P2P lending is a topic I have been wanting to do for a long time but I never had the experience or expertise to write about it. I’m the kinda guy that actually likes to do something before I claim any knowledge on the subject. There are people out there believe it or not, that actually give seminars and speeches about how to become master in topic X without ever actually have been a expert in the first place.

Anyway, peer to peer (P2P) lending has been an interest topic of mine for about 2 years now. And when a reader emailed me with their experience with P2P lending I thought it would be a good opportunity for a guest post.

Chris has been investing in P2P lending platforms for over 2 years and he was kind enough to share his experience with us.

So without further adieu, here is the post. Enjoy 🙂

P2P Lending Guest Post

Several years into my FIRE journey I was seeking more diversification, more yield, and more interesting ways I could take control of my investments. Already I had delved into the share market, given managed funds a second chance (a story for another day). Then, one dark & stormy night, while searching across the digital internet on my electric computing device, I came across something called Peer-to-peer (P2P) lending.

Reddit and Whirlpool, where all the cool kids hang out, wasn’t much help in terms of details – just a few mentions here and there about UK company, RateSetter, entering the Australian market.

Magnets, How Do They Work?

I was able to discern that P2P lending, broadly, involves lenders/investors, being able to choose where their money is invested using online platforms. This is in contrast to a Real Estate Investment Trust, or index fund, where the investor’s money is managed by someone else. ASIC has a nice little write-up here (https://www.moneysmart.gov.au/investing/managed-funds/peer-to-peer-lending).

Each P2P provider does things in their own way, but it seems common across all platforms that these investments are very risky, often uninsured, unsecured, and can have a very delicious return.

At the time (December of 2015) the major players were RateSetter and SocietyOne.

SocietyOne is only open for the “sophisticated” investor – with a hefty minimum investment of $500,000, while RateSetter had a minimum

investment of $10… So, ugh, RateSetter it is!

My Experience With RateSetter

RateSetter operates both personal loans and business loans. Lenders elect what rate of return they want, what amount of money to lend at that rate, and for how long (1 month, 1 year, 3 years, 5 years). Then, they are matched to a borrower, who is seeking the lowest rate they can get. This makes the market a bit competitive as lenders undercut each other in order to get their money matched to a borrower.

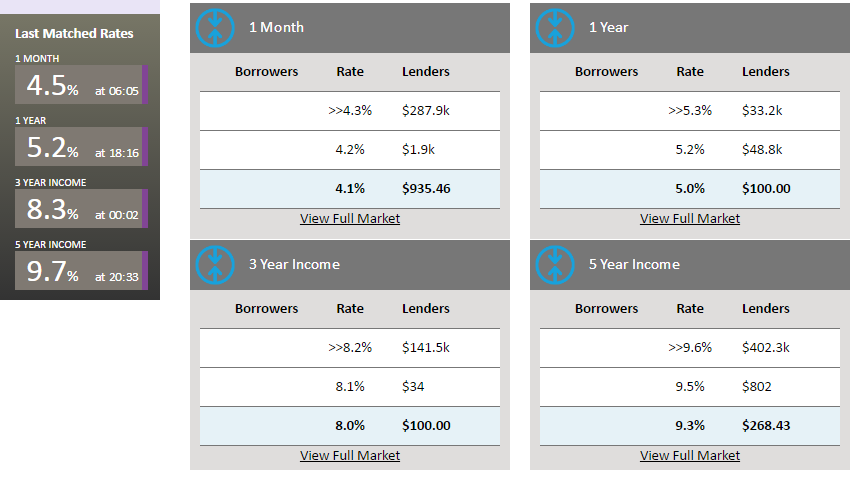

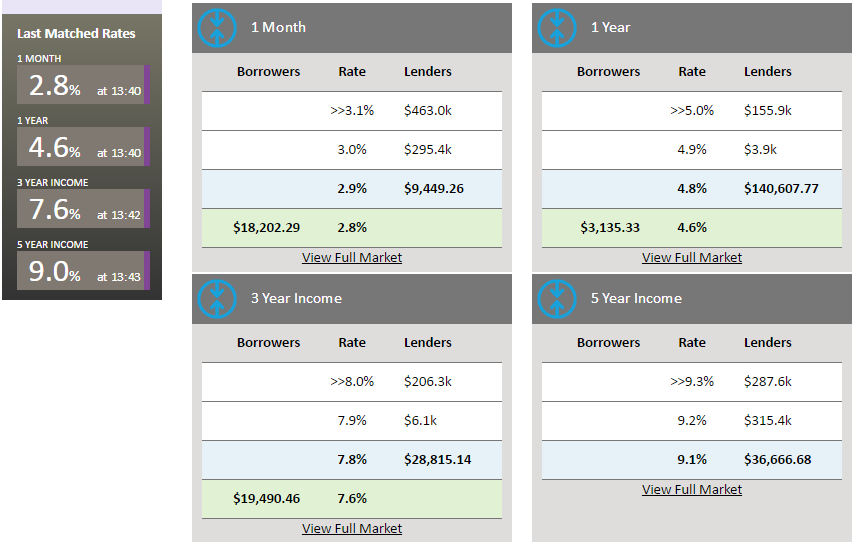

In this competitive market borrowers can snag rates better than what a bank would offer them, if the bank would lend to them at all. I’m going to paste in two screenshots now. The first is from December 16th 2016, and the second is from January 12th 2017. You can see how competition and demand can affect the rates over the course of just one month.

1 – December 16th 2016.

2 – January 12th 2017.

After assessing the PDS and reading about the risks involved, I decided that $5k was appropriate for me to start lending. I watched the 1-year market, selected a 5.9% rate (which was slightly above the last match) and I got matched in a few days.

This turned out to be a good rate, as competition pushed the rates down a full 1% a few months later.

Given the Peer-to-peer nature of the platform, I was expecting a little more involvement on my behalf in the matching process, and later I’ll discuss MarketLend which has exactly the level of control I was expecting. Then again, I can see how some people might prefer the ease of RateSetter’s automatic matching.

The 1-month and 1-year markets in RateSetter are structured very straight forward. Your returns are paid once per month at the rate you were matched and at the end you get your principal back.

In the 3-year and 5-year markets, however, both the interest and part of your principal are returned each month.

None of RateSetter’s loans are secured but there is a “provisional fund” from which they can compensate lenders for losses at their own discretion. Information on how often this happens is hard to come by (my Google-fu failed me).

Over the course of the investment, here are my interest payments:

| Jan/2016 | 26.73 |

| Feb/2016 | 23.49 |

| Mar/2016 | 23.49 |

| Apr/2016 | 26.73 |

| May/2016 | 22.68 |

| Jun/2016 | 25.11 |

| Jul/2016 | 25.92 |

| Aug/2016 | 23.49 |

| Sep/2016 | 25.11 |

| Oct/2016 | 25.11 |

| Nov/2016 | 24.30 |

| Dec/2016 | 23.49 |

So… what to do now that’s finished?

Well, I delved straight back in again and got matched in the 5-year market at 9.5% 🙂

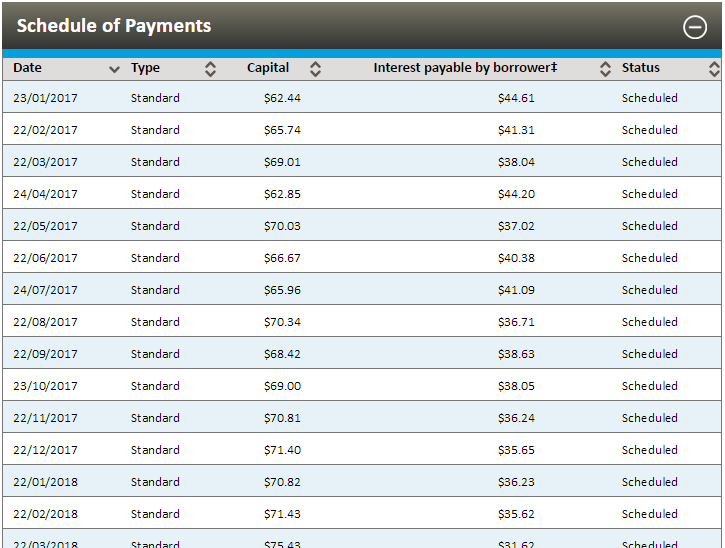

And RateSetter provide a nice little schedule of payments for the life of the investment.

As you can see, this time, in the 5-year market, a portion of my principal (“Capital” column) will be returned each month, and my interest earned is reduced accordingly.

When these payments start rolling in, I will give the “auto-bid” feature a crack. With the auto-bid, payments made to your holding account can automatically be reinvested in the market and rate you specify – either a set rate, or the current market rate. Very handy!

My Experience With MarketLend

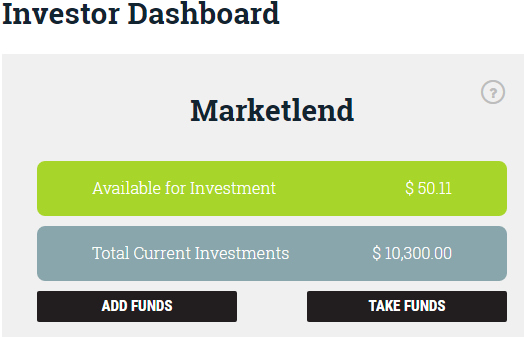

My good experience with Ratesetter made me a little braver when I decided to try out MarketLend. I threw $10k at it in August 2016 and payments started in September.

This is a platform which focuses on business loans.

Some loans are insured, some are uninsured. Some loans are for supply chain financing – where MarketLend will own the supplies – and some are simply a line of credit. One of the more interesting loans I’ve seen was for a short-term money lender. I was an investor, lending money to a business to lend money to a business to lend money to people… Hold on while I go watch “Inception” again….

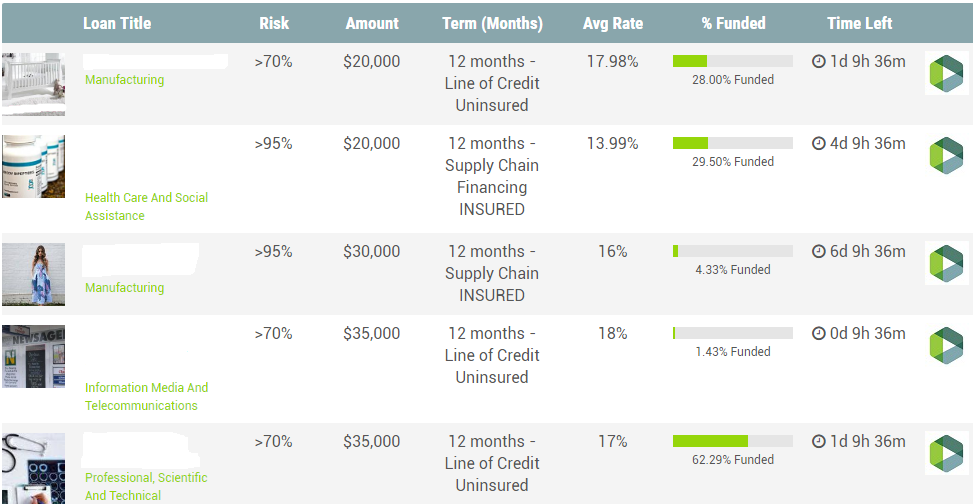

MarketLend advertises these loans to investors in the form of units, each valued at $100. I.e. if i want to lend $1000, I would bid on 10 units at the rate I want. At any time another investor can undercut my bids, introducing a competitive element here as well.

Those high percentages might look amazing but hold on… because I should tell you about utilised versus unutilised parts of the loans – which will affect your return.

In these loans, the borrower might not access all of the capital which is on loan. The money which HAS been accessed, is the “utilised” amount. The rest is “unutilised”. This is important because your return (of say 18%) only applies to the utilised amount. So, even though you might be lending out your money at an amazing 18%, your gross return will be much less. Then MarketLend takes out their fee and your pre-tax return might be %8 (this is my actual average return so far across all my units).

Borrowers could also back the loan early. In which case you get your principal back early, the loan ends, and you are free to carry on your merry way – maybe withdraw the money, maybe invest in more units.

What I really like about MarketLend, is that credit checks and financial statements from the borrowers are available, so you can get very acquainted with them before deciding to bid.

This is the level of control and information I was looking for in a Peer-to-peer lending platform.

In the interest of diversification, I spread my $10k around many different borrowers at many different rates and levels of risk. Here’s a sample:

And here’s my returns so far:

| Month | Amt | Real Return |

| Sep/2016 | 34.60 | 4.15% |

| Oct/2016 | 74.87 | 8.98% |

| Nov/2016 | 81.55 | 9.69% |

| Dec/2016 | 76.56 | 9.10% |

| Jan/2017 | 83.53 | 9.83% |

I have used my returns to buy additional units, so I currently have $10,300 invested.

Finally, MarketLend features a secondary market where lenders can sell off their units to other lenders. This is useful if you no longer wish to carry the investment, or just need some liquidity.

I’ve picked up a few discounted units here – it’s definitely worth a look if you decide to go down this path.

Conclusions

P2P lending is cool. It’s high yield. And comes with high risk (so read those PDSs).

I like how MarketLend lets me choose who to lend to and the ability to make an informed decision – but RateSetter is also nice so I will continue to use both.

| Ratesetter | MarketLend | |

| Pros’s |

Website looks and feels more professional. Predictable returns. Provisional fund may reduce risk of loss. |

More information and more control and over lending. Easier to diversify investments. Secondary market allows selling/buying units. Australian owned & operated. |

| Con’s |

Little control over matching process. Did not notify me when my investment ended. The queue-like structure delays matching. |

Utilised/unutilised was confusing at first. No Bpay facility. Did not notify me when one of my investments was repaid early. |

What’s Next?

Another P2P platform caught my eye recently; Brickx. These guys break down a house mortgage into 10,000 units, which investors can bid on, buy, and trade with each other.

Returns come from cash-positive rental income, or capital gains in a sale. I have a bit of saving to do, and a couple of impending financial commitments to get past, before I’m ready, though.

For now, my P2P returns will continue to be reinvested. Due to the nature of the investment, I should expect some losses over time, as borrowers default or make late payments, but that’s why we manage our risk.

-Chris

Wow, what a quality insight into the world of P2P lending. I would like to thank Chris again for putting that amazing post together. If you have any questions about it please feel free to comment on this article. Chris has agreed to answer your questions in the comment section below.

Show Notes:

Thanks so much for this. I have identified P2P as something I would like to play with as a satellite investment somewhere down the track (for Chris’ reason of “more interesting ways” to invest.) Hearing from someone who has experience with the two platforms, and being able to see the screenshots is really helpful. Bookmarking for the future.

No worries Mrs ETT 🙂 You should be thanking Chris though. He put a lot of work into this. Happy to hear positive feedback

I’ve been concentrating my portfolio into P2P for a while now because of its consistently high returns. You should check out the platform I’m using it’s called MoneySpot. There are a few new options for Aussie retail investors. True Pillars is another one.

My preferred P2P’s are True Pillars, Ratesetter and Latrobe Financial. I think the key to P2P is to only invest small amounts in individual loans, to spread the risk. Some platforms have minimum requirements e.g. Latrobe Financial Select Investments has a minimum of $1000. Balmain Trilogy has a minimum of $10,000.

My experience with Marketlend has been poor. Their communication with investors on defaulted loans is abysmal, and they extract 23% in fees on the interest you get. While I am ahead overall, I am still waiting for one defaiulted loan to be finalised two and a half years after it matured. Marketlend likes to boast none of its investors have lost money. They can continue to support that claim by not winding up a default.

Once I am out of Marketlend, I am never going back. In hindsight, the interest rates they charge borrowers indicates they are lenders of last resort, to the riskiest part of the P2P market.

I wanted to dip my toes into P2P but simply haven’t found the time to do the research. I’ll take a look at these when I get a minute.

I’ve just been reading about P2P lending & I’m interested where I need to go to have someone invest in a loan for me, (individual). I’m trying to get some money together to put in a split system air conditioning unit. I’m looking at $1,600 and that includes instillation. There’s a system on sale for $600 ATM,, not instillation, but I don’t have money up front to pay up front. Where do I go so I can pay back each week/ f/night. I’m looking at $20 P/week to pay back loan.

I’m a student with credit report score of 726.

Please help or point in right direction. Much appreciated 😊

Hi Katrina,

I’ve only looked at P2P lending from an investors standpoint I’ sorry. I don’t know how it compares to other products that are offering loans. I’d be very interested in knowing how you go if you decide to go through with it though.

I’ve been using Ratesetter since the day it was launched in Australia – I’d been watching them and Society One for about two years waiting for my invite. I have to say that I LOVE it. My investments rarely wait for more than a week to be matched with the reinvestment facility (Chris called it auto-bidding)

I set all payments from my 5 year investments to be reinvested in the five year market. Consistently seeing 9%+ returns (From memory, Ratesetter takes 1% of your interest payments, an absolute pittance!). For me it has been the ultimate set and forget investment, and within 2 years I’m now seeing returns of $100p/month.

I could wax lyrical about Ratesetter for hours. Every single friend who asks me where they should start investing, this is my choice for them. Ratesetter has 100% repayment rate in Australia, and their original UK company has not cost investors a single dollar. Reading between the lines, some people have defaulted on loans, and only the capital is returned to the investor. So there is the potential for a zero return, but it still gives me warm fuzzy safe feels.

Sorry – 10% of your interest is taken as fees, but it is rounded down, so…

$1000 invested at 9% generates a $90 return over the year. Of that $90, $9 is taken by RateSetter. So you’re $90 return becomes $81 and your 9% becomes 8.1%.

So your return is generally about 1% less than the listed rate. That’s why I was thinking 1% 🙂

It’s interesting they choose to round down though. The smallest loan you can make is $10, so my monthly payments for a $10 loan are generally less than 10c ($10 * 9% / 12payments = 7.5cents) and they don’t take a fee out of that.

It’s nice to hear about someone else using P2P with success 🙂 I felt a bit alone when I dived into that ocean.

Checking out your site, and omgosh, a fellow chainmail enthusiast? 😀

I made a mail byrnie back in 2011-12. Took hundreds of hours but it was totally worth it.

Thanks for your reply LadyFIRE. VERY interesting to hear about your positive experience. After reading that and speaking to Chris about it..shit, I think I’m ganna have to dip my toes in ?!

Dive in! I absolutely love it. I think I may have over-loved it and I’m in the process of trying to balance it. My Ratesetter investment once sat at about 50% of my portfolio (ignoring real estate).

Those returns are just to tempting, got to diversify!

And @Chris – Chainmail is good fun, although I wouldn’t go so far as enthusiast! But I do love being able to make something out of (almost) nothing. I think I bought an $8 coil of fencing wire and churned out six or seven bracelets before my hands got tired.

I’m currently invested with New Zealand-based P2P platforms, Harmoney and Lending Crowd. Both have different structures with different levels of risk and return. I’ve been with Harmoney for about 18 months and am getting a net annual return of around 15% although it’s higher risk with unsecured loans. Lending Crowd have secured loans and I’ve been investing through them for around 4 months. Net return there is around 12.5% albeit with lower risk.

Both have set rates for the borrower depending on their assessed risk level. The lender then gets the interest and principal repaid minus a 10 to 12% fee on the interest paid.

As you rightly point out, it is a higher-risk investment so I am limiting how much I have invested to $50k. But I still consider it a valid investment option. Just have to understand the potential downsides when considering it.

Thanks for the post Chris,

Great podcast listened to it this morning on my daily commute.

‘Cloak and Dagger’ ‘I’ll edit that out’ gave me a good laugh its still there.

I heard about P2P over a year ago too but it was SocietyOne and when I checked it out the sophisticated investor hurdle through me off. It’s something that I will consider in the future and like yourself would probably limit to 10% maybe 15% of my portfolio.

Cheers,

FIitOut

I haven’t listened to the final podcast yet… Mr Firebug left that in?? oh no! D:

A long while ago I added myself to SocietyOne’s mailing list just in case they did make smaller investments an option.

You could also look into ThinCats and MoneyPlace.

Shop around 🙂

I genuinely LOL when that was pointed out! How did I miss that!? Ahh well, Lucky we are both anonymous plus I doubt anyone at Rate Setter will even visit this website let alone listen to the podcast ���?���

:O Oh no lol Chris is going to kill me!

Ha! I had to skip ahead on my podcast catch up just to hear this. Love that it made the final cut.

Is brickx a p2p lender? After having a quick look, it appears to be fractional ownership of the underlying property.

Is there maybe a different section of the website they do mortgage lending p2p?

I haven’t done too much research into it tbh. I think it’s like a REIT ETF where you can get exposure to the real estate market with minimal capital by only owning a fraction of the property.

I could be wrong though so please do your own research if you’re looking to invest.

Hi Dazzle, you are correct, BRICKX is fractional ownership of trusts that own residential property.

Hi

Andrew her from RateSetter. We’d be more than happy to chat to you about how RateSetter works. It’s an exciting time for peer-to-peer lenders and investors. Lots of choice and transparency is a good thing!

Cheers

Andrew

La Trobe Financial also offers P2P lending in addition to its standard pooled credit fund. The advantage over RateSetter is that the loans are secured by a mortgage over the property, which means lower risk than the unsecured loans offered by RateSetter. This feels like a better risk/reward ratio to me, but check it out for yourself. Disclosure: No investment in either product, but currently interested and investigating both options.

Ratesetter and TruePillars have been good for me. Be extremely cautious with Marketlend. Go to the Whirlpool website under the Financial tab to see why.

To expand, search the Financial tab for Marketlend. Then read the comments. Marketlend was responding early on to comments, but hasn’t done so in the last year.

Thanks for the heads up Baz!

Is Ratesetter really that good?

While the security of my funds in Ratesetter is something I am happy with, I am not so sure about the interest rates on offer. The devil is in the detail.

Let’s start with the one month market. I have $1992 at 2.9%. The detail of the contract says I will be paid $4.87 at the end of the month. Annualised, that is 2.93%, less fees of approximately 0.2%. Better than banks and credit unions are offering, OK so far.

In the one year market, I have $1163 at 4.5%. Schedule of payments says no capital repaid until end of term, interest paid monthly, total interest $38.96. X100/1163 = 3.35%. Wait a minute, that’s not 4.5%, or 4.3% after fees. It’s not within a bull’s roar.

OK, try the three year market. $4714 at 7.5%. Capital and interest paid; interest is paid on a reducing balance. My total interest payment is $609.20 over three years. 609.2X100/4714 = 12.9%

Divide by 3 = 4.3%. So unless I want to keep rolling capital and interest back into those three year loans indefinitely, I’m not getting anywhere near what’s advertised.

Five year market is the same. $3525 at 8.9%. Same as three year market, capital and interest repaid in monthly instalments. Total interest = $722.87X100/3525 = 20.5%/ 5 years = 4.1%. I’m actually doing better in the three year market. Do I want to tie up money for five years continuously? At my age, I don’t even buy green bananas.

I am currently averaging about 5.3% return with a mix of all four terms, and rolling capital plus interest back in. I don’t have any problems thus far with Ratesetter’s business model. However, Ratesetter’s advertising on rates can be quite misleading at face value.

Unsure what’s going on in your 1-year market investment. It might be best to contact the Ratesetter people with that query and let us know what you find out 🙂

For the 3 and 5-year markets, I like to reinvest the interest earned and the principal returned. Over time this has spread my investment over many loans.

There is an auto investment feature to get money in your holding account back in the market, although I prefer to do it manually.

One feature of Ratesetter I do like is getting one’s capital back. No mucking around. Then you can choose to reinvest or withdraw.

In contrast, getting capital back out of Marketlend is like getting blood out of a stone. I have several loans there which have reached their one year term, and I have declined to extend the term of the loan. Where’s the money? Fuctifino.

The early return of capital is actually the very problem of ratesetter. You may rejoiced that you are able to get a let say 11% for a 5 year lending period, then bam, you get very often, the return of those capital and you have to decide what to do with your capital. In other words, when you buy it “cheap”, you are unlikely to enjoy the cheap perks i.e. high interest rate return with time, yet with zero capital gain.

If you had instead purchased shares at a very low P/E ratio instead, you forever keep that low purchase cost forever till you sell it for a profit (capital gains). In bonds, you also benefit from that feature when you buy cheap.

For this very reason, I’ve stopped investing in it.

Some of the questions from the podcast…

* In the ratesetter statistics page you can get all their loans in an excel file.

* On the same page you can get the % of people who didn’t pay or are currently delayed.

* When they apply for the loan, they get charged some money to put into the provision fund. If they’re risky people, they will be charged more.

* You can also get the $ amount of applicants for loans vs the actual $ approved here too.

They have never sent me an email about people who delay or haven’t paid. But they’re always happy to send me emails about people who have paid early. Another minor risk of this thing is if interest rates go down, people can pay early to refinance into a new loan at a lower interest rate here or somewhere else.

The interest rate is based on your return if you “reinvested” all your returns. Say you do the 9% return for 5 years, you won’t get 9% after 5 years. But if you reinvest all the payments for another 5 years, then it’ll add up to 9%.

Ratesetter must have fairly adequate software, because they are managing loans of a few hundred dollars in a loan base of $250 million. I also think their lower interest rates compared to P2P such as True Pillars and Marketlend means they are probably more selective with borrowers.

I’ve never been notified of a default; however, if I was a borrower I would want to stay onside with them, because the next tier of lenders demand much higher interest rates.

It looks as if the Provision Fund is coping with any defaults arising at present.

Very low P/E ratios on shares are very low for a reason. Either the market thinks the stock is loaded with debt, and is very risky, OR it has zero chance of capital appreciation. Bear in mind the chances are pretty good on a company with a low P/E ratio producing a lower dividend than it did in the past – just ask Telstra shareholders.

Market lend no longer takes rank amateur investors, which is a shame. I was using it for a while. You have to be a “sophisticated investor” which basically means you have a lot of money lying around. Having not even a million or so across all asset classes I am apparently not sophisticated enough and got kicked out, or maybe I should have lied on the questionnaire since they never actually checked up (wouldn’t recommend this, they’ll probably check up eventually).

Ratesetter, Raiz (formerly Acorns), Spaceship etc all have much better end of tax year paperwork than Marketlend so I’m not that fussed. I’m aiming to have a nice chunk in all of them and Vanguard ETFs too over the next couple years, I’m currently very heavy in property and only breakeven now, not positive. Something something don’t put all your eggs in one basket, there’s lots of options out there, and even the ones that seem a little dubious are still good to put *some* money into.

Personally, I will be glad to get out of Marketlend, because they treat investors like shit.

Example 1. When loans come to expiry ( usually 1 year ) the borrower mostly wants to extend. So the onus is on the investor to decline extension of the loan. However, having done that, I have several examples where Marketlend does nothing to ensure the capital is repaid to the investor. Instead, one has to put it on their Loan Exchange and hope for the best.

Example 2. Loans in default. Stating settlement will take place shortly wears a bit thin when an investor has been waiting for up to a year without seeing a cent returned. I suspect Marketlend hangs on to money it has already received so it can maintain its advertising that no investor has lost capital. I have close on $10K sitting in limbo while Marketlend produces the occasional condescending update when it feels like it.

You have been warned.

I’ve been trading on a few P2P platforms now since August last year. After comparing the ones available to retail investors (RateSetter, MoneySpot, TruePillars & Wisr) I’ve now got money in the first three. TruePillars was my first platform and I must say, I quite like the way it works. I’ve had a focus on diversification and to date have not had any defaults (currently returns sitting at about 13% to date across my 70+ loans with the biggest loan now only 4% of the total portfolio. Just note to be patient on building the portfolio as it has taken me a while to build all the different loans).

MoneySpot is simply just a fund where you have no active involvement in the day to day operation but I’ve not complained about the 12.8% returns.

RateSetter I’m only newly invested in (several weeks) so too early to tell. To date I’ve held off Wisr as it has a 10K min investment and the quoted returns were about 7.6%.

Have never had a problem with Ratesetter in about 3 years. Bear in mind the capital is repaid as well as the interest on a monthly basis, so unless you reinvest the returns of interest decline accordingly. They have cut out the one year term, so it’s either 1 month, three years, or five years. TruePillars is also quite good, although they have had several defaults.

Latrobe Financial only pays 5.2% interest, but that’s on residential bricks and mortar with a maximum LVR of 70%. One year term.

Still slowly reducing my exposure to Marketlend. Their communication with investors on defaults is shit.