’t think about the investment potential of the home you buy, you are going to miss out on the potential gains from one of the only tax free investments your are ever likely to make. With careful selection your should be able to meet both objectives.

As someone with retired parents who have saved and who own there own place and have savings, and parents inlaw who have not, and don’t own their own house, it is clear the most important thing is to learn how to save. And that should be the important takeout from this blog for anyone who wants future financial stability. As the author points out, there is more than 1 path. He is right to advise to do the sums, rather than be blindly led by other people’s bias.

Hi Matthew,

I hear what you’re saying but honestly, it sounds to me like you’re investing when choosing a house mate. The capital gains exemption should not be a consideration because it is only viable if you sell. Do you buy with the intent to sell for a profit later? If so, you’re investing. Which is a completely different argument. I’m trying to compare apples with apples in this article.

Also, it is possible to invest in the sharemarket without paying any tax. Franking credits anyone?

Thanks for the comment mate.

agree that w/o capital gains need to be considered

some people just put all their money into their home whilst they have kids and look to recover it and downsize when the kids move out – maybe 10-15 years later

from that pov it makes sense – you’ll get the cap gains back tax free + have a great house

it’s clearly a strategy that should be considered

Exactly what I was thinking – the math is very flawed and bias.

While houses in Sydney may no longer double every 10 years, you still build a hell of a lot more equity, which can in turn be used to purchase income producing assets.

How confident are you that house prices in Sydney are going to continue to rise? What happens if they fall in price? The math is not flawed. Maybe a bit bias to complement my position ;), but not flawed.

I did say at worst 2.5%.

FYI houses don’t necessarily increase in value every year. We have had a fantastic run in Australia but this is not the norm. Who’s to say that we won’t be hit by a recession and houses will be less valuable than they were 10 years ago?

See Japan for an example.

Although some of the points you make are good. You only ever work out the scenario for 30 years. When most people can expect to live to be around 80 years old at least. If you changed the numbers to caculate renting for 60 years vs buying and working hard, paying house off in 15-20 years, the numbers are well in favour of buying. Goodluck getting to 80 years old and having to pay rent out of you pension!!

Actually Steve, if I recalculate for 80 years. The rentvestor will be millions of dollars ahead of the buyer. The distance between the two strategies will continue to increase over time because the rentvestor will have the majority of his wealth in an income producing asset whereas the buyer will have had a good chunk of wealth stuck in his home and will suffer from lost opportunity cost.

As I said from the start of the article. I’m looking at this purely from a financial point of view, not an emotional one. I do plan to own my home eventually because I plan to have kids. But financially I can make more money rentvesting.

Good article, but narrow in its argument without including other historical references. Allowing an Inflation rate of around 3% per year, rent over a thirty yr period on a $400 rent bill would rise to around $560 in the first ten years, mortgage would remain the same. After 20 yrs, rent would rise to around $790 and after 30 yrs would rise to around $1100 per week while the mortgage payment remains stable. Wage growth annually would rise as well as career advancement (with pay rises) would also change the calculations. After some years, the mortgage payment would become more affordable on a percentage basis of earnings as well as becoming less than paying rent. Buying a house should be seen as a long term investment.

Hi Kim,

I have already factored in rent increasing with inflation of 2.5%. Please see this line:

Increased wages would make the rent increase void too. I also don’t consider a family home an investment or asset. It doesn’t produce income but it costs you a shit load of money to hold. Not a very good investment if you ask me.

Lol what a dumb article. House prices do appreciate over 30 years, and as you are highly leveraged your 150k equity experiences very strong returns if the house price growth is strong, which given limited stock and a growing population it will be long term.

Also you day appreciation doesn’t matter because you don’t benefit because you live in the house. You are comparing renting to buying…you realise you could sell it in 30 years and start rentiing again, benefiting from the growth in capital? Houses are on of the new assets that let Australians enter the debt market and squire capital – enter if you can.

I really wish you ran this through a spellcheck, I can’t even properly understand your argument David.

Thank you for that info, most interesting as I have always thought it is better to buy.

No worries Kate 🙂

To be honest, it’s never black and white and there are a lot of factors that come into play. Best to do your own research in your area. But there seems to be a weird foregone conclusion with most Australians that it’s ALWAYS better to buy when that’s simply not true.

Don’t let facts get in the way of a good article.

Home ownership is not for everyone for certain but your blog has many numbers dropped from the rental equation 3.5% rental isn’t a national average either. 5-6% yields are readily available in capital cities, interest rates are sub 4%.

A home IS an asset, that doesnt mean it doesn’t have costs and liabilities against it.

I’m not an B&B advocate, it is a way to generate an income from a home when the kids move out or rent a room as student accommodation.

If you buy well, growth or no, you may still be able to develop the site. You can’t develop the place that you are renting.

On top of that, rents will fluctuate. If you add capital value fluctuations and add rental fluctuations, then add the cost of moving as a tenant in time and money,

your figures won’t be as pro rental.

Hi Cameron,

I wrote this article over 2 years ago. The figures I provided (with a source from CoreLogic RP Data I might add) were accurate when I published.

The key distinction I make in this article is that we should not be comparing buying to live in with property investment. You suggest developing the site and renting rooms. Sounds to me like you’re trying to compare property investing with renting. I’m comparing buying to live in vs renting. Key difference.

Exactly buying to live in. Not buying rules out a lot of opportunity. I bought a house to live in, due to a zoning change I split it into 7 and still kept the house. Cant do that if you are the tenant. Further to that, if you are the owner you can choose to put savings into solar panels and have no electricty bill, short term pain, long term gain, again cant really be done as a tenant unless the landlord wants to fork out.

You assume 9% return on savings, that means shares/super which aren’t exactly stable.Your loan cost calculations also don’t include the benefits of using an offset account.

Your calculations also dont allow for using the equity to make a positive cashflow from investment which can go straight back into the home mortgage. So yes there might be a 9% yield from the share market but that’s about itYour calculations also dont allow for using the equity to make a positive cashflow from investment which can go straight back into the home mortgage. So yes there might be a 9% yield from the share market but that’s about it.

The home ownership cost doesn’t allow for offset accounts which reduce the cost of the loan.

The figures from RP data were saying that sale prices were up which means low yields, to fix the yield prices either need to go down or rents need to go up.

The calculations you have done don’t allow for $1.8million in extra rent if you rent for your whole life ie from 20 to 80, assuming 2.5% rental growth.

The calculations don’t allow for capital growth which at only 3% per annum would be $2.6million of growth. That means that you have a nett gain of $1.45 million.

Depending on your luck you could have $50 – $100k in moving costs over that time because you are forced to move due to the landlord.

Rent money IS dead money, but it CAN serve a purpose if flexibility is the goal of the individual. By all means talk people out of the property market, im happy to keep the capital growth down and rental yields up.

I’m not trying to talk people out of the property market, I myself have three investment properties. But it’s completely different to compare an investment property to a home to live in.

Everything you have mentioned in this comment is not measurable. I can’t model for every single type of scenario when I write these articles. I went with averages and the target inflation rate.

To your point about it the article not factoring in someone’s whole life.

Well, in my above example, the difference in net worth would be even greater after 80 years because the rentvestor is already 1.5M ahead after 30 years in assets vs the person who bought. The person who bought will NEVER catch the rentvestor with everything else being equal.

You can argue and debate the returns that are mentioned above to suit your narrative. But from MY research this is the conclusion I have reach.

YMMV

Thanks for the comment. Always good to hear from another perspective 🙂

Gidday,

Sorry, but this is a bad article. You’ve chosen one particular perspective for every point you raise, which is glossy misleading.

Some simple points to illustrate the busses one can drive through your plot holes:

* how do you fund accommodation costs when you want to stop working?

* the article ignores the depreciating value of money over time. Although the total amount is a shock, over the course of 30 years, each dollar is worth less

* most people do not see out the full 30 year life of the loan. They pay it off early or up trade their house. Reduce the life of the loan to 20 years and watch how that interest falls away.

* most of the “renting is better” crowd argue that you need to invest the difference between what rent costs and what your mortgage would be. This generally just does not happen.

* once you buy, your mortgage payment is now “fixed”. See how much rent goes up over the next 10 years.

Above just to get started. Bad article mate.

Andrew.

Hi Andrew,

Using the passive income generated by the $2.7M worth of assets you have accumulated over the 30 years. Or alternatively, you could buy outright with the superior funds you were able to generate vs someone who bought 30 years prior and still have a lot of cash left over to retire early.

the article ignores the depreciating value of money over time. Although the total amount is a shock, over the course of 30 years, each dollar is worth less

Inflation has already been factored in the article. Regardless, the renter ends up with more money at the end of the day.

most people do not see out the full 30 year life of the loan. They pay it off early or up trade their house. Reduce the life of the loan to 20 years and watch how that interest falls away.

Can’t account for every situation. But in that scenario, the buyer would still lose out on opportunity costs by committing such a large portion of their income to their house and the result would still be the same with just less interest paid.

most of the “renting is better” crowd argue that you need to invest the difference between what rent costs and what your mortgage would be. This generally just does not happen.

I do agree with this which is why I mention that one of the benefits of buying is the forced savings mechanism. But for those who have the discipline, renting can work out better financially.

once you buy, your mortgage payment is now “fixed”. See how much rent goes up over the next 10 years.

Already factored in rent increases through inflation in the article.

Thanks for the comment Andrew. I hope I have given you some food for thought.

Cheeky to assume 2.5% capital growth for the house and 9% for the shares

Yeah I’ll give you that.

But I did say at worst 2.5%… Even if you plug in 5% returns for capital gains (which seems high anyway) reinvesting still wins out.

Shares historically have had a better return overall however.

How can you compare 2.5% housing growth to 9% share market? Historical average in Aus for housing is 7.25%. Using your scenario above the house would be worth $4.898m after 30 years putting your position $3.6m better off!

Also comparing 7% interest rates with 3.5% yield is misleading. Higher interest rates drive up yield making the rent position more expensive.

Additionally, the analysis ignores wage inflation which makes paying off that mortgage much simpler over time and gives the house owner an increasingly beneficial cash flow position.

Hi Paco,

Historically shares have had better returns on a percentage basis than real estate in Australia.

7.25% you say? I hope you’re not including rent in that figure. Seems outrageously high for the entire country to historically have capital gains of 7.25%. Got a source for that one?

I went with averages and target inflation rate when crunching the numbers. Obviously, it’s impossible to know what the future returns are going to be for both asset classes and there’s a whole other bunch of other factors that are hard to factor in when writing this article such as tax, leverage, credit rating, risk tolerance, financial position etc.

Without a crystal ball, it’s hard to give an exact answer. This is what I came up with using the numbers as quoted above.

I have actually accounted for inflation too.

Thanks for stopping by

Very biased article in my opinion, and the data just doesn’t seem right.

A ‘yield’ calculation should really be based on 4%+ at $600k; if your yield is below that, there is something wrong with the property, or over capitilised. You’re really only looking at 3.5% yields on ~$1m properties. ALL of my ~$600k properties yield 4.6%+.

Also, if you put in the hard yards for a couple of years, you can get your repayments to be lower than your rent payments. That’s a massive win, and from that point forward, you’ll generally be ahead (sure interest may go up, but rents go up too). Why pay $700/wk on rent, when a mortgage repayment can be less?

Further, you don’t need to sell to access equity. Correctly structured, you can use that equity to purchase income producing assets, which can help pay down your non deductable debt (the house you live in) faster.

We did the math. We purchased an ~$800k house. To rent something similar would be $700/wk. At the time the interest rate was 4.88%. To be ‘even’ in terms of ‘dead money’ we would have a debt of $746,000. So, we were already on par at purchase. The dead money was even, and the principal payment just ‘savings’ now anyways. Any additional payment we made, increased our savings. We bought well, so that 1.5% maintenance you think is required, was not.

In 3 years, we have managed to get our principle AND interest payments to lower than what rent is (assuming no raise in rent). So, in 3 years, our

Lifestyle is back to what it was (also assuming no income increase), and our house has risen significantly in value, so we have ~$400k in equity, which is used to buy income producing assets to pay further principle off my loan, and gaining tax deductions to further that.

Now we have started a snowball effect where our home gets paid off faster, keeping the same lifestyle.

Our houses are unlikely to crash over night like the stock market you seem to love so much.

I have a mate who thought renting would be better for them, whilst we bought. In 4 years, we have a networth nearly 5x theirs. Same incomes, we have a child and they don’t, they pay the same $700/wk rent with no increases during that time. All we did differently was buy instead of rent, and toned down our lifestyle for 3 years.

I suspect that in 10 years, our networth difference will be 15x theirs, and with further smart moves, this will just snowball.

Having written all this now and reading through it, combining it with your stuff, I think that if you’re going to pay the bare minimum off a mortgage each month, and actually have a 30 year mortgage, you may be similarly off.. but if you even make small additional payments, you’ll be far better off with a house. And this can be snowballed ridiculously.

For the sleep at night factor, houses are better than shares.

Hi Mike,

I can’t account for every single different scenario possible. I crunched the numbers for a specific example that included a 30-year loan that was not paid off early. It’s extremely hard to cover every single scenario when writing these articles. Of course, different circumstances will yield different results.

Further, you don’t need to sell to access equity. Correctly structured, you can use that equity to purchase income producing assets, which can help pay down your non deductable debt (the house you live in) faster.

I address this point in the article:

If you withdraw equity then I am of the opinion that you’re selling yourself short of the major benefit of buying a home in the first place (security).

We did the math. We purchased an ~$800k house. To rent something similar would be $700/wk. At the time the interest rate was 4.88%. To be ‘even’ in terms of ‘dead money’ we would have a debt of $746,000. So, we were already on par at purchase. The dead money was even, and the principal payment just ‘savings’ now anyways. Any additional payment we made, increased our savings. We bought well, so that 1.5% maintenance you think is required, was not.

In 3 years, we have managed to get our principle AND interest payments to lower than what rent is (assuming no raise in rent). So, in 3 years, our

Lifestyle is back to what it was (also assuming no income increase), and our house has risen significantly in value, so we have ~$400k in equity, which is used to buy income producing assets to pay further principle off my loan, and gaining tax deductions to further that.

Now we have started a snowball effect where our home gets paid off faster, keeping the same lifestyle.

That’s awesome mate!

If it works for you then that’s great. But what works for Bob may not work for Billy.

YMMV

For the sleep at night factor, houses are better than shares.

This we can agree on. I did have a disclosure at the start of the article that it was going to be written purely from a financial point of view. There are intangibles that come with home ownership for sure.

Thanks for the comment mate.

The one argument I have with this article is the short time frame. It only focuses on the duration of the loan, which has NO correlation with home ownership.

Example

Lets say a 20 year old is deciding on whether to buy or rent a house. Their life expectancy is lets say 80.

So please redo your calculations on this time frame.

Total rent, increasing as CPI only over 60 years VS 30 year loan cost and 60 years of costs (rates etc) increasing at CPI.

Every time I do that, Buying comes out so far in front.

Also let me finish by saying asking this, Do you REALLY want to rent on the pension?

If someone buys a house when they are 30, and pays the mortgage off by the time they are 60, they then only have the running costs of the property (maintenance, rates, and insurance) all significantly less than renting.

The current life expectancy of an Australian is 82.4 years https://www.aihw.gov.au/reports/life-expectancy-death/deaths-in-australia/contents/life-expectancy

So I believe your argument doesn’t Include the additional 22.4 years of life and the money that would be spent on rent when an individuals income and earning capabilities are reduced after retirement

As per the other comments, I think its sheer stupidity to rent and ignore the buy option. Whichever way you cut the cake, most people don’t stay in the same home for 30 years, most people pay down the mortgage faster, and if they do so in 5 years the mortgage can work out to be cheaper per week than rent plus you have an asset which is growing at 3% to 8% per year depending on where you live of course.

When you get to the end of your life you can sell it and move into a very nice fully paid for retirement village. Try that with renting your whole life. You will be significantly disadvantaged, and as you say your calculations are based on renters saving the difference, unfortunately human beings are flawed. Most of us seem to have a problem with saving the difference as opposed to a forced saving program via mortgage. The only alternative for a renter at the end is public housing unless you like moving a lot and living in poverty, well that’s something to look forward to!

The only hard part of the puzzle is getting the deposit and the legal/taxes deposit up front. Although I’d suggest that with mortgage insurance being so pricey there should be some sort of refund once your equity in your home hits 20%.

It’s a no brainer if you rent throughout your life you will lose out in the end, this is just a fact of life, so put aside that overseas trip, the avacardo toasty and suck it up, save the deposit and buy a home.

You write this as a one-size fits all argument, which is wrong.

I got tired of paying rent, but did the calculations. All I could afford was an old house in a regional area.

So I left Australia and can save now. Invested in shares and started a small business.

The repairs, rates and fees are a big % of it. It’s so expensive relative to opportunity cost.

A tiny house in regional Victoria has gone up 50% in the last 3 years.

You can’t tell me the real value of that house has gone up 50% in terms

of the security, storage and facilities it provides you.

What you say depends entirely on what, where and how you buy.

Don’t think a 40 year old who borrowed deep and is now about to lose their house is going to ‘win’.

Wow! Lot’s of comments trying to debunk Firebug’s theory. I won’t bother going through the numbers, but I believe Firebug is right and I am speaking as somebody who is a homeowner in Sydney with no mortgage at all, own an investment property and share investments. I could’ve made much more if I never bothered buying.

Having said that, Firebug is right about the security aspect – it’s nice not having to pay rent or mortgage, but quite annoying that I’m still paying rates, insurance, etc. From a purely financial perspective, my own personal experience correlates with what Firebug is saying. Of course, everyone’s experience will differ.

Don’t worry about all the homeowners saying you’re wrong mate. This is Australia and property is the single biggest religion in the country…

Thanks Chris,

The old ‘Bricks n Mortar’ crowd is really grilling me here since this was republished on news.com.au

The numbers don’t lie 👊

You are a complete moron. This is the ONLY formula that applies. At the end of 25 years of renting, you have nothing. At the end of 25 years of paying off a house, you have a house! There is NO other argument.

That really depends what you did with what you saved.

Agree! Not only was Midge’s comment rude but was not based in reality. People often get salty when their life long mistakes are pointed out to them & instead of engaging ones brain & thinking through the different scenarios & actually crunching real numbers they are immediately on the back foot trying to defend their position & their mistakes.

What people need to remember is what is right for one person is not always right for another.

With AFB (amongst others in the FIRE & FI crowd) advice I sold my house back in 2017, started fresh & rented close to where I work. Between now & then my family of 5 (wife & 3 young daughters) have managed to build a share portfolio of over $900k & growing fast. I semi retired at 35 last year (now 36) & will easily be fully retired by 40 but more than likely next year or the year after.

If you believe the “buying a house is the only option” narrative you are closing yourself off to a lot of options & basically giving away your money to the banks & your freedom. Have an open mind, work out what will give you the best outcome based on actual numbers & DD & go with that. If that means buying a house, do that. If it means forgoing buying now to build a multi million $ share portfolio & buying later then do that. Don’t be close minded & believe what the media wants you to believe. That will keep you working forever which is what the government wants.

Property enthusiasts will believe their home will achieve far greater annual growth rates. Many will assume 7% plus is easy. I disagree with this but obviously assumptions like this change the whole result. Likewise, many will argue that 9% growth in shares may not be achieved despite historic performance. If you plug in 9% for share market returns I think it would be better to quote a historic period you chose. Likewise, when picking out assumed house price growth. If we happen to use the last decade (I am not saying this makes sense & do we use Australian or international shares?), well buying a home probably wins. If we use data for 50 years plus as an example (but is the data even reliable for property?), then maybe renting and investing in shares wins.

A lot comes down to your crystal ball with these two variables of predicted rates of share price growth v house price growth.

Pleased to read your article like this though as it helps to broaden minds, and well done for putting yourself out there! Seeing some replies above that don’t seem to have read your article in full indicate to me some very property biased readers. For example, thinking you didn’t factor in inflation in rents. Or assuming your plan means the person could not choose and buy a home just before they retire at 60 years of age perhaps. i.e. saying you must finish up renting on a pension.

Disclosure – Owner of my own home with no debt and a share portfolio. I believe I would have been financially better off not buying the PPOR in favour of an all shares strategy. But it is difficult to measure, perhaps I invested better in shares because of the secure feeling of having capital in my own home.

Hi Steve,

Great comment mate.

I agree that it does come down to which asset class will perform better over the 30 years. And like you have said, without a crystal ball, it’s hard to predict. Even if you plug in a 5% return for the house over the 30 years, the shares still come out as the winner.

Thanks for your insight mate 🙂

Wow, very interesting article! Even more interesting comments. I think many people who replied seemed to be assuming that the rentvestor will be relying on the pension when they retire, which would make renting challenging. However you clearly refer to the rentvestor using their savings to invest and therefore generate an income that could sustain them post retirement. Also, I can’t help but think about your point about living in the country versus a capital city. I believe home ownership in metropolitan areas is increasing becoming out of reach for many Australians, however this doesn’t stop people buying property that is ridiculously overpriced, leaving them with million dollar mortgages. Despite what many say, you are right- most people who buy homes to live in do so from an emotional not financial perspective. My point is, I agree with your thoughts around home ownership for security but would like to add that your home should cost you as little as possible, given that it is not an investment like you mentioned. There was a great ABC article recently on the overcrowding of our capital cities and the importance of investing in infrastructure in rural centres. Love your blog, looking forward to reading more!

Great article! I’ve shared with some family members and it’s been great discussion fodder. Thanks 😉

What happens in the case where you have paid off the loan in in less than 15 years. (less interest) and then you become unemployed for a long period of time? So you own outright, and getting government handouts?

You still have a roof over your head.

Unless you have at least 12 Months living expenses when your renting, you can’t pay rent with no job!

This could happen if you had only just purchased – but this would give more incentive to hold on to it.

So, if you own and still can survive with government handouts your better off.

Also, 20 years ago houses in Sydney ‘the most expensive were more affordable. Now it’s a different kettle of fish.

I agree it is cheaper to rent. However, if you acquired 3 or 4 houses 20 years ago you would be ahead solely on the capital gains achieved. With the cost of property now out of reach of most, it would be better to park your money in the share market and build wealth for retirement and hope your not out of work for a long period of time.

Hi mate,

Enjoy your blog, good to see some aussie content on the blogosphere.

I currently rentvest (whilst sharehousing), and this seems to me the best way to keep investments up, and costs low.

I do think that your statement that PPOR doesn’t give you income is a little misleading. The income granted by a PPOR is not having to pay to rent elsewhere. And like the best of things, it is tax advantaged (well, kind of). If you don’t need to earn the money, you will not be taxed. The more you earn, the better the “return”, due to the tax rate being higher. There are costs associated with this, such as maintenance etc., but if you are aggressive with paying off your mortgage, or simply have a large deposit, it should still add considerable value in the long run.

e.g. Assuming in retirement a 30% average tax rate, in terms of income only, $500k fully franked shares yielding 4%, is at best equal with a $500k PPOR with approx. 4% rent equivalent not needing to be paid. However, the house provides cost stability which is important. So with enough assets/income, having a paid off house becomes more valuable.

I haven’t worked out all the math I should have, as the ideas are still percolating as to ‘ideal’ situations for various things, but there are various situations where it might work out more favourably. For instance, for sole high income households ($200k+ maybe), the benefits are likely higher than dual middle income house, because of the personal tax rates involved.

Not sure if you are familiar with the blog https://earlyretirementnow.com/.

He has some very interesting material on early retirement, and indicates that owning a house is important for withdrawal rate stability. He also recently posted about how his condo actually earned him money. It may not globally applicable, but very interesting.

Sorry about all the flak you are getting, would be nice if people had their minds at least a little more open…

Hi Mischa,

There’s no right or wrong answer here. I just wanted to open up the debate that seems to be one-sided in Australia (renting sucks, you must buy a house ASAP). I admit that there are parts of the article that are obviously biased to strengthen the point I’m trying to make but it’s impossible to know the future returns of asset classes.

I know plenty of people that buy first and pay off their house who are very wealthy. That’s the safer bet IMO.

I’m very familiar with ERE. Great blog.

Thanks for the comment, I enjoyed reading it 🙂

I figured that’s what you were doing, and it’s well worth having a conversation about.

I agree that we are very bullish at the moment on buying property, but this may change a bit after some of the outcomes from the Royal Commission into banking are finalised. I think we will see some headwinds for property in the near future, particularly for interest only investment.

Buying first is only safer if you buy within your means. If you buy too much house (or mortgage to the hilt as I’m often told), it would take too long to pay off, and you would have too much exposure to only property. Then add the potential volatility of interest rates, and it’s not a pretty combination.

The cashflow benefits I outlined in my above comment are better the lower the cost of housing, as in, money not spent on house can be spent on investments.

I don’t think that’s as clear as it could be, but I’ve got to get back to work. Hope it makes sense 🙂

Makes perfect sense mate. The Banking RC is so interesting to follow. I wondering if anything will actually be done though.

This is the best article I have read about this topic. Easy to understand and well presented. Thank you so much!

Thanks Michelle! Glad you enjoyed it

Excellent article and it’s the first time I seen someone actually factoring-in the interest on a home loan, (which most seem to ignore) and it’s something I’ve been saying for years.

I have owned 18 properties to date, (as a home renovator and sold every year) and have no interest in buying another at this time, as renting is far cheaper IMO if you weren’t to buy and sell.

Well done.

What if we have the full amount to buy a house ie no mortgage?

I would say congrats! And well done on saving that much money. I have not done the modeling for someone who doesn’t need a loan sorry. Tbh, both are good choices, the most important part is that you save well, and the fact that you can buy a house outright tells me you must be doing something right when it comes to savings 🙂

there are even more advantages to renting. a good article which points out the main pros and cons well. If I had known, I wold never have bought.

Haha I’m sorry AFB. I got a good chuckle reading the comments from the closed minded individuals who obviously know nothing of how the share market actually works (fear breeds ignorance) trying to convince themselves that property is better.

Most of them didn’t even read the article properly and if they had and actually punched in a few numbers themselves would quickly work out that shares are hands down the best investment.

I was pro property for years and bought 3 investment properties myself but only because I didn’t understand how the share market worked either. People tend to be frightened of that which they don’t understand.

Now that I do know. I’m selling all my property down and putting it straight in the share market. Now I’ll have about 3 more years of full time work and then I’ll be able to cut my work down from 6 months of the year down to 3 months of the year. Semi retirement by 34 and full retirement whenever I want after that and that’s only because I realised this too late. If I had started investing in shares when I started my property investing journey I would have been retired in my mid 20’s. Try doing that with owning your PPOR in full first.

I’ll continue to work those 3 months a year indefinitely after that though as I will continue to grow my nest egg and my dividend returns. Plus my work benefits are too good to give away for good.

Bet shares will help people retire earlier more often than property will. Give me the stress free predictable returns of the share market any day over the headaches and high costs associated with property.

Keep up the good work AFB. I bet your opinion on property has changed too the more you have discovered about shares. Would I be correct?

Hi Ben,

I wouldn’t actually say I’ve had a negative experience with property, in fact I’ve had mostly success with it. It’s just not the best asset class that’s going to help me reach my goals now. And that’s to generate a passive stream of income to live off.

I think property has its place for certain types of investors and I can’t say that one asset class is better than another. They’re all different with pros and cons.All I know is that I have identified the share market as my preferred method for funding my retirement (and it appears you have as well).

I laughed when you wrote about realising about it too late. Dude, 34 is so young. Some people NEVER realise it! It’s a blessing that we’re are about to live in this great country and even have the option to reached FIRE. What a privilege 🙏

When I saw part of the blog in the preview I was ready to greatly question your research however upon reading the whole blog I was delighted to know you do indeed know your stuff! Great post.

Thanks 😊

Hi ,have enjoyed this conversation immensely as a 51-year-old Who rents , what shares should I invest in

Hi. I’m 56 years old, divorced, and only live with a pet. During my life I purchased many times, and I also rented many times, and if truth be told the amount of stamp duty I ended up paying the government would set me up for the rest of my life and then some. I’ve also been a landlord, which I would never do again. It’s not for me. I sold my last home, just a small one-bedroom cottage in the Blue Mountains, for a good price in 2017 (thank God for the housing boom) and now I’m back in Sydney. I used to own a studio in Glebe, which I sold to go to the mountains, and then I sold to come back to Sydney two years later. All past purchases were emotional and I learned that I’m a bit of a nomad and tend to move every couple of years. The thought of living in one place for the rest of my life is a stifling one for me.

My problem now is this: I’m renting in a lovely place that I won’t be able to afford long term if the rents go up too much in future. I no longer work due to some chronic health issues, but I’m still 11 years away from the age pension, and I have very little super thanks to my last evil ex, who ran off with our retirement fund (we were investing in shares). So now I live off my savings; I don’t receive any Centrelink benefits; therefore, I live off my money 100%. I’m not rich and I live on a tight budget, but I have about 600k invested (not in shares as this is too risky, just in the bank). The interest I get from the bank is not enough to cover my rent, so I subsidise my living with the savings, which will keep dropping over the years.

Having said all of the above, however, I feel going back into home ownership is probably not a good idea in my situation. I did some figures and worked out that if I should live until my 80s, I can still rent, although my savings will be quite depleted by then, but the age pension will be of some help. Even though at present I can afford to buy a studio outright, I don’t want to tie myself up with with rates and strata levies (especially when they raise a special levy, which has happened to me before, and I had to end up paying thousands in a lump sum).

Having read your blogpost, I agree about all the pains of renting (big rises in rentals, stingy landlords who never fix anything, etc); on the other hand, buying again would be costly, with stamp duty to pay (yet again!) and there is always something to fix in the place, which can be quite costly, as well as going back to rates and strata, etc. I wouldn’t have much by way of savings left, and not being able to work (except in a very part-time capacity) I wouldn’t have a proper income.

One thing people don’t tend to factor in when buying is their health. I never thought I’d end up with a pain condition, which means I can’t handle too many stairs now, and I can’t do my own renovations eg. painting walls, putting up curtains, etc.

At the end of the day, I would be interested to know what you would do if you found yourself in my position. Single, some savings but no other income until age pension, no help from family, chronic pain condition.

It’s a scary thought but one worth thinking about. Life can be very cruel and if one is not prepared they can be left in the lurch. So like you said, at least with renting one has more options and flexibility while having your own “castle” is more secure, but you have to be careful that your possession doesn’t end up possessing you.

So many salty home owners

What are your thoughts on doing both? As in rentvesting to save up and buy the family home to live in outright (skipping all the interest on a mortgage) or at least rentvesting for a while to save a large deposit?

I’m a big fan of that Beau. We have rent vested our entire lives basically and i like how much freedom that grants us too. When we have kids I’d say we will most likely buy though 👍

Cheers

We are 0ver 70 and selling a home for 635K and working out rent or buy at our age. Our pension is very low and s there a consultation we can have with you and what fee to work out what to do.

Hi Sandi,

I don’t do consultation work I’m sorry.

Haha reading back into this and there are a lot of salty home owners. We own home and shares and that will be our strategy moving forward.

Only issue I see in the horizon is if we have to move from our 2 bedroom to a 3 bedroom which I am not looking forward to. Keep doing what do you do AFB!

Cheers mate 🙏

Thanks for being so open-minded despite some feisty replies in the comment section.

Your article combined with the comments here have given me, a newbie at adult stuff, tremendous insight in this topic.

Have been listening to your podcasts which are great. But it’s articles like this that are just so amazing for my financial education. Thanks Mr Firebug!

No worries Barydos 🙂

Can anyone work out roughly how many years it would take for a share portfolio to grow to the point where you could buy a house outright?

I would like to own a house at some point in my life but I am willing to wait. It seems it would be financially smart to buy outright, as opossed to paying off a mortgage and losing heaps to interest.

I would be looking to buy a 600k type of house (todays value) investing $500/wk into VDHG, can anyone have a crack at running the figures and advise if this is a wise plan or not?

You can have a go at calculating the time horizons for this using a calculator like this https://keisan.casio.com/exec/system/1234231998

Plug an inflation adjusted return into interest rate field – so what you think the market will generate after inflation and after tax.

Use something large for the number of years, like 50.

Payment frequency can be monthly, then work out how much you would contribute each month (ie 4 * 500, something around there).

As an example, with an interest rate of 4% it would take 17 years if you are contributing $2000 a month.

I m a firsthomebuyer I ve no deposit n I want to get in to house I need help if I can pay rent I can get in to a house