I’ve been thinking about this post for the past 18 months, and to be honest, it’s long overdue.

So much has changed over the last 11 years since I first stumbled across FIRE.

And if the article’s feature image wasn’t obvious enough, I recently became a father. So, now is the perfect time for a big update/recap on life at the Firebug household.

Are We Still Chasing FIRE?

A few people have noticed we haven’t invested in shares since October 2022 (over a year ago!). Some community members have been commenting on my net worth articles and emailing me directly, asking if we’re still actively pursuing FIRE.

The short answer is yes.

The long answer is more interesting.

For the first time since we started our FIRE journey, we have switched from accumulation to consumption. We’ve been dipping into our portfolio (spending some of our dividends) every now and then for the last two years.

And believe me when I say this was not a simple task to accomplish. When you’ve dedicated over a decade to pursuing a goal and have structured your life around constant optimisation and channelling every available dollar into investments, it goes against your instincts to spend rather than save.

Old habits die hard.

Imagine asking a seasoned marathon runner who has spent years training for endurance races to suddenly become a professional weightlifter.

But what’s the point of investing if you never switch from accumulation to consumption?

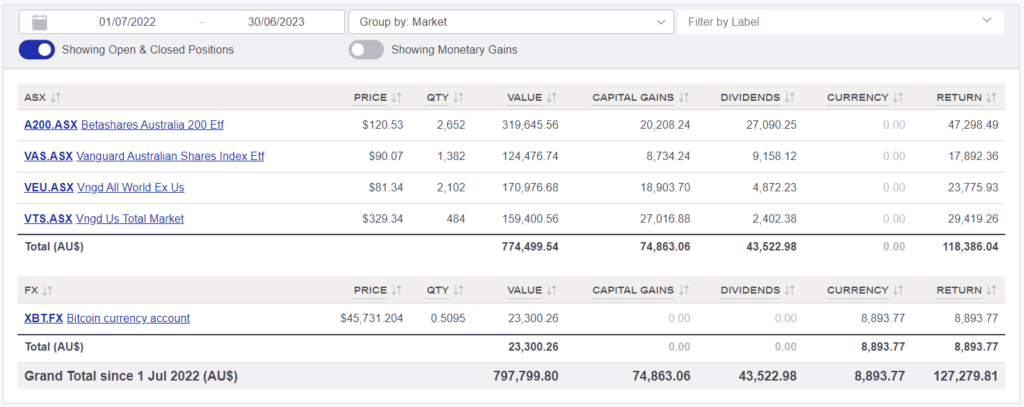

We earned ~$43K in dividends last financial year.

Even though the markets had an above-average return last year, $43K is not enough for us to live off completely. However, it’s a fair chunk of change that allows us to buy back our time now rather than waiting to hit some arbitrary number in a spreadsheet.

During our FIRE journey, our priorities changed, and the race to financial freedom no longer seems so important (more on this below).

Side note: This is a major consideration point that many Excel spreadsheets neglect to model for. Super is a fantastic vehicle to save for financial freedom. However, if your priorities change halfway through your journey, that money is locked away until your preservation age. Looking back, I’m really pleased that we decided paying extra in taxes was worth the added flexibility.

Heavily inspired by the book ‘Die with Zero’ by Bill Perkins, we knew that in our late twenties, we had a brief window of health, financial stability, and free time to explore parts of the world we had always wanted to visit.

And that’s exactly what we did.

We have travelled to over 30 countries and visited every continent on earth (except for Antarctica).

I’ve found that many people in the FIRE community tend to be a bit cynical about the whole ‘Travel the world while you’re young’ cliché.

“Sure, it’s cool and all. But you know what’s really cool? Never having to work ever again!”

I held a similar belief for quite a while and often wondered whether those who splurged on travel were trying to convince themselves it was all worth it because they spent a fortune.

But living overseas and visiting so many different cultures changed my point of view.

I’m not saying it will be as transformational for everyone as it was for me, but travelling dramatically broadened my horizons, particularly regarding my relationship with meaningful work.

Spending god knows how much we spent during those two years abroad was, in some ways, more of an investment than saving our money and buying shares.

There’s a good quote that sums it up for me.

“Travel is the only thing you can buy that makes you richer.” – Anonymous

Retire From The Rat Race, Not From Work

When I reflect on my journey towards FIRE, it’s crystal clear that my desire to escape the rat race was largely motivated by a job that left me unfulfilled. I wanted to create a passive stream of income so I could pursue other interests without worrying about paying the bills. Financial freedom was my ticket out of the monotonous 9-5 grind and onto eternal Happyland.

I think many people are attracted to the idea of FIRE because they either hate their job or are left unfulfilled after spending most of their time there (that was me).

My professional work life has had two distinct phases. Pre-London and post-London.

I worked for various levels of government in regional Victoria for eight years before my wife, and I jetted off to the other side of the world for a two-year adventure.

Pre-London, Matt enjoyed the people he worked with and found parts of his job fun and interesting. But it was extremely rare for him to get ‘excited’ about work. Work at that stage was 95% about making money so he could live his life outside of it. Public sector culture tends to be sluggish, bureaucratic, lacking energy, and occasionally downright wasteful.

I never had a problem with any of that because as long as I was cashing my paycheck, it’s all good.

However, an unstimulating work environment can gradually destroy your creative spirit.

Subconsciously, I was checking out. Towards the end of my first job, I just didn’t care what was going on. I had no passion for the work I was doing. No pride or excitement. Just rocking up to collect money, talk with some of my mates and bounce.

If you put up with this long enough, you may lose sight of, or simply stop searching for, the enjoyable aspect that meaningful work can provide which is a terrible outcome.

Or as Dr Robert Doback so eloquently says at the end of Step Brothers, “Don’t lose your dinosaur”.

Fast forward eight years, and I started my first consultant gig in one of the busiest cities in the world.

London is like a vibrant melting pot filled with diverse ideas, talented people, and innovations. It’s filled with folks who are passionate about changing the world. I was working alongside some seriously talented people with incredible energy and an ambitious spirit that rubbed off on everyone they worked with.

It took me until I was 29 years old before I got my first taste of kick-ass, motivational, and inspiring work culture with world-class leaders.

I had a really interesting conversation with Carl Jensen (AKA Mr. 1500) in July, and we spoke about sliding door moments and how fulfilling, purposeful work has the power to inspire you to leap out of bed each morning.

He asked me a thought-provoking question that went along these lines.

“Would Aussie Firebug be a thing if you moved overseas straight after uni and were genuinely inspired by your job?”

I’ve been thinking about that for a while now, and the honest answer would be no.

Why would I need to reach financial freedom and escape the rat race if I was in a job I really liked? If I had been truly satisfied with my job, I wouldn’t have been driven to explore other paths.

That being said, even if someone enjoys their job, there are still legitimate reasons to aim for financial freedom. However, in some cases, the burning desire to make necessary lifestyle changes may not be there, and it’s really hard to change your lifestyle if you don’t have a strong ‘Why of FI’.

So What Now?

In some strange way, I feel like I’ve skipped the ‘Financial Independence’ part and gone right ahead to the ‘Retire Early’ portion. My version of RE has always been ‘Retire Early’ from the rat race. It’s never been about not working.

And financial freedom isn’t binary, either. There are levels.

From an Excel spreadsheet point of view, we have not reached financial freedom. But from a real-life point of view, I’m as free as a bird. I know that our portfolio will continue to compound over the years and eventually hit our FIRE number.

But that part is kind of irrelevant to us now. I already feel like we have conquered our first mountain (FI), and now it’s time to shift our attention to the next phase of our lives (RE).

Another sidebar: Some people never get off their first mountain. They make all sorts of excuses to keep working another year and saving and investing and saving and investing. They drop their safe withdrawal rates from 4% to 3.5% and then 3% just to make sure. A lot of people in the FIRE community have drifted away from the movement’s initial objectives and principles. Live a happier and more satisfied life by buying back your freedom through intentional lifestyle choices and common sense investing. But if you never dare to take that initial leap from that first mountain, you’ll remain stuck in the daily grind, even if you accumulate immense wealth.

I’m not kidding when I say that I feel thankful for how my life has turned out almost every single day.

The life I’m living right now was something Matt could only dream of in 2015 (when I first started blogging). And I’m not just talking about all the travel either. I’m mainly talking about having complete control over my time during the week. Some days are spent travelling back and forth to Bunnings doing home renovations with my dad. Some days, I’ll walk with my sister and little nephew for a few hours. Some days, I’ll catch up with Mum, and she’ll tell me all about her and Dad’s next trip over a cuppa.

Some weeks, I’ll spend 40 hours working on my business if I’m in the zone. Some weeks are dedicated to getting AFB content out there.

Having absolute control over your time is a blessing, yet it can also present challenges.

It’s kinda like going to a restaurant offering over 100 different meals. It’s overwhelming at first. You feel the need to look at every option in case you get meal envy after you order. Sometimes it’s really nice when they only offer 3-5 dishes.

Having a job to go to gives people structure. And I’ve rarely appreciated that structure until I stepped out of the 9-5.

It took me about two years to actually figure out what I wanted to do work-wise. I don’t care who you are, everyone has a vice. We all need to engage in some form of meaningful work, even if it doesn’t necessarily result in earning money.

In this net worth update, I wrote about my aspirations of bringing some of that vibrant work culture from the UK back to my hometown in Victoria and my dream of a co-working space.

Helping foster a local community of like-minded people is really important to me. It’s part of what I’ve been missing since returning home from London. I haven’t found my ‘work people’ yet, but I know they’re out there. I just need to bring them together 🙂

Feel free to follow our Co-Working Facebook page to follow along.

I guess the main point is that I march to the beat of my own drum these days.

I’ll always be a finance nerd, but I have completely lost the obsession I once had with investing, budgeting and tax minimisation strategies. I’ve even put a pause on consuming FIRE-related content, except for those I’ve been following for a while and have a deeper connection with as individuals, rather than simply using it as motivation for my own journey.

I’ll continue posting our net worth updates until our passive income exceeds our expenses (based on the 4% rule). Once that happens, I don’t see a need to continue to publish those articles.

As far as our strategy is concerned. We are still aiming to build our passive income mainly through shares, cash and a little bit of Bitcoin for some speculative fun.

Our core mix of A200, VAS and VTS remains the same. Our current target weightings for each market are 20% US, 20% world and 60% Australia.

I know plenty of people will say that’s weighted too much towards Australia. However, I want to stress the significant psychological power of using dividends to cover your expenses rather than selling shares.

We still haven’t cracked open VTS or VEU even though that was the original strategy. And I’ve come across countless members of the FIRE community who have suffered the same fate. Many find it much simpler to use dividends that land in their bank account, as opposed to selling down their portfolio.

We must be pragmatic about these sorts of things. Efficiency is important, but there are times when it’s wiser to choose the strategy you’re most likely to execute.

I’m a Dad Now!

The biggest change of all has been a recent one.

Mrs FB and I welcomed the newest member of the family in September, marking a moment that forever changed our lives.

I won’t get into all the details of how our little bundle of joy has transformed our world because it’s an emotion that only other parents can understand.

But what I will say is that from a FIRE point of view, having a child hammers home how important controlling your time really is.

And to be fair, this is something I’ve been speaking about since I started this blog. I knew all the way back in 2011, when I first started working, that having a kid really chews up your time. One of my biggest motivators for reaching FIRE was to be able to do everything I loved doing while also being a committed father.

I just couldn’t see how that was possible working 40 hours a week since I had so many extracurricular activities I enjoyed.

I had seen this story play out a bunch of times before. People have kids, and suddenly, they can’t find the time to look after themselves, or they start forgoing activities that make them happy.

They might be unable to focus on their health and fitness as much and become unwell. They begin to see friends and family less frequently than they used to. They start skipping social outings because they’re exhausted from the week etc. etc.

From what I witnessed growing up, it appeared that new parents often set aside their passions and self-care to invest more time and energy in raising their children. A noble goal, but I selfishly wanted to put myself into a position where I could do everything that made me happy and be a kick-ass dad.

FIRE was going to give me my time back when I needed it the most.

And it’s pretty much worked out that way now.

Friends and family have been asking me when my paternity leave finishes, and I’m like:

“I work for myself. I can have as long off as I want”.

I feel incredibly fortunate to have the best of both worlds. I’ve kicked off some projects that fulfil my desire for meaningful work, yet I also have the freedom to relax and spend entire days with my lovely daughter if I feel like it.

This is what FIRE is all about IMO.

Conclusion

Our FIRE goal from the very start was always to ‘Retire Early’ from the rat race. It was never about not working altogether or amassing the biggest fortune.

From my experience, once we had around 50-70% of our expenses covered in passive income, that was enough to give me the confidence to quit the stable 9-5 and have a crack a something else without worrying about the money.

For me, that’s starting a co-working space in my hometown, helping build a community of like-minded people, and addressing my love of all things data through a business idea I’ve been cooking up.

When you have autonomy over your time and start to work on projects that ignite your passion, you look forward to working almost every day.

There is also a really important concept that I hope you’ll consider too. Similar to the unwritten rule of not starting another book before finishing the current one, it might feel like you’re cheating if to jump ahead in the journey and begin enjoying the benefits of RE before reaching FI. However, not only is it perfectly okay to do so, but I also believe it’s the better path.

I consider myself extremely fortunate that my partner and I found ourselves in a situation where I had to resign from my job to fulfil a bucket list item (living abroad). That incident became the catalyst for stepping one foot off the FI mountain and starting to climb the RE one.

But I’d like to be crystal clear, Mrs. FB and I are still on the journey towards FIRE, but we’ve decided to start enjoying the fruits of our labour sooner rather than later.

We’re now drawing down part of our portfolio after devoting so much time and effort in our 20s to building it.

Life’s short, and I want to be as present as possible to watch our beautiful daughter grow up.

That’s what it’s all about. Buying back your time to enjoy special moments (like leisurely sleep-ins) with the people you love.

As always,

Spark that 🔥

Congrats on the baby! Guess you’re happy with semi-retirement and Baby FIRE 🙂

On another note, just wait until your kid(s) goes to childcare and school and you have to recalculate your FIRE number 😂

Thanks Kevin!

I’m actually looking forward to seeing all these child related expenses that everyone keeps telling me about. I’m a parent now so I can actually have an informed opinion haha!

Congratulations! Our story is almost the same as yours, minus the travel. We earn around 75% of expenses in passive income and have both been working very light over the past 7 years since the kids were born. Our Why was to have the time to spend with our future kids and when they arrived, we did so. With three days a week total work between the two of us, we can cover the last 25% and have all the joys of retirement without requiring net zero work.

Also, kids are super cheap when you realise the only thing they need is your genuine invitation to exist in your presence. You might find a blog on BabyFIRE expenses to be quite empty.

Congratulations on becoming a father!

Children are as expensive as you want them to be, they don’t have to be a big financial drain.

Anyway, wishing you and Mrs AFB all the best on this new chapter

Congrats on the new born, children change your focus but as someone who has just finished traveling with my two children around Australia, time is the best investment you can spend on kids and family. I personally have followed you and the Fire concepts for a number of years and have just switched to semi-retired this helps to continue our road to building our net worth but more importantly in riches our life with positive relationships and memories each what I like most about the Fire concept.

This was a particularly striking and helpful article. Thank you and of course congratulations. It’s interesting your thinking on work. From a Judeo-Christian perspective, work comes before the fall and there will be work in the new creation. Die with zero had a similar impact on me. My wife and I have just returned from a glorious 8 days in midwest WA Australia including an expensive but so worthwhile flight out to the Abrolhos islands. MAy you and your family continue well and be blessed

Congratulations mate, both on the new arrival and on your FIRE/lifestyle success.

You’re living the dream right now! Its been great to follow your journey and witness your success and how you’ve evolved/changed over time.

Thanks a lot Dave. It’s been some jounrey so far. And it’s getting better each year 😁

Congratulations. I’ve followed you from the beginning and have had a similar journey but made money via business and property. Quit my day job 2 years ago before being completely financially independent. Also have a baby. No pressing need to work but choose to when it suits. I must admit that I feel I should have kept the pedal down and got the job done though haha. I’d rather have more $ and not even think about working but I’ve run out of steam a bit and having a baby takes a lot of time and energy. All the best.

Congratulations to you and Mrs AFB on the arrival of your beautiful daughter. Nothing compares to the newborn phase with your firstborn. It’s so fantastic that you can thoroughly enjoy it without worrying about returning to work etc.

I think this has to be one of your best blog posts. It is very philosophical and comes from the heart. It is very inspiring too. Thank you.

Thanks Vicky 🥰

Congratulations! So happy for you both, what an exciting new chapter that you can give yourself to without the money worries of most new parents.

#lifedesign

Congratulations! So happy for you guys 😍

Congratulations on your newborn! Happy for you guys. I especially liked both your sharing about passion in job and also the diehard nerd of optimisation slowing dying off – feels like I could relate to both of it in recent months. Maybe age is catching up XD

Thank you for the inspiration you have provided me with!

I moved to London after finishing uni and found the work culture unsustainable and started my investment journey as a path out of this. At one point I was looking to retire in a lower cost of living country but decided that I ultimately wanted to move home to the country in Australia, where I found my partner and will also be welcoming a baby in the coming months. Your podcasts and blog posts have given me a different perspective of how I can persue greater time freedom, without needing to be obsessive about being 100% financially independent without the need for some work. You and your wife have been relatable and inspirational on my journey ☺️

Thanks, Sylvia,

London also has a dark side (burnout culture). I’ve seen it but was fortunate to recognize it for what it is, and I never felt the need to climb the corporate ladder, even though so many do.

I’m glad you can take inspiration from our journey. That means a lot to me.

Congratulations to you and Mrs AFB on starting life as a family. Funny how quickly your mindset can change once a baby is around. I write this from the couch next to my wife and 3 day old son who kept us up all night… 😂

Congrats on your son Myles.

The sleep is a killer, but so worth it.

Congratulations a truly love changing event. I have a almost 2 year old and been following you for the past 3-4 years and even though haven’t been actively pursuing FIRE, the investing and saving strategies have put myself in a more comfortable position. And I feel in future years I can go to part time and spend more family time while still living comfortably and not have a major financial stress like most full time workers

Congratulations on your new arrival! Must be a great feeling to have the flexibility to spend time with the family in times like this. Your hard work is paying dividends in more ways than one!

Congratulations mate. Your journey is very inspiring for many. Keep doing great work.

Congrats mate, I have walked a similar path to you since 2015 and it’s exciting to now have these life options opening up. Have been taking some time off this year and also living partially off the 30k or so of dividends coming in. I also get what you mean about the psychology of dividend income v selling down international holdings. A good way I have found to deal with this psychologically is to assign the 25% of my NW in super to international holdings (think I stole that idea off Dave Gow), which takes my outside super international allocation of 15% closer to 40% overall, and can let that grow over the next few decades inside super. Meanwhile live off dividends and slowly draw down the FI portfolio until preservation age

Thanks Mate. That sounds like a great plan 🙂

Love this post!

Real perspective on life, loves and balance. Very inspiring, I’m late to the party, but hope to still make some inroads!

Enjoy parenting, will take you places you never knew existed ❤

Aww I just listened to the podcast on my afternoon walk and got a little emotional! Massive congratulations, I’m so excited for you and your little family! Your daughter is beautiful! 🙂

Everything you said on the pod resonates with me. Although our circumstances are different, we seem to have arrived at very similar conclusions on the whole FI thing.

Kids really change everything the moment they arrive, and almost five years in, I can say that they continue to change everything. Sounds like you are in such a great place in life to make the most of it. When your life and heart are full, all this spreadsheet stuff fades into the background.

Soak it all up! 🙂

Thanks, Tina.

Yep, children change your world for the better. It feels like I’m just starting a new adventure with this little one 🙂

Big news and congratulations on this new stage in life!

Wow fantastic news, congratulations to you and the family!

It’s great to see how the FIRE journey has paid off for you and the family so that you can spend time doing what you all want to do rather than having so spend time at a 9 to 5 job to keep the lights on.

I look forward to future updates on how it’s all going, maybe even another podcast on the costs of kids!

Cheers, HIFIRE,

Yeah, I’m actually looking forward to all the kiddie expenses so I can be more informed about them. It’s going to be interesting, to say the least.

What wonderful news! Congratulations to you and Mrs AFB on the arrival of your gorgeous bundle of joy! That’s a lovely photo at the end of your post.

Congratulations AFB! We have a toddler and when I was pregnant I was like yep, have this baby.. back to work keep smashing saving goals… but once he arrived, hell no. Happy to be able to continue part time and slow that FIRE journey because this time is magical. And work is better part time!

Congratulations on your newborn Mr and Mrs AFB! Such a precious time and thank you for sharing so openly. Your fire journey allowed you the freedom to spend time with your family without the constraints of a 9-6 job! That itself is #lifebydesign 💗

Wonderful news on the baby. Congratulations.

You sound like your little family is in a great space right now. Enjoy!

Thanks Frogdancer. We’re over the moon 🙂

Amazing changes in your life and congratulations on the little one. It is wonderful to see your flexibility and not being fixed to one way of living. Enjoy this stage of your life journey and the love that comes with a little one. What you have accomplished so far has set you up for life and you should be very proud of the foundation you have both built for your family. It’s very inspiring.

Your baby is super precious. Take a lot of videos, future you will be thankful, it really goes so fast! Sleeping dramatically improves in the 2-3 month mark if you’re wondering ;P

Congratulations on the new addition! I’m a fairly recent father myself (little guy is 20 months old) and can confirm it really does change your approach to finances! Like you my partner and I also did a lot of travelling before settling down and having kids. Unlike you it’s take a while to hammer our finances into shape – but we’re doing OK.

A child can be quite the disruptor to both life and FIRE pursuit but my advice is to try strike a good balance. I’m sure you’re already thinking how you can setup everything for your child to have a great life and it sounds like you’re well ahead on the journey thanks to the discipline and work you and your partner out into FIRE.

Congratulations again and remember: you will get used to operating on little sleep!!

Congrats on the start of parenthood! It’s interesting to see how your thinking has evolved in real time over the years—life’s fluid. Ideas are there to get rid of and come up with new ones. I design schools. We are finishing the 2nd stage of Traralgon Secondary College. It’s nice to know that maybe one day your kid(s) will go to the school that I’ve had a hand at improving. I like your idea of the collab space. The region needs that kind of enterprise.

Thanks mate.

You’re in Tgon? I love it when people from the Valley comment on my content 🙂

Congratulations! What a wonderful read. Our portfolio is only a 10th of yours and we have also chosen to do the same and spend some time our while our little one is growing. Congratulations to the entire family.

Exceptionally well written and articulated article. Your narrative around need to look beyond fire is nothing but a fact that many who are not happy with their work (myself included) look for FIRE in a hope they can stop living that boring, self-destructing, outdated lifestyle. Those who works with smart mind always remains energetic (mentally and physically).

However, I must say as you are back in Australia that your ability to find work place that is not just energetic but also innovative is challenging in Australia and I can say that with confidence as I have worked in government over a decade and couldn’t find a department in NSW that is innovative in real sense and I worked in private as well and it is same story…! I also lived in London for 3 years before coming to Australia and I guess everyone who migrate to Australia gets well into laidback lifestyle of this country and if you really wanted to have that fun, energy and be with smart people on earth then move to America where not just dream comes true but you will meet seriously smart people in my opinion…! It will take your life to new meaning and new horizon… and do it now while you got young child as you won’t be able to do it once they grow older!

Congratulations on became a parent and importantly able to realise what is more important in life then FIRE!

Thanks a lot, Dave.

It’s funny you say that about America.

Ever since my London experience, I’ve had an itch to have a go in Silicon Valley. That’s where the cream of the crop in my industry all goes.

But I just couldn’t be away from my family for that long. I’m very content to see what sort of company I can build here in Oz.

I wish I had gone to London earlier in life, but as they say, you can’t have it all.

Congratulations on the birth of your daughter!

Enjoy the ride – it’s a roller coaster of emotions but so much fun!

Thanks for another great post.

Brilliant news! Congratulations. Good to hear your strategy has changed too – I’ve done exactly the same thing since we fired at the end of 2020. I have very little interest in investing since our portfolio sustains us, and WAY more interest now in optimising my health and lifestyle. I put my life on hold saving for the financial freedom that FIRE seduces us with – and now wish I’d had a more moderate approach like you to achieving fire. Congrats again.

Congratulations Mr and Mrs Firebug, so happy for you both. Awesome article, I have loved your journey, you have really educated me in matters of all things money- so grateful. I wish you and your family all the happiness in the world- it’s going to continue to be a fabulous ride ❤️❤️❤️❤️

Auguroni per il piccolo! Cheers mate

Molte grazie, Daniele!

Congratulations! The joy of watching them grow is just indescribable (2y.o + 1 on the way) – you are so fortunate to be in a position that allows you to use the ‘fruits of your labour’ to spend the precious time with her! We have taken a similar approach, and the extra time we spend as a family builds memories that far outweigh any income earnings we might be losing from not working as much. Not discounting how fortunate we are to be able to do this – but it hasn’t come without sacrifice and hard work either. Just soak up every.single.thing that little bundle does!!!!

Congrats on becoming parents! It’s amazing how it can change your goals and outlook on life so quickly.

I have no desire now to retire early, only to have the financial independence to control how my time is spent. Being a stay at home mum and travelling/holidaying as a family are such privileges and I will always be grateful for the life we are living. Our financial journey is slower but I wouldn’t change a thing.

Die with memories, not dreams.

Congratulations on your beautiful little daughter …..Kids bring so much love and joy to the world and to your household – take as much time as you can to enjoy mate as they grow so quickly ….from your blogs I know you will be one amazing father.

Thank you once again for your great content in this blog

I’ve been listening for a few years and have heard you mention kids many times – big congratulations to Mr & Mrs Firebug!

I’ve done everything backwards – so have definitely made my life more complicated. We got together at school in 2007, started a business (failed) in 2010-2014, had our twin daughters in 2015, then got married 2018, and now building another startup, building a house and homeschooling all at once. its madness, exhausting and I really think I’ve bitten off more than i can chew a lot of the time. But there is a plan, it should fall into place in about 6-8 months, and once we’re in the new house, not renting… Fire is the next project to work towards.

Congratulations. Beautiful news. Can I ask how your earning the remaining 30 to 50%? Is it from side gigs? Has Mrs firebug given up work or intends to? My Hubbie says ‘a man’s got to have purpose’ so I hope that doesn’t throw you 😀. I’m sure it won’t

Thanks, Belinda.

I have a company that I run, which generates more than enough for us to live off. Additionally, I make a little bit of money (around $30K) from running this blog/podcast.

Hopefully, this co-working space is profitable too.

Cheers.

Loved reading your life update and congratulations on your lovely daughter. I’ve followed you from the start and have been really inspired by you. Thanks for giving so much by sharing your journey and helping me and others – it is a great legacy for your daughter.

So happy for you & congratulations! Thanks so much for all the amazing content, you have had a huge positive impact on my own money journey, so incredibly grateful.

May i ask are your numbers just yours or do they include your wife as well?

Thanks Jess. All numbers these days are our family as one unit. We haven’t had separate finances since around 2015.

So happy for you both! A new phase of life full of excitement and challenges! Just wanted to say a thank you for all you have done for so many people. Always honest and well researched! I hope all your dreams come true!

Congratulations to you all. Your little one is gorgeous. I thoroughly loved reading your post. It perfectly encapsulates the importance of meaningful work – paid or otherwise. I think you are in a situation where your little one may not need daycare as you are close to family and can work hours that suit you. Looking forward to reading more about the journey in the future.

So never had bio kids, don’t know the feeling. Do know you’re in your first km of a marathon and I’m keen to know how you fair further along – with maintaining your hobbies and parenting and finances. I read FIRE content as an observer rather than a pursuant (maybe a sceptic, a little). So keen to see how your journey unfolds!

That last photo melted my heart ❤️ as a parent myself and having the flexibility to work part time and control the hours I work is definitely one of the biggest blessings in my life. I could stop work altogether but honestly being home is more work than my actual job 😂

I’ll keep it simple. Congratulations mate 🙂

Congratulations. You have worked very hard to get to this point in your life and you will now have the time and resources to enjoy it. Good on you both.

Brilliant post, thoroughly enjoyed it. Congratulations on the arrival of your daughter, such a special time!

Congratulations Matt! You and your wife must be super happy. Having a child is a life-changing experience and I absolutely resonate with the guarding your time idea. Time is valuable and what matters most is spending it with people you love.

Enjoy the early months 😊

Great article, I couldn’t agree more. We’re expecting our first any day now! I was wondering if you have any advice for someone who doesn’t know what they’d like to do for meaningful, fulfilling work if they were to leave the rat race? Or do you think it’s a matter or leaving and then you have the mental space to figure it out?

TThanks, Mel.

It’s quite likely your baby has arrived by now. Wishing you all the best in the upcoming weeks.

Everyone’s journey is different, and it took me literally two years to figure it out, haha. Just having a go at different things that you’re interested in is one way you can do it.

Maintaining mental bandwidth is crucial. It would have been impossible for me to consider it with the weight of a stressful job.

Best of luck with everything! 😊

Best post yet, congrats on your daughter and on being content with all you’ve achieved.

Congrats on the birth of your beautiful daughter.

This update really hit home for me as I’ve been torn between keeping my head down and steaming towards FI in a job I’m really not keen on or pulling the pin and travelling whilst I’m still young.

Your experience and insights have made this decision easier. Thank you for your updates, I’ve learn so much from them.

Congratulations! What a great post/podcast.. An exciting time in your lives. I have listened to all of your podcasts over the last year and I have 2 favourites that I have listened to several times, the one with your Dad and the ones with Peter Thornhill. Unfortunately, I am too old to RE in FIRE 😂 but still aiming for the FI.. Keep up the good work, your podcasts are great listening and super informative..

Congratulations to you and Mr FB on the birth of your daughter. It’s great that your choices earlier on will hopefully make this stage of your life more comfortable. I love the travel photos too – some places I recognise from my own travel but also a great reminder that it’s time to get back there again.

Hi,

Love your content and your new attitude really resonates with me. Especially taking the opportunity to spend some of the etf income. We’re a single income family of 5 and slowly plodding away.

Quick question do you plan to deplete your $760k in shares before you hit 60?

You repeatedly say if you’d focused on super you wouldn’t have the FI to do what you’re currently doing but I think if you’re going to coast then it would still be possible. Even if you added 200+k to super. It’d just mean ~8k of sales to make up for the dividends lost. Obviously that sale would be offset by corresponding gains in super. It could be possible that the 8k capital draw down from etf is offset by a greater gain in low tax super making the FI number smaller than you’ve calculated. I guess it depends on if you have the resources to coast to your preservation age.

I guess it’s clear that I think anyone who plans for life after 60 shouldn’t dismiss super. Especially considering die with zero means spending the right money at the right time. Everyone has money set aside for life after 60.

BTW I’ve always said FIRE should be FI(re) with FI as the primary goal and RE as a consideration. I’m not at exact the same level as you but we have worked out that for now FI means less work and more time with our young family (3 boys born between Dec 13 & April 17!).

Hi Biggles,

Thanks for the kind words 🙂

No, we don’t plan on depleting our portfolio down to $0 by 60. That’s my main criticism of using Super to FIRE. I have yet to meet anyone who actually draws down their portfolio to $0 by the time they’re 60. Many say they will, but then end up making more money and never have to deplete their shares.

Something else to consider: We’ll be liquidating a decent amount of shares next year to use as capital to get this co-working space off the ground. These sorts of opportunities are limited if the bulk of your wealth is tied up in Super.

Super is fine, but the opportunity costs of locking up your money until preservation age doesn’t get talked about enough, in my opinion. If your priorities or circumstances change, you don’t have as many options.

All the best with your journey, mate.

Cheers

Congrats on the new baby girl! I have 3 girls & they are definitely a handful. Sometimes they’ll drive you crazy but there is definitely a lot of memorable times that make it all worth it. Especially when they are little. Once they turn 1 & start developing their cheeky little personalities & wanting to hug & spend time with you is the moments you’ll remember the most. But the hard times can be very trying but being FI helps tremendously. Have fun & enjoy the ride. Just remember 1 child is easy street. if you decide on anymore good luck lol

Matt, I’ve been following you since 2017 and this is the best update ever!

It really resonates with me and my personal story as well. I’m in the software industry too, and I’ve got two young kids and started the minimalism and FIRE journey as a result of wanting to be a great worker AND an awesome dad.

Wait But Why had a great article about time spent between parents and their children. By the time kids finish high school, they’ve already spent more than 90% of their face-to-face time with their parents, including for the rest of their life. Really sobering stat!

Article here – https://waitbutwhy.com/2015/12/the-tail-end.html

Best of luck with the growing family and staring the RE portion of the journey off early. Again, best update ever!

Thanks, Papa!

OMG, that high school stats are crazy. I should print that out and keep it as a reminder in case I ever get caught up with life admin. Spending time with your kids when they’re young is so special.

Much appreciated, mate 🙂

Hey AFB

Long time lurker, first time poster

First of all congratulations on the baby and making it to semi retirement

I feel like I’m also getting close to FI

Managed to pay of 2 mortgages and have some substantial savings 140k plus 70k in shares and 30k rental income

Currently working full time still as my next step is to invest for the next 5-7 years 10k monthly which should bring me up to 700k invested then drop to part time my partner will Be part time next year

Do you still calculate your savings rate if so where are you at

currently our savings rate is 60% which I think is pretty good but not to sure if I can increase it to 68-75% I feel that’s like not having room to breathe

Thanks a lot, Earl 🙂

I haven’t calculated our savings rate for some time. I had to stop tracking our expenses when we did the London trip back in 2019. I know myself. I just couldn’t have enjoyed that trip as much if I knew how much we were spending.

We’ve been on a travel extravaganza ever since 2019, and I knew our spending levels would not be this high when we had a kid.

2024 will be the year I start to track again. We now have our baby, and I want to know what this new life is costing us.

Congrats on the new bub and the upcoming business venture. Not sure if you’ll see this, but those distributions look way too high on A200 – no way you got that much in dividends in a year – even at a gross level…

Thanks Chris.

Those distributions also include franking credits which are fully refunded in our situation (trust)…

bravo… I found this one of the best reads I’ve had in a long time as someone who has followed along since my early 20s (28 this year).

Congratulations to you both on the birth of your daughter and on the transition to a new approach on life and relationship with spending…

Thanks Lachlan 🙂

Ha! I was wondering how all this FIRE stuff worked once, ah, life happened (kid/s travel etc involved)… I started with your LIC vs ETF articles so I did it backwards. Fire noob.

Congrats on doing it all young! I travelled most of my 20s-30s (for work and myself). Had a blast, poured $ into super and a mortgage. Also got divorced and started the $ thing again.

Am now 40s and watching mate’s parents all too sick to finally travel now they’re retired (mid 70s and super wealthy- well, compared to my parents). They were “too busy” working before that.

My parents had me very VERY young and while they didn’t have super high paying jobs (or even degrees) saved like crazy people their whole lives. Spent a lot more time with us kids too. They are finally getting to do all that travel in their mid-late 60s that I did (no backpacks in their holiday plans though). But they’re healthy and financially comfortable. They retired mid-late 50s so they were all about FIRE before it was even called that.

Thanks for the articles and best of luck with your new lives. Flexibility with your (paid) time is utterly priceless!

Beautiful comment fire noob. Thanks for sharing 🙂

Thank you so much for sharing your journey! I am so happy for you and Mrs FB having your baby and being able to spend so much time together. Your podcasts have been a massive inspiration on my FIRE journey and can relate so much to your story. I am a software developer working in government and just had our second baby.

We’re working on some big goals and I wouldn’t have had the same understanding of the Australian Finance landscape without your amazing podcast! It literally has changed the trajectory of our life in more ways than one! Thank you and congratulations!

Thanks so much Alicia!

I never get tired of reading comments like this 🙏

It’s inspiring to see you take the time to smell the roses, enjoy life and live life. That’s what financial independence is all about.